Cheap Car Insurance Third Party – As a car owner, you may have heard of a third -party car insurance and comprehensive car insurance. However, do you know what the differences are between them? Want some tips on choosing your car insurance? Today, you are writing a lot about car insurance.

It is mandatory to purchase a third -party car insurance plan for car driving in Hong Kong. According to an article on the order of the insurance (third party risks) (CAP272), any person, or will not be used by another person if the interested machine is not covered by third party risks covered by insurance; Criminals H.K. A fine of $ 10,000 will be responsible for the convict and convict for 12 months. As the name itself says, the insurance of the third -part cars not only covers you because of your responsibility due to physical injury, loss and loss of third party, in the event of an accident, but not due to your own damage, loss and medical expenses.

Cheap Car Insurance Third Party

On the other hand, a comprehensive car insurance plan gives you and your car advantages, such as your own loss, medical costs and wind glasses. Here is the difference between a third -party car insurance and a comprehensive car insurance:

First Party Vs Third Party Car Insurance

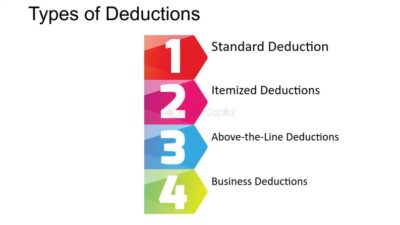

Excessive, known as deduction, is a predetermined amount of money that Paul’s owner has to pay any claim on a motorcycle injury or damage. Generally, you can choose the amount. For example, if the claim was H.K. If the $ 20 dollar is more than $ 10,000, the owner of the pole is responsible for the initial HK $ 10, and the insurer will pay the rest.

NCD (not a claim discount) AKA NCB (no claim bonus), a bonus for a discount prize for policy owners who are constantly appealing to complaints annually. Maximum NCD for private use vehicles differs from business consumption cars while discounts are not crossed:

With the Neline Platform for the stop insurance platform, you no longer need to spend a lot of time from quoting different insurance. If you are looking for comprehensive third -party or car insurance, you can get instant quotes, compare policies, and buy the one we offer a wide range of car insurance.

Say goodbye to the old -fashioned and confused insurance path and welcome the Eruson Nine insurance platform, where you can compare similar policies to various insurance companies. You can determine what is best for you, for expenses, coverage and other permits by izing. Our platform Neline platform is 24/7, which means you can buy and manage your insurance at any time and anywhere. Get ready for a thrilling trip to find the final third -party car insurance in the United Arab Emirates, if no one else! We cover you when it comes to the best car insurance covering for the most affordable prices. But keep it, because before we disclose a list of third -party car insurance plans, let’s stop the pit to realize everything you need to know before you buy a third -party car insurance in that area. So we reject the secret of receiving the best third -party car insurance in the United Arab Emirates! Join us when we are!

Private Vehicle Third Party Insurance

Third -party car insurance is like a level of security that protects you from economic responsibility in the case of a car crash. It involves damage to the third part, both personal and car -related. The only exception is that this type of car insurance will not hurt your own car. For example – in the case of a car crash, your insurance company will be covered by the other party called the third party. This coverage is especially used on other vehicles involved in the accident. Third -party car insurance is especially suitable for old cars.

Costs are effective compared to comprehensive insurance: Third party car insurance is usually a more affordable bonus than extensive insurance, allowing you to save insurance costs while fulfilling legal requirements.

Provides liability: You can enjoy the calmness of the mind, which will be liable for a third party, which means protection against financial liability to damage someone else’s car or property.

This is very necessary: by covering a third party, you can focus on the requirements, to make sure that your financial responsibility for third parties meets your own car without the need to cover it.

Compare Third Party Car Insurance

Comparison: Considering the prevalence of third -party car insurance, it is easier to eliminate various insurance providers that only cover third party coverage and compare quotations. This gives you the authority to make a knowledgeable decision that meets your needs and budgets. Best offers to check available fats

Flexibility and -D -S: Some insurance providers can provide additional benefits and additions to enhance your third party coverage, such as a road aid or a car repayment, allowing you to some extent change your policy.

This type of car insurance only offers to cover third party damage. As a car insurance owner, you are responsible for repairing your own car. One easy option to avoid this value is to get a comprehensive car insurance policy if you need more coverage

Automobile Specifications and Age – The cost of buying car insurance in the United Arab Emirates is higher for precursor cars. Old car owners prefer a third -party car insurance and affordable option.

How Third-party Car Insurance Protects Everyone

Driver’s Age and Experience – Studies have shown that small drivers are known for reckless management and therefore are more likely to be insured. If you are an experienced driver from 30 to 60, you are likely to get a discount on your premium.

Ask for history and management record – If you have a neat management record, you will pay for a potential low premium.

You can visit our quotation page to review all the highest party insurance providers and compare all the available policies.

Now it is easier to buy the best third -party car insurance than before. All you have to do is fill in some simple details, for example, your emirates ID and your car specifications, and we present a list of options that are most suitable for you, or just click on the plan you are most appealing and immediately with your amazing application.

Car Insurance Inclusions In The Uae

This means that the owner of the pole is covered with financial responsibility that arises as a result of a car accident due to damage or loss of third party.

Yes, in fact you must follow legal commands, which also indicate old cars that have at least third -party car insurance to ensure that drivers on the road are safe.

All planes listed in the listed third party are ideal for anyone who is looking for car insurance in Dubai, Abu Dhab, Sharja and the United Arab Emirates. Some of our providers can be chosen – Sukun’s insurance company, Abu -Dhabi National TaFul Co.

Third -party car insurance is an ideal choice for budget conscious persons and people with low -value machines. If you get into any of these categories, you can easily see our quotes and get the right plan immediately.

Third Party Legal Liability (tpl)

You can browse our car insurance department to get the most affordable third -party car insurance in the United Arab Emirates. Work only with trusted insurers to get the best and often specific transactions.

Refusal to Responsibility: The goal is to present accurate and advanced information, but we do not take responsibility or responsibility for content mistakes or payments.

Explore our insurance products, including car insurance, health insurance, home insurance and travel insurance to find the best coverage of your needs. When you want to buy an insurance policy for your motor vehicle, one of the questions that will inevitably overcome your mind is that you have to legally buy a compulsory third party insurance plan or go through an extensive policy of motor insurance.

In search of this question, it is important to understand how these two policies are different.

Third Party Car Insurance Quotes Victoria

Comprehensive motor insurance ensures financial protection against the loss/ loss of Lisi insurance vehicle, as well as the loss/ loss caused by a third party or their property.

As the name suggests, third -party policy only protects against the loss/ loss of third party’s personal or wealth. According to the 1988 vehicle, the Eter-Port policy is mandatory.

According to the third party insurance LISI, which is a tax, each machine must work “within the borders of use”. These are restrictions on the use of a vehicle except for their purpose. Here are some examples that will help you understand better –

Politics covers any harm caused by a police officer, as well as damage to third party or their property.

Insuremile Third-party Car Insurance

Yes, you can switch to a comprehensive policy from a third party policy, but before your car is to monitor

Best third party car insurance, quote third party car insurance, third party car insurance companies, cheap third party insurance, insurance car third party, car third party insurance online, car insurance third party only, third party car insurance rate, third party insurance car price, third party car insurance rates, car insurance third party claim, cheap third party car insurance