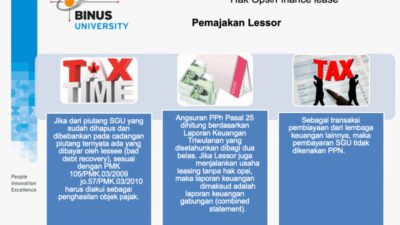

Finance Lease Dan Operating Lease – Lease (Lease) includes two income and operational capital in the capital. Capital rental agreement or amount to pay for capital goods for capital goods is greater than 90% of capital goods price or mini market price (reduced with tax relief) is determined at least 2 years of rental For capital goods for at least 3 years for 3 years for capital goods II and at least 7 years of building capital goods. 2. OPERATIVE RENTAL RENTAL RENTAL PAYMENT Can’t access the amount of rental capital plus the lease No lease has no choice but to buy the right to the end of the tenant.

In the capital rental, the incarceration gets the property of goods, and then rented for a maximum of time, the fact that tenants are forced to pay tenant tenants to finance goods plus tenants and financing advantages.

Finance Lease Dan Operating Lease

Lease transactions Register as a fixed asset and obligation and rent value for all payments for all payments must be paid by the end of the rental.

Finance Vs Operating Lease

In principle, the fixed assets obtained will be recorded at the price of purchases, namely the purchase price plus assets and costs ready to use fixed goods can be grouped into two types of expenses. namely: income expenses

Acquisition of fixed assets when purchasing fixed assets purchases, fixed assets with fixed assets are distributed through exchanges …

1 Acquisition of fixed assets if cash purchase is made in cash, the bank pays the purchase price. The purchase can be made (paid) Mental offices or offices through credit professionals, complex credit expenses will create interest. Therefore, it must be distinguished between investment and income expenditure. Interest costs are income costs, so they do not adhere to the acquisition price of the goods. Interest expenses should be registered for yourself

Fixed assets purchases can be obtained by substituting securities with values with values with fixed assets. Thus, the fixed assets obtained are valued in reasonable value. If the real value of fixed assets is not obtained, it is based on value value.

Ktp & Company Plt

The exchange of fixed assets with a type of fixed asset with different types of points involve fixed assets of different types of functions, which are not values. Different types are not seen from physical. It is the exchange of fixed assets evaluated in the fair value of accounting processing, or in accordance with goods or more appropriate goods available for data. The difference between the actives presented with the fair value used on the transaction date must be registered or registered as a loss of exchange.

5 Fixed assets purchases through their manufacturing to obtain fixed assets and warehouses, a bank itself can do. Examples of manufacturing cabinets, tables and other proabotas. The costs of raising and acquiring prices are raw materials, labor costs and costs. Note: Costs, as a result of these assets can increase costs or be charged according to additional costs.

6 Fixed activity recording / prices in the market price recording / prices are obtained at the market price, but if this asset is achieving, the sacrifice will only be clean value.

Costs are required to use bank facilities. This cost is income expenditure so that it is registered separately. Repair and maintenance costs, such as costs, compensation occurs at low costs and magazines

Capital Lease Vs Operating Lease Determination 1630

Debit Account (RP) Credit (RP) Dr. Repair and maintenance cr. If money maintenance and repair costs increases the age of fixed assets (RP) credit (RP) Dr. Culture of fixed assets by cr. Box release

15 Specifically, relatively large compensation costs should be taken the value of the component of the fixed component exchange. The substitute value must be removed in the book and then entered / recorded a new value in the book compensation.

The use of fixed assets used will be eroded with fixed assets. Therefore, the value of fixed assets must be provided to compensate for reducing the benefits given each time. In general, the repayment of fixed assets is conducted by the Bank, as it is: physical factors for functional factors

To determine the amortization value, there are several methods: StrarigTH Line Method Method Method (Summit Sum of Method) method

Finance Lease Vs Operating Lease

Example: Dr. Date. Credit debt account is the cost of fixed assets for the cost of fixed assets. Redemption of fixed assets – Car

To work with this site, we record the user data and share it with processors. To use this site, you need to agree on our privacy policy, including cookie policy.

International Accounting Rules (IASB) and Financial Accounting standing (FASB) offers different criteria for rent classification, they are very similar to practical purposes. However, these differences will be important to correct the management of rentals and rental portfolio.

It is important to mention that these descriptions are important to the rules of current rentals; IAS 17 IFRS users and 840 topic (former phase 13) for US gaap users. Over the last ten years, IASB and FASB worked together to develop a new standard of rental accounting to recognize all rental commitments on the balance sheet. From January 1, 2019 to the IFRS and US gap from 15 December, these new standards will take the current guidelines.

Capital Lease: What It Means In Accounting

According to current accounting, the rental agreement is classified as a financial lease, such as the tenant’s property at the end of the lease, or a significant part of the lease is the financial life of the asset calculated. If the rental agreement does not comply with any of the following conditions, they are classified as an operating agreement.

There are two types of leases and advantages according to some conditions of your business, you can find out that it is more convenient for an alternative to some assets. To help make the decision, our expert caused leases compose this commitment to the agreements between the agreements and financial rental agreements.

The following changes in global lease accounting will change those who have their own leases, especially variable leases. 2.8 TN assets will be included in the balance sheet because almost the leases must be recognized in financial reports. It is important that companies notice how to influence the Treasada of Treasades and lease. Learn more about how and why they will be able to take the next step.

For more information on global lease in your new lease and more information about your company, you can download this guide to our rent experts here.

Accounting For Leases As A Sub-lessor Under Ifrs 16

The lease is an essential concept in the company. Home companies or new small businesses seek lease opportunities because resources are limited, and the owners do not invest money to help active business in early. Therefore, they rent assets each time they need.

Economic lease is a lease, where risk and return tenants (entrepreneurial) are transferred when they are rented for business assets. An operating rental, on the other hand, the risk and return of the tenant.

So how would the entrepreneur choose between the agreement of financial leases and a rental agreement? And why will he choose above each other?

This article will determine how and why the agreements of financial and operational rental occurs. We will also find out the difference between a financial lease and operational rentals. For example, the largest difference between financial leases agreement and operational agreement is that the financial lease cannot be canceled the first time of the contract; On the other hand, the operating agreement may also be suspended within an entry for a contract.

Difference Between Finance Lease And Operating Lease(with Table)

There are many differences between economic lease and vs. Operation rental agreement. Let’s see the most important difference between these two –

As you can see, there are many differences between financial lease and vs. Operation rental agreement. Let’s see critical differences between them –

Trade agreement when the tenant uses the active agency for periodic payments.

Commercial, when the tenant tenant allows the tenant to use an asset, rather than regular payments;

Ias 17 Leases

In the case of financial leases agreement, the tenant should take care of and maintain assets.

In case of one