Finance Freedom – On August 17, he always is established as a special day for all Indonesians. This is because the people of Indonesian people release the invaders on August 17, 1945. The problem of medicles in all areas may be included in various fields, including the financial sector. So this complete question is, of course, “Are we financially independent?”

According to US financial experts, Robert T. Kiyosaki may be interpreted as financial independence or financial freedom, and its wealth does not mean that there is very rich and abundantly. Financial independence is free conditions, that is, you will be free and completely free to gain yourself.

Finance Freedom

Still, he said he would not reach this condition. Financial independence can only be achieved, as the level of living from which it can be thought about paying daily costs, as it is a living standards. Some examples of the conditions showed that you are financially independent!

Mencapai Financial Freedom Di Usia Muda? Ini Caranya!

If you have a family, if your children have children, they will always be the first to be good. The problem, the current cost of education continues to increase the cost. If so, savings will be forced to earn the education costs.

This is, of course, those who are financially independent are not experienced because they have education funds. Financial independent people are usually prepared under the education fund that increased by 6-20% per year.

In addition, many real equipment may be used in the preparation of educational funds. Education, educational, deposits, savings from total funds or shares. Select all of what you want and select which investment weapon.

Independent financial people, usually protected by different insurance, health and health. Why insurance and required? This is a reason, that the insurance defense will help minimize the consequences of arising risks. Without defense, after these risks, it may have a great impact on these risks.

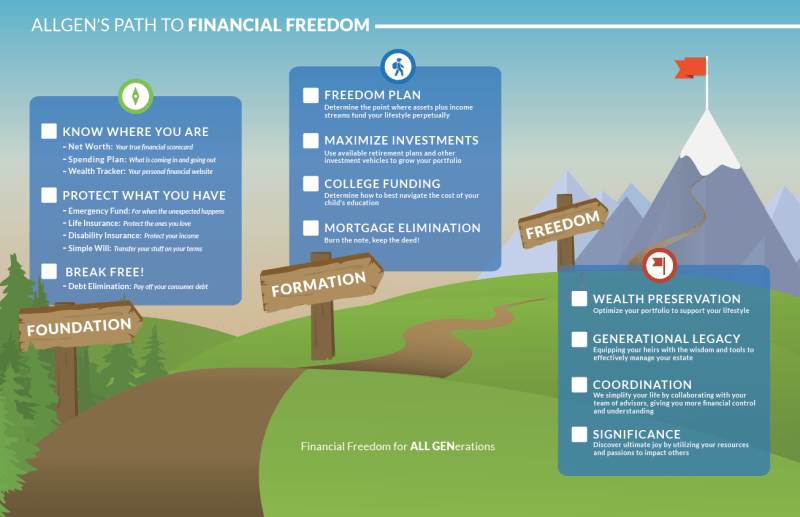

Your Ultimate Guide To Money And Financial Freedom

After retirement, they are not always anxious about their way. This, of course, not to apply financially to people who are financially independent, as they have enough pension funds for the old days.

Today, there are many choices to prepare pension funds. Elderly (JHT) Insurance insurance is forits to insurance, if 5, 7% of the institutions of the institutions are 5, 7% of the income fund (DPLK). In addition, investment funds can be used to 10% of investment funds as an alternative pension fund.

Money is not only healthy. In addition, monthly cash savings in the bank will be interrupted by administrative commissions. Should not be said that the inflation that has increased more than the bottom. Well, in which investment can guarantee the money you do not have enough money, it has said it did not know where it was.

One of the investment tools you need to try now is connecting to Paul. Why? This is because the founder of women in the microlored will be 15% per year and cash flows every week. In addition, it can be done at any time!

10 Cara Mencapai Kebebasan Keuangan Atau Financial Freedom

Examples of cashbooks Mystery: July 27, July 27, July 27, July 27, 2025, are you starting online online online activities? How to read the article and electric axis for the start of the bags of 2025, on 2025, and how to read the article, which reads the article, is a written agent! Read July 2625 next to the next to the cheap credit and token application! 26 July 2025 Read

Lost business Mitra Promo Promo Promo Promo Promo Promo Promo Promo Promo Promo Promo Promo Promo Promo Promo Entity and Gallery on internal relations on domestic relations

Do you have any questions about blog articles? Or do you want to send your best article to blog? What is the financial freedom or one person of financial freedom. This was overwhelmed by the world economy.

This 2022 World Economic situation is not good. The World Economic Institute, IMF (international cash) said that from 6% to 3 and 3 to 3 decreased by 6% to 3 decrease in world economic growth.

7 Level Financial Freedom Dan Cara Mencapainya

The impact of this decline is the most difficult money – there is an increase in goods and inflation. Therefore, it is necessary to understand financial freedom.

Financial freedom is a condition that a person has achieved freedom. This means that the freedom does not think too much while the person is spending money.

This explains that you will not be dependent on the situation that you may make someone or money. You don’t have to act too hard to get it infected.

Financial freedom is not easy and requires principles and difficulties that they can reach. He concluded what you need to prepare for achieving financial freedom:

Mengenal 7 Tahapan Menuju Financial Freedom

Anyone who has achieved manager does not mean that the income you receive should be greater. You don’t have to pay billions of things you to get in financial freedom, because the most important thing is like managing it.

This is undisputed that a large salary will have freedom. However, the role and many other factors played only.

If your account is, if your cost is expensive, it is difficult to achieve financial freedom. If you are not able to manage financial and resources well, then.

There is no need to start steps to pursue a large salary and prepare for financial freedom. Thus, you can regulate what is financial freedom now.

Tips Memulai Piramida Financial Freedom Dari Nol

Another mentality, financial freedom does not mean that you will be free from expense expenses. The purpose of financial freedom is that you do not contact the needs of the life of life.

You know all financial messages, such as needs, desires and other things. As a result, you will not sacrifice one of the money to the debt point.

After having a good mentality, you need to understand today’s financial conditions. Thus, you can easily prepare financial plans and other items that support financial freedom.

The financial conditions of each person differs depending on income and losses. Therefore, you need to understand everything that contains your duty.

Kesalahan Anak Muda Dalam Memahami Financial Freedom

Financial Freedom is a structured road of all financial activities. To find out the details of the financial action, you need to organize a financial plan.

This financial plan receives your income from where and sum of your income. Thus, costs, savings, insurance, loans and other means you have spent monthly.

During the financial plan management, it is necessary to review which financial literature to dissolve materials. This statement is generally related to their daily needs, such as nutrition, transport and others.

Undercoming for financial freedom is a loss of income from income. It is necessary to determine which expenses are not needed and that they are not needed, so they will leave the budget.

Cara Mencapai Financial Freedom Di Usia Muda

It is easier to determine the financial life of the daily life. Microsoft Excel and register all income, cost and emergency media in Google.

For insurance, you are one of what is easier to achieve financial freedom. The insurance can help you keep you for any important purpose.

The insurance options you choose may be appropriate for your needs. For example, you can choose different insurance, such as: health insurance, car insurance, education insurance, and others.

Passive income or passive income can be a big step to achieve financial freedom. This means how passive income is the middle company or the stock weight.

Ini Dia Pengertian Dan 9 Cara Untuk Mencapai Financial Freedom

If you have passive income, you should not depend on the income of the financial salary. If you dismiss your job, there are other sources of income to meet your needs.

In some cases, some needs are not big. Like or not, it should meet these needs by debt or get a loan.

For example, household loans or buying a motorcycle or car. Both of this need waste full money, deceived by debt, and deceived by debt.

If you pay the expiration date, debt is usually good. Your financial plan will not change, do not have to pay the debt on time and do not spend more money on the fines.

Financial Freedom: Pengertian, Contoh Dan Caranya

The biggest problem in achieving financial freedom is the cost of income you received. This is unsuccessful, depends on money and debt.

Ways to make the expensive lifestyle, as well as the desires that can cause you to lose more. Therefore, it is just balanced, the balance between the needs and desires.

You can use the concept of personal finance to achieve financial freedom. Personal financial institutions include personal finance or costs and income.

Private principle is 3 basic principles, there is 3 basic principles I will use, and I have priority (evaluation) and control (measurement). This principle makes you easier to manage money.

7 Cara Raih Financial Freedom Untuk Masa Depan Lebih Tenang

If you want to know more about personal finance, it can be said that it may be superior to financially and financially. This will help you to achieve financial freedom.

From the age of your youth, you start, for example, you can see from your age, for example, you can see from your youth. The various things given in the article can now reach themselves. I wish you good luck!

Individual financial literacy Personal finance … Starts 0% 0+ Alexander Jerredo

Investment Polish Planning … Medi 0% 0+ Jugher Ahmmdy

The True Meaning Of Financial Freedom

Freedom finance login, freedom finance loan, freedom finance, freedom finance company, freedom finance bank, freedom finance address, freedom finance phone number, freedom finance mortgage, freedom finance murfreesboro tn, freedom finance review, freedom finance careers, freedom finance murfreesboro tennessee