Finance Ar Adalah – Accounts receivable (AR) refer to the money owed to a business for goods or services that have been delivered but have not yet been paid, and is recorded as a current asset in the company’s general balance.

Accounts receivable (AR) is an accounting term for money owed to a company for goods or services that it has delivered but has not yet been paid. Accounts receivable appear in the company’s general balance as a current asset.

Finance Ar Adalah

Accounts receivable represent money that their customers owe a business, often in the form of unpaid invoices. “Accounts receivable” refers to the fact that the business has earned the money because it has delivered a product or service, but, at that time, it is still waiting to receive customer payment.

Zoomat Live: “tips Dan Trick Start Your Business”

Accounts receivable, or accounts receivable, can be considered a credit line extended by a company and normally have terms that require payments to be made within a certain period of time. If the effect, the company has accepted a customer IOU. Depending on the agreement between the company and the client, the payment could be due anywhere from a few days to 30 days, 60 days, 90 days or, in some cases, up to a year. At some point along the way, interest on debt could also begin to accumulate.

Companies record accounts receivable as assets in their balance sheets because the client has the legal obligation to pay the debt and the company has a reasonable expectation of charging it. They are considered liquid assets because they can be used as a guarantee to ensure a loan to help the company fulfill its short -term obligations. Accounts receivable are part of the working capital of a company.

In addition, accounts receivable are classified as current assets, because the account balance is expected of the debtor in a year or less. Other current assets in the books of a company may include equivalent in cash and effective, inventory and easily commercialized values.

Assets that cannot be easily converted into cash within a year are recorded as non -current assets. This category often includes things like physical property, long -term investments and intellectual property, such as commercial brands.

Loker Staff Finance & Accounting

When a company owes debts to its suppliers or other parts, those are accounts payable. Accounts payable are the opposite of accounts receivable. To illustrate, the company cleans the carpet of the company B and sends an invoice for the services.

The company B now owes the company a money, so it lists the invoice in its column of accounts payable. While the company waiting to receive the money, records the amount in its column of accounts receivable.

Accounts receivable are an important element in the fundamental analysis, a common method that investors use to determine the value of a company and its values. Because accounts receivable are a current asset, it contributes to the liquidity or capacity of a company to cover short -term obligations without additional cash flows.

Fundamental analysts often evaluate accounts receivable in the context of billing, also known as the billing relationship relationship receivable. It measures the number of times that a company has raised its accounts receivable for an accounting period and is considered an indicator of how efficient it is the company to raise its debts and the credit quality of its customers.

4 Factors That Make Ar Collections Difficult For Finance Analysts

An additional analysis would include the evaluation of pending sales (DSO), which measures the average number of days that leads to a company to raise payments after a sale has been made.

A daily accounts receivable example would be an electric company that invoices its customers after customers receive and consume electricity. The electric company registers an account receivable for unpaid invoices, since it waits for its customers to pay their bills.

Most companies operate allowing a part of their sales to be on credit. Sometimes, companies offer such credit to frequent or special customers, who receive periodic invoices instead of having to make payments as each transaction occurs. In other cases, companies routinely offer all their customers the ability to pay within a reasonable period after receiving products or services.

An account receivable is created at any time that money is owed to a company for services provided or products provided they have not yet been paid. For example, when a company buys office supplies, and does not pay in advance or by delivery, the money that must become an account receivable until the seller received it.

Profil Perusahaan Pt Ppa Finance

Accounts receivable are recorded in the balance of a company. Because they represent funds owed to the company (and that are probably received), they are reserved as an asset.

Accounts receivable represent funds owed to a company and are reserved as an asset. Accounts payable, on the other hand, represent funds that a company owes to others and are reserved as liabilities.

When it is clear that the customer will not pay an account receivable, it must be canceled as an unpobrarable debt expense or a unique charge. Companies can also sell this outstanding debt to a third -party debt collector for a fraction of the original amount, creating what counters refer to as accounts receivable with discount.

Net accounts receivable are an accounting term for accounts receivable of a company except any accountable account that has reasons to believe that it will never be collected. In general, it is expressed as a percentage of uncollectible debts in relation to the copper, and the lower the percentage, the better.

Lowongan Kerja Pt. Infokes Indonesia

Accounts receivable is one of the most important order lines in the general balance of a company. It reflects the money owed to a company for the sale of its goods or services that the buyer is paying. Although it is not yet in hand, it is considered an asset because the company expects to receive it in due time. The shorter the period of time is, a company has accounts receivable, the better, since it means that the company can use that money for other commercial purposes.

It requires writers to use primary sources to support their work. These include white documents, government data, original reports and interviews with industry experts. We also refer to the original research of other accredited editors when appropriate. You can get more information about the standards that we follow to produce precise and impartial content in our editorial policy.

The offers that appear in this table are of associations of which it receives compensation. This compensation can affect how and where the listings appear. Does not include all offers available in the market.

Net income: definition, calculation and commercial impact How are accounts payable in the balance sheet? Analysis of the Financial State: Techniques for balance, income and margin of cash flow and margin trade explained more advantages and disadvantages Operational gains versus Net income: What is the difference? Certified financial statement: What is it, how it works and examples in cash is the king: definition and examples of the term of the deferred charge: what is it, how it works and the example

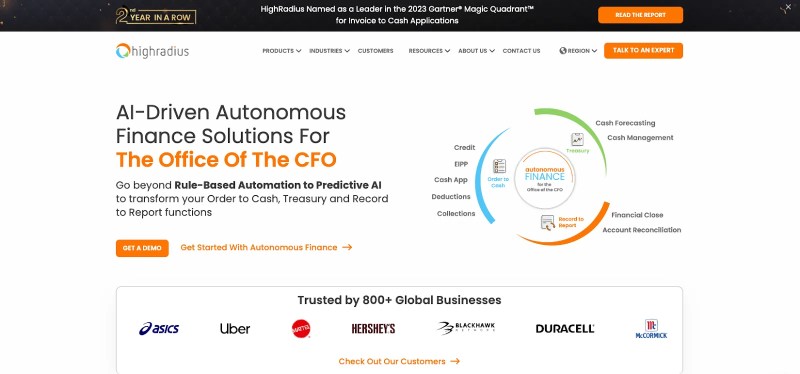

How Autonomous Finance Is Reshaping Risk Assessment And Ar Portfolio Management

Clean general balance: What is it, how does it work and the method? What is an interim statement? Definition, purpose and example of linear relationship: definition, formula and examples Vertical analysis: definition, how it works and the example of capital contributed: definition, how calculates and example what is an annual report? T-Count: Definition, example, recording and benefits of quartile understanding: definitions, calculations and examples of Dari Dari Segi Bahasa, Berasal Finance Dari Bahasa Inggris Yang Memiliki Arti Keuangan. Itu will be, dry istilah, Finance Merupakan Ilmu Pengetahuan Yang Berkaitan Degan Face Peelolaan Uang agar Kondisinya Senantiasa Stabil Dan Tagak Kekurangan Maupun Kelebihan.

Jika Merujuk Pada Professional, Maka Finance Adalah Pekerjaan Yang Berkaitan Dengan Pegaturan Dan Pengelolaan Uang Perusahaan. Dengan Demikian, Finance Bekerja Mengawasi Keluar Masuknya Dana Perusahaan, Serta Memperbaiki Alokasi Dana Tersebut Dan System Keuannya Jika Terjadi Kendala.

Dilansir Dari Failfaire.org – Sebbagagai Penelola Keuangan, Finance Memiliki Fungsi Dan Tujuan Tersendiri Bagi Perusahaan. Diantara Fungsi Yang Paling Umum Dari Seorang Finance Diantaranya:

Dalam Sebuah Perusahaan, Akan Banyak Aktivitas Operational Yang Membutuhkan Dana, Sehing Harus Senantiasa Tersadia. Untuk memenuhi kebutuhan tersebut, Finance Berfungsi megumpulkan Dana Dari Perusahaan, Baik Dari Pemasukan, Ataupun Pinjaman Kepada Bank.

7 Cara Meningkatkan Penagihan Piutang Usaha (ar) Anda

MENYALURKAN DANA PERUSAHAAN ADALAH TUGAS FINANCE YANG HARUS DILAKUKAN DENGAN SELEKTIF. Jika Dana Dibutuhkan Untuk Hal Yang Tagak Terlalu Berpengaruh Pada Kemajuan Perusahaan, Maka Finance Harus Bisa Chenahannya.

Agar Perusahaan Yang Dikelola Semakin Maju, Maka Keuntungan Perusahaan Tagak Bisa Digunakan Untuk Hal Yang Bersifat Stagnan. Say Sinilah Fungsi Penting Seorang Finance, Mampu Berpikir Kreatif Dalam Memajukan Perusahaan Dengan Megella Keuntungan Yang Diperoleh.

Fungsi Terpenting Dari Seorang Finance Adalah Membuat Laporan Terkait Kebijakan Yang Akan Diambil Untuk Mensostabability Keuangan. Finance Harus Pandai Berkomunikasi deny Pimpinan Perusahaan Dan Meyakinkanya Agar Kebijakan Designed.

DENGAN ADANYA MODUL FINANCE DI, ANDA DAPAT DENGAN MUDAH MEMONITOR Kegiatan Finance Segecek Cash Flow Keuangan, Menghitung Hutang Puitang Perusahaan Dan Sebbagainya. By clicking on, you continue to join or start session, you accept the User Agreement, the accuracy policy and Linkedins cookie policy.

What Are The Accounts Receivable Best Practices?

When it comes to administering the finances of your business, two critical processes often take the center of the stage: accounts payable (AP) and accounts receivable (AR). These two functions not only ensure financial operations without problems, but also affect cash flow and general financial health. We will break them up to make them simple and processable.

The accounts payable refer to the money that your business owes to suppliers, suppliers or service providers. These are short -term liabilities that must be paid within an agreed