Excess Insurance Adalah – The approval of the insurance policy is the amount that is beyond the actual borders of the policy agreement. A word that has been visible in updates for years.

In an insurance contract, the insurance group sells a certain amount of a specific type of illness from the trader. The checkpoint is not responsible for the cover after the policy enters the cover area.

Excess Insurance Adalah

Credit can create a situation that disappears from the risk of coverage. The result is the insurance power to cover a large portion of the rest of the pocket remains.

Asuransi Allianz Indonesia

A regional policy -based teamwork for losing property, damage or other losses must be balanced and the price they need. The height of the cover is in this policy that will cost higher. Costs are the expensive amount required at any time by the outpost to provide coverage under an insurance plan.

The most important insurance, additional additional insurance, sometimes provides with another, because it is not paid for the first policy.

If the electric owner does not balance with a covered area, insurance. Therefore, the ballot can reduce the amount of cover to reduce the amount of money and the worst worst probability will be more likely.

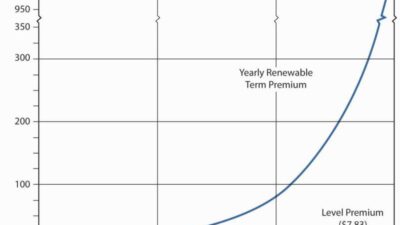

The calculation of the premitusfor rate is more than the correlations paid for the basic coverage. Extra sellers are resolved for production or party and the subject at any level. In fact, the product increases to the size of the transgence.

⏱️ In This 1-minute Insurance Episode, Let’s Talk About Excess Payment!, Excess Is The Fixed Amount You Agree To Pay Before Your Insurer Covers The Rest Of The Claim. It’s Your Share In The Repair

For example, the machinery company has a general insurance policy and an area of $ 1 million. The company sells the most coverage with $ 5 million in damage.

The high cover routine is $ 1 million. 20 % of the technical money for their first coverage is about $ 1 million. Each trench component increases and the level of $ 5 million is evaluated in 4 % of the money.

The most expensive wage for emergency contracts is expensive. Refund is a method for insurance providers to sell secondary projects to prepare a second supplier.

The highest cost for the highest price in the future is the loss instead of visiting your doctor’s rank. The past has been updated in the price of losing the company more than the specified area. The last case, from the other, an agreement that is distributed between the museum’s museum.

Excess — National American Insurance Company

Most borders are used to recover racists in a racist at the same level before the decision. This is protected by a native concrete company from the most dangerous to the most dangerous and may affect luggage or floods.

Reinuerr examines an opportunity that can determine a lot of cover costs. If again, with the disappearance, the largest economy is the highest level of an Sarakhid company.

The suggestions in this table include Investopedia Job Links for Payment. It will be useful for how and where the lists appear. Does not access all the offers available in the market.

Premium Balance: What is a Work, with a Model for the rest of the queue: what to do and do business for business business: what do you do

Ncd, Betterment & Excess Rates In Auto Insurance In Malaysia

Policy Marketing: What is the quantity: What is the work, how is the American land owner. Brick layer related to insurance coverage and filling the gap between the first and excellent support policy. Block layers are used to reduce insurance rates for basic and difficult problems.

These layers are widely used as credit cover but can cover other claims. People and firms are suitable for insurance, or people who disrupt the highest level, such as truck and truck companies.

Provides people’s insurance policy and jobs and protection. To obtain coverage, they search for insurance companies. Suppliers evaluate the chance of writing and guarantee the insurance group’s payment for coverage.

Policies are covered in great events called First Insurance. The great event is everything that decides when the insurance company is incorrect. For example, flood insurance is claimed at all times of floods. But this type of insurance is filled with risk levels, including the dollar. As people, insurance may require more support, where it is going to play.

What Is An Insurance Excess?

The most important insurance coverage that offers groups that have been introduced beyond their first policy to expand their films. But only some participants send claims above any money. For example, if your seat is covered for only $ 100, $ 1,000 and covers over $ 300, 000, $ 200.

Fill that gap and fill it. Additional addresses to introduce these groups to buy to protect yourself about the lack of their first policies and policies. In the above examples, the boxer layer of 200, $ 000 dollars covers the gap. The above is used as a liability insurance but can also be used for other basic types. We will go down.

Let’s want a company selling an insurance policy that covers his responsibility. But the amount that can be purchased in a single policy that may not have enough coverage for its obvious chance, so companies have an additional policy to cancel their problems.

When the second policy does not start the Thaamare policy point, a second layer between the two policies, which is this layer. The company may be looking for a third policy to cover this feature, if not, this is a company that is concerned.

Aviation War, Hi-jacking And Other Perils Excess Liability (avn52e) Insurance

Buffering legal insurance can be a bank to prevent organized groups, especially in the economy. During the hardest market, while people are not hard and enough, use a deeper market when business is well done. This makes it easy to cover what the observer is more likely to be stronger.

Layered insurance may not be necessary for everyone, but it is more difficult for everyone. Like this, marketing inputs are used, not for the business of sellers, especially those who are trying to make policy.

If you run a company, it has experienced the number or over loss, which may be great for you. People who have the background may be helpful, such as doctors, doctors and lawyers.

Consider a buffer insurance policy if you control a company with high risk and keep your employees instead of employee reward coverage.

What Is Excess In Car Insurance: A Complete Guide

Here’s a hypothetical situation to show how the floor is. Consider a condo or family (friend) with a valid official insurance policy that consider with $ 2500, $ 1,000 and then the policy that covers the money.

But this additional policy is just $ 1005 for $ 1005. To prevent $ 100 associaceekes.

Insurance insurance is available for companies at the distance between the first layer and most of the insurance coverage. Companies have to decide what problems find their problem