Coverage Year Meaning – Waiting is a lot of time for which the insured must wait for the insured to come into effect one or the entire coverage. The beneficiary may not be beneficial for the benefits of the claims filed while waiting. Waiting can also be known as elimination periods and qualification periods.

The waiting time or period of elimination for insured may be the claims of the insurance company, policy and type of insurance. With a more extended waiting, before active coverage, the cost of the premium is a bit crazy. There are several types of waiting times in health insurance.

Coverage Year Meaning

The employer’s management time requires the employee to wait for the specified period, such as three months before he can receive health care with the company. Such a provision is often carried out for a company that expects employees a high level of income. When the employee registers, he may have additional waiting until they can apply to coverage.

What Is An Aggregate Limit On An Insurance Policy?

Health maintenance organizations (HMOs) have the relevant periods. The Act on Health Insurance and Liability (HIPAA) regulates the association periods and does not allow them to exceed two months (three months for delayed entries).

The previous existing condition for the exclusion period ranges from one to 18 months. These waiting periods apply to specific health conditions that a person may have in six months before registration for the health insurance plan. Coverage may be limited or excluded for an existing state. However, if the insured may prove continuous insurance before the change of policies, this coverage may be calculated with regard to the exclusion of the condition. Exceptions allow those who have at least one year of group health coverage at work and a period of no more than 63 days to avoid this provision.

Insurers must consider their ability to pay for expenses when choosing the length of waiting for a policy.

The waiting period of the homeowner’s insurance usually varies 30 to 90 days before validity. After the waiting is to wait, the policyholders can claim a policy. The waiting periods vary according to the insurance provider. In some regions, such as coastal zones, when a storm is named in this area, new policies are not valid before the storm passes.

Quality-adjusted Life Year

Some states may introduce waiting times for other insurance products. For example, Texas places a 60-day waiting time for new vehicles insurance contracts. This period gives the provider a chance to decide whether the driver fits into his risk profiles. During the 60-day period, the company may abolish cars if he is worried about a risk profile or non-matched problems.

Short -term disability coverage may have only a few weeks waiting, but these policies will have higher prices. Most short -term policies are expected to cover 30 to 90 days. Long -term ventilation diodes may be between 90 days and the whole year. As with other insurance products, no benefits must be paid during the trial period. As far as social security is concerned, disability payments will also have a waiting period of five months.

Require writers to use primary resources to support their work. This includes white contributions, government data, original reports and interviews with experts in industry. If appropriate, we also refer to the original research from other reputable publishers. You will learn more about the standards we follow when we create accurate objective content in our editorial policy.

The offers shown in this table come from partnerships from which the receiving compensation. This compensation can affect how and where lists appear. It does not include all offers available on the market. Interest coverage is a debt relationship and profitability shows how easily the company can pay interest on its outstanding debt. It is calculated by the distribution of the company’s profits before interest and tax (EBIT) after its interest costs for a given period.

The Last Bear

Interest ratio is sometimes called the relationship of “time interest” (tie). It helps creditors, investors and creditors to determine the risk of the company of future loans.

Interest Coverageratio = EBIT Interest Cost Where: EBIT = Earnings in -house Treasures Begin & text = frac}} \ & & & & & TEXT = text End Cond CoveRAGAGAGAGAGAPTIO = EBIT interest expenses Where:: EBIT = Resortridax income

The “envelope” is the number of times the company can successfully repay its liabilities with its earnings. The lower relationship signals that the company is burdened with debts with less capital for use. If the company’s interest is 1.5 or lower, it can only cover its obligations for only one and a half times. Its ability to adapt to interest costs may be disputed in the long run.

Businesses need earnings to cover interest payments and survival of unpredictable financial difficulties. The ability of society to fulfill its interest duties is the aspect of its solvency and an important factor in the return on shareholders.

How Enhanced Life Insurance Works

With increasing business rates, this may result in a decline in the company’s interest coverage. Raising rates limit the profits and damage to the company’s ability to borrow, invest and hire new employees.

When business matches with its duties, he can borrow or delve into his cash voltage, source capital activation or need for extraordinary events. Analysis of interest coverage over time often provides a clearer picture of the position and tracking of the company.

Looking at the relationship of society every quarter for many years, let investors know whether the relationship improves, decreases or stable. Some banks or potential bond buyers may be satisfied with the less demanded relationship for the accounting of the company’s higher interest rate from their debt.

Suppose the profit of the company in the first quarter is $ 625,000 with monthly debt repayments of $ 30,000. To calculate the interest coverage ratio, you must transfer monthly interest payments to quarterly payments by multiplying three. The company’s interest coverage is $ 625,000 / $ 90,000 ($ 30,000 x 3) = $ 6.94. This suggests that the company does not have current liquidity problems and can cover almost seven times its obligations.

Insurance Premium Defined, How It’s Calculated, And Types

The coverage of the interest rate of 1.5 is the one in which creditors are likely to refuse to borrow more money, as the risk of breach of the company can be perceived as high. If the relationship of the company is under one, it is likely to use some of its cash reserves to customize the difference or borrow more.

The company’s relationship must be evaluated on others in the same industry or those who have similar business models and income numbers. Although all debt is important in calculating the interest ratio, the company may be isolated or excluded certain types of debt when calculating interest coverage. It is important to determine whether all debts are included in the company’s independent interest coverage.

A good relationship suggests that the company can serve interest rates at its debt through its earnings or has shown the ability to maintain income at a consistent level. A well -established tool is likely to have consistent production and income, especially as a result of government regulations. Although it has a relatively low relationship, it can reliably cover its interest payments. Other sectors, such as production, are much more unstable and often may have a higher minimum acceptable interest coverage three or higher.

Poor interest, for example under one, means that the current profits of the company are not insufficient to serve its outstanding debt. The chance of a company may continue to meet its interest costs is still disputed, even if the interest rate is covered below 1.5, especially if the company is vulnerable to seasonal or cyclic decline in income.

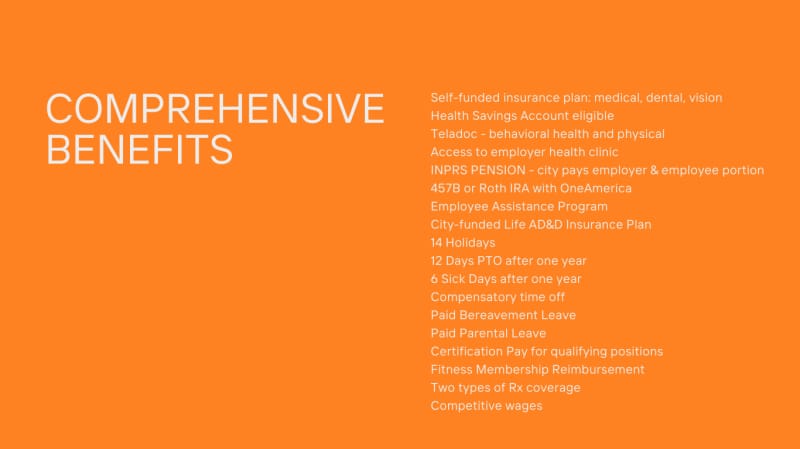

City Of La Porte, Indiana Human Resources City Of La Porte, Indiana

Relationships with interest rates or times exclusively acquired (those) show how well the company can pay interest on its debt. It is calculated by sharing EBIT, EBITDA or EBATI after the period of the period of the period. Interest coverage varies significantly during the sector.

Require writers to use primary resources to support their work. This includes white contributions, government data, original reports and interviews with experts in industry. If appropriate, we also refer to the original research from other reputable publishers. You will learn more about the standards we follow when we create accurate objective content in our editorial policy.

The offers shown in this table come from partnerships from which the receiving compensation. This compensation can affect how and where lists appear. It does not include all offers available on the market. The guarantee is a guarantee or promise of a manufacturer or a similar party relating to the state of their product. The warranty also applies to the conditions and situations in which they are corrected, returns payment or exchange if the product does not act as originally described or intended. Guarantees offer consumers a certain certainty that the goods and services they buy are advertised.

As mentioned above, guarantees are promises from manufacturers or retailers about their products and services. These promises can be explicit or expected. The guarantees provide a guarantee of the status of purchased goods and services, assuring that they are advertised. As a rule, they are only good for the specified period. After the end of this period, the issue is no longer obliged to repair or replace the product that has been previously included.

Infographic: Crop Insurance And Risk Management

Guarantees usually have exceptions that limit the conditions if the manufacturer is obliged to solve the problem. For example, many guarantees of ordinary household items cover the product for only one year from