Commercial Auto Insurance California Quote – Commercial car insurance helps you protect you and your employees on the way while using vehicles belonging to the company. This key insurance can help in paying for damage to real estate and medical expenses for everything, from the FENDER bending machine to a fatal accident.

Protect your company on the road and receive a commercial car insurance quote from our partner, Tivly today.

Commercial Auto Insurance California Quote

Although availability and requirements for coverage vary depending on the state, these are one of the common types of commercial car insurance options available to company owners:

Compare Car Insurance Quotes (2025 Rates)

Protection of responsibility for body injury helps cover the medical costs of the other driver if you or one of the employees causes an accident.

You drive other cars, executive officials and their spouses, if they drive vehicles that are not in a commercial car insurance policy.

The collision range can help you pay or replace the company’s car if you hit something like another car or a pole.

Protection of medical payments can help in paying medical accounts for employees and their passengers in the event of an accident, such as treatment and rehabilitation, dental care or funerals.

Cost Of Landscaping Business Insurance

Unfined/uninsured driver’s insurance helps to pay for medical costs for you or employees or repair a car if the other driver does not have sufficient liability insurance or is not uninsured.

Rental protection offers liability insurance, while you or your employees drive a rented vehicle for business. Many rental companies have waiver of exemptions from loss of losses or dismissals from collision damage that can be signed to avoid paying the landlord’s car for damage to the property.

Protection against injuries (PIP), also known as insurance without guilt, can help in covering medical expenses, loss of wages or the cost of the funeral after the accident, regardless of who is guilty.

Employed and incapable car insurance offers protection of liability for a lawsuit, if you or your employees are involved in an accident with a personal, rented or leased car that was used for business matters. However, this type of insurance for the insurance of a commercial vehicle will not pay for personal, rented or leased car.

Best Commercial Auto Insurance Companies For 2025

Accidents that occur when the employee drives a personal vehicle for personal reasons. You can get protection for the fact that the employed and uninvolved car insurance.

Repair of the landlord vehicle, which you or your employees led while waiting for the company’s repair after the accident. If your company needs this type of protection, you can add to the policy of employed and uninterested car insurance.

Most states require commercial car insurance if your company uses any company vehicles. Contact state law to find out what insurance is required for your company. We can help if you have questions or wonder: “Do I need commercial car insurance?” At least you should consider commercial car insurance if your company:

“Hartford helped me get a truck to the store, fix and pay in less than 2 weeks.”

Commercial Auto Insurance: Top Options For Your Business

“Hartford coped with everything smoothly and quickly. Customer service was perfect and I appreciate the updates and continuation.”

Medium commercial car insurance costs our customers $ 574 per month or 6, 884 USD per year. ** Remember that the amount of the premium you pay for the insurance policy of a commercial car depends on the industry and types of vehicles that your company operates. Therefore, the commercial insurance premium of your company may be different than the average cost.

Usually, companies based on contacts such as landscapes, electricians, carpenters and some construction works will have a higher monthly fee than other competitions. Other factors may affect the cost of car insurance, such as:

We make it easier for you a quick and free quote from Hartford. Thanks to over 200 years of experience, we are an insurance company that you can count on. We helped over 1.5 million small companies to get the range needed. Regardless of whether you are looking for commercial car insurance, do you have questions about what commercial car insurance is, we can help. Get a car insurance quote from our partner, Tivly.

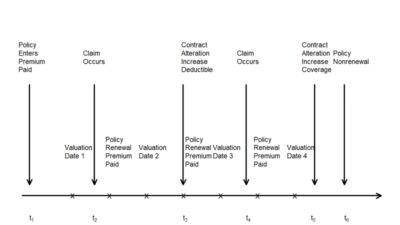

What Does An Auto Insurance Policy Look Like?

All company owners encounter a unique risk. We can work to adapt the rules to meet the special needs of your company.

Our experienced claims specialists are ready to help to accelerate the claim for restoring you on the road – and return to business.

You need commercial car insurance if you or your employees use the company’s vehicle for business reasons. Personal car insurance is needed when you or your family drive a car for personal reasons, including work to work and from work. Commercial car insurance usually offers higher limits and civil liability insurance than a personal car insurance policy.

Usually, all employees of your company with a valid license would be covered by this policy as additional insured, if the Company’s vehicle is driving.

Best Long Beach, Ca Auto Insurance In 2025 (find The Top 10 Companies Here)

The tools and materials that were in your commercial vehicle at the time of the accident are not covered by a commercial car insurance policy. You can get the range of company physical assets, such as tools and equipment, with the company owner policy (BOP).

Today you can get a commercial car insurance quote from our partner, Tivly. If you already have commercial car insurance, find out about the insurance regarding the verbusiness and insurance insurance we offer.

Hartford has established cooperation with Transportation, Inc. because it develops from USA to Canada, offering a commercial car range to protect its drivers and passengers. For more information on insurance, read the principle. For more information, get answers to other commercial questions about car insurance.

** Costs, contributions and these insurance are estimates and are not guaranteed. The actual cost, bonus and coverage are determined at the time of quote or issue and are specific to individual risk. The bonuses are based on Hartford information provided, including, among others, insurance criteria and evaluation. All examples contained on this page or in advertising are intended only for information purposes and are not a bonus or insurance guarantee. The described coverage and products are subject to the conditions found in the political agreement. All educational information provided on the available insurance does not modify the language of the rules or suggest that all claims are covered. Products are not available in all states or for all companies.

Hired And Non-owned Car Insurance

Hartford is not responsible for any damage in connection with the use of any information provided on this page. Consult your insurance agent/broker or insurance company to specify specific insurance needs because this information is to be educational. The information contained on this page should not be interpreted as specific legal advice, HR, financial or insurance and do not guarantee protection. In the case of loss or claim, the insurance will be subject to the language of the policy, and each potential payment of the claim will be determined after the claim was reached. Some covers vary depending on the state and may not be available to all companies. All Hartford insurance and services described on this page can be offered by one or more subsidiaries of the real estate insurance company and accidents at Hartford Insurance Group, Inc. listed in the notification of Thelelegal. Hartford Insurance Group, Inc., (NYSE: HIG) operates through subsidiaries under the brand, Hartford, and is based in Hartford, ct. To obtain additional information, read Hartford’s legal notification. * Customer reviews are collected and juxtaposed by Hartford and are not representative for all customers. Next offers personalized commercial car insurance that is adapted to your work line. This can cost only USD 12.50 per month or USD 150 per year for companies such as yoga and accounting instructors, but the exact cost of car insurance in a month depends on the specific circumstances. We spread the variables that affect how much you pay and what you can do to alleviate your costs.

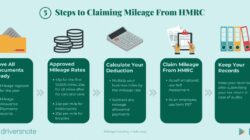

43% of our clients pay less than USD 150 per month for commercial car insurance **. This is the division of what our clients pay for this type of insurance.

If you are a mortgage broker, your insurance will be less than a contractor for roofing covering, because the nature of your work includes less work to work.

The cost for carpenters who go to work on the property of other people, he encounters a greater risk every day than many other professions.

Customized Commercial Auto Insurance Policies Offer Businesses Tailored Coverage, Including Liability, Physical Damage, And Medical Payments For All Vehicle Usage. They Can Also Choose Specialized Options Like Hired And Non-owned Auto Insurance,

If you have a cleaning company and have three cars, your insurance will cost more than if you are a cleaner only one car.

How often do you drive, how many miles you drive, and the brand, model and year of the car also affect costs.

If you are the owner of a small company in Miami, you will probably pay more for insurance than if you worked in a small town in Minnesota. This is partly due to the increased threat of natural disasters, such as hurricanes along the coast of the Persian Gulf. It is also partly caused by more populated areas with higher real estate prices and greater crime.

For example, if you run a company dealing in removing debris, and your employees have supported several too many mailboxes, you can see the increase in bonuses during renewal.

Commercial Specialty Auto

If you want to be covered by more incidents, you can choose higher insurance insurance limits