Cash Value Life Insurance Meaning – Home / Life Insurance / Articles / Life Insurance Cash Value: Continuous poli growing preservative unit

Cash value is a part of the policy that will increase over time through investment gains and interest rates. It is a savings unit, which creates financial benefits to the policyholder, allowing access to payment or loans, even if it is a source of income during pension.

Cash Value Life Insurance Meaning

The economic value in life insurance refers to the saving factor of a permanent life insurance policy that grows over time and can be used throughout their lives. This feature is beneficial for Indian policymakers who want both defense and savings channel in a politics.

Do I Need Life Insurance? 3 Variables To Consider

Below are the key points to be learned in the economic value of life insurance, especially in the Indian context:

Since the policyholder is paying insurance premiums for their permanent life insurance, some additional amount paid is targeted for the benefit of the death and the additional fee goes to the cash value. This cash value is accumulated and increased over time depending on politics: depends entirely on a fixed interest rate or market performance.

For example, the value of money in all living policies increases in a steady, guaranteed interest rate, making its growth able. On the other hand, products such as ULIPs offer market -related income, where the value of money fluctuates with the performance of the fund.

Forty and Mumbaiist Shri Sharma takes a lifetime of life insurance, which is secured by 50 Lakhi from Lakhi, the additional fee of Rs 1 lakh each year. In ten years, the value of this policy has reached 10 lakhs.

Business Owners — Connie Costanzo

For politics, Mr. Sharma needs cash for a financial emergency, so he borrowed 5 lakhs for his policy value. This loan interest rates are collected; If it is not paid, the amount of the balance sheet is cut from the benefit of death at the time of death.

*Note that Indian Life Insurance Policies usually do not show “cash value” access to a minimum number of years but usually 3+

The value of cash life insurance supplies a two -type goal, which provides both protection and savings. For Indian distributors, the economic value is a financial LETTLLET and is brought to various stages of life. These tasks, with their influence, need to understand how to make a conscious decision, immediate financial requirements and to measure long -defense goals.

Over time, the savings unit of the permanent life insurance policy will accumulate and the insurers will be able to enter their lives.

Permanent Life Insurance Offers Lifelong Coverage, Often With Higher Costs And A Potential Cash Value. #insurance #lifecoverage #financialplanning # Cashvalue #longtermsafety #insurancepolicy #lifelongsecurity #premiums #protection #investment

You can get it through political loans or payments or can be used to pay a bonus. It depends on your political conditions.

Yes, forgetting the amount of refund or payment will reduce the benefits of their death.

Generally, political loans are tax -up. However, the withdrawal can be taxed if paid insurance premiums are exceeded. If the policy does not meet the rules of the Income Tax Act 10 (10 DD) rules, the withdrawal or deadlines may be taxed, in particular in the case of Ulips or high -level policies.

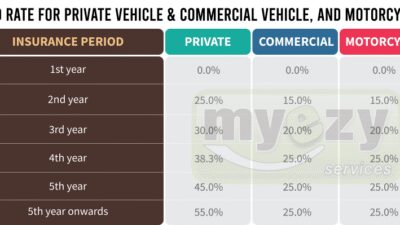

Yes. The transfer of politics gives you a submissive value, which is a cash value, which is less specific obedience.

Actual Cash Value And Recoverable Cash Value: What You Need To Know

The cash value is increased with political interest rates or market results based on which organization’s insurance policy you have. When it comes to life insurance, there are two main types: temporary life insurance and all life insurance. If a fixed -Term life insurance provides a specific period (usually up to 30 years), all life insurance is a permanent living insurance that gives the life of the entire policymaker. The main feature of life insurance is the value of cash, which is essentially a savings account that grows over time. A cash value factor can be an attractive feature for some policy holders because it provides an opportunity to save when providing life insurance. However, it is important to understand how a cash value unit works, and before deciding if this is the right choice for you, all life insurance has pros and cons.

Here are some things to keep in mind about the unit of all life insurance and cash value:

1. A cash value factor is basically a policy saving account. Some of the paid bonuses paid by the policyholder go to the value of raising money over time. This cash value can be used in many ways, such as borrowing against it or paying bonuses.

2. A cash value factor usually develops with a specified profit from an insurance company. This rate may be higher than earning in a conventional savings account, but it is important to remember that edible politics may be related to fees and other fees.

What Is The Meaning Of Life Insurance And How Many Types Are There Of Life Insurance?

3. A cash value unit can be used to pay an additional fee. If the cash value is adequately increased, the policyholder can be used to pay additional fees instead of making payments. This is a useful feature for those who are struggling to pay a bonus in the future.

4. Cash value unit can be borrowed. If the policyholder is to enter the cash value, they will be able to lend against it. However, it is important to remember that all dues reduces the benefit of paid death for beneficiaries.

5. All life insurance can be more expensive than life insurance. Since all life insurance policy ensures the entire life of the policyholder and has a aspect of cash, it can be more expensive than life insurance. Before you decide what is right for you, it is important to consider the costs and advantages of each policy.

Generally, a cash value factor is a key feature of life insurance, which provides an opportunity to save when providing life insurance. However, it is important to understand how it works, and before deciding if this is the right opportunity for you, consider the costs and benefits carefully.

Whole Life Insurance Vs. Variable Universal Life (vul)

There are many factors that should be considered for all life insurance. Cash value is an important factor, which can be a little confused. In this category, we distribute exactly how all life insurance works and how the cash value unit fits into the equation.

1. Subsequently, life insurance is a kind of life insurance that ensures insurer throughout your life when paying insurance premiums. It differs from temporary life insurance, which only gives a certain amount of time.

2. If you pay your insurance premium for all your life insurance, some of these money goes to death (the amount paid to your beneficiaries if you lose) and the part goes to cash value.

3. The cash value is essentially a savings account that has been built over time if you pay your bonuses. Cash Value Account Money increases the tax delay, which means you don’t have to pay it until you are extracted.

Bogleheads® Chapter Series

4. You can access the value of all your life insurance policy in several ways. You can take a loan for cash value (it needs to be repaid on interest), withdrawn money (which is a tax tax and a penalty) or you can use a cash value to pay your insurance installments.

5. The fact that the life insurance is worth the life of a life insurance may be a valuable property for some people. It can provide savings that can be used for emergencies or other expenses and can be used as a source of pension income.

For example, let’s say you have a full life insurance policy with a financial value of $ 50,000. You can receive this cash value to pay for your home renewal, and then pay the loan over time. Or, if you retire and you need additional income, you can withdraw money from each month’s value account to supplement the sources of your other pension income.

Generally, it is important to understand life insurance when you consider buying a policy. A cash value unit can add additional flexibility and safety to your financial plan, so it is worth considering it.

Know The Importance Of ‘cash Value’ In Life Insurance?

For all life insurance, the most important quality to be understood is the value of cash. This unit can be a little complicated, but it is worth taking time to understand how it works and what it means to your policy. In principle, a cash value unit is a savings account for your policy. If you make bonuses, some of these money will go to increase the cash value. Over time, this cash value may increase, tax delays and can be used for various purposes.

1. Cash value

Accumulated cash value life insurance, buy cash value life insurance, permanent life insurance cash value, life insurance guaranteed cash value, no cash value life insurance, maximum cash value life insurance, cash value life insurance reddit, cash value life insurance plans, cash value life insurance quotes, cash value life insurance loan, cash value life insurance companies, cash value policy life insurance