Finance Portfolio – The portfolio management is the art of selection and monitoring of the investment group that meet long-term financial goals and tolerance at the risk of client, company or institution.

Some people work their own investment portfolio management. This requires a deep understanding of the key elements of the construction of portfolios and maintenance that are for success, including the distribution of assets, diversification and rejolancing.

Finance Portfolio

Professional licensed portfolio managers works on behalf of clients, while people can build and manage their own portfolio. In both cases, the ultimate goal of the portfolio manager is to maximize the expected return on investment in the appropriate risk exposure.

Asset Management, Portfolio Optimization, Financial Growth Concept With Character. Investment Portfolio Abstract Vector Illustration Set. Portfolio Management, Wealth Growth, Financial Strategy 35151847 Vector Art At Vecteezy

Portfoli management requires the ability to when the strengths and weaknesses, opportunities and threats of the investment spectrum. Elections include competes, of debt in relation to capital on domestic against international and grow against safety.

Property distribution (eg supplies, chains, real estate) in the portfolio to achieve the preferred risk return.

Conservative investors often have a greater bond allocation, while aggressive investors want more exposure to growth in growth.

Beta of 1 means that investment moves in accordance with the market, while the beta greater than 1 indicates a greater volatility.

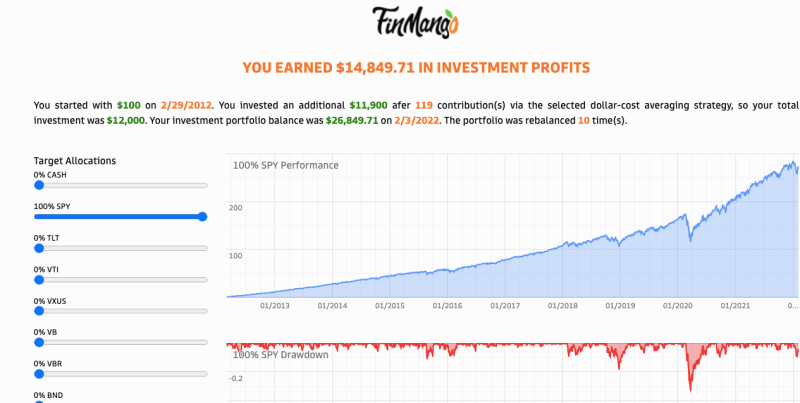

Is Your Portfolio Working For You?

Type of mutual fund or fund traded (etf) that monitors the performance of a particular market index

The S & P 500 index, which accompanies the largest 500 American trading companies in terms of market capitalization.

Strategy that aims to replicate the performance of the reference index, often by investment in indexes or eths.

The investor can choose a passive S & P 500 index fund for the mirror performance of the American large cap.

6 Monthly Paying Investment Options Globally: Diversify Your Portfolio For Steady Returns

They sell some supplies and buying more bonds to return to the award of 60% shares and 40% chains.

The principle that potential returns an increase in risk by increasing risk. Thus, lower risk investments offer lower potential returns, while investing larger risks offer greater potential cuten.

Adjustment measure of risk, calculated as excess return on investment in the course without risk divided with standard deviation.

Portfolio management is a critical investment practice-used by two types of entities: individual and institutional investors. The categories have different strategies, goals and resources. Understanding different approaches and requirements of the two types of investors can provide a larger insight into as the portfolio management techniques apply by the financial spectrum.

Google Finance Portfolio Alternative

Individual investors often focus on personal fortune and future needs, managing smaller amounts of money with different degrees of professional assistance. In contrast, institution of investors carry large money with a professional approach adapted to meet special financial liabilities and institutional goals. Both groups, however, aim to improve their yields by managing their portfolio to adapt them to certain circumstances and financial goals.

Individual investors have a number of personal goals, risk preferences and resources. Their goals include retirement savings, accumulating wealth for large purchases, financing education for children or construction of an emergency fund. Each goal requires a different strategy or profile of risk.

Tolerance at risk as well as investment knowledge between individual investors worries very very. In addition, their approach to investment management can range from a very engaged active trading and rebellancing for trust on automated or professional governance. As financial markets have evolved and technology has expanded access to investment information, individual investors has extensive prospects for adapting their investment strategies to meet their personal goals.

Institutional investors are the entities based on large sums of money and invests the money in various financial instruments and property: Pension funds, indebtedness, banks and insurance companies. Each has special goals and limitations that affect their portfolio management strategies. Many institutional investors have long-term financial liabilities that have focused on long-term growth and sustainability due to short-term winnings.

Portfolio Diversification, Hedge And Safe-haven Properties In Cryptocurrency Investments And Financial Economics: A Systematic Literature Review

In addition, institutional investors are often under strict regulatory supercient to ensure that they are responsibly lead their user money. In addition, the questions of ethical and social administration increasingly affect their investment decisions. Risk management is a critical part of the institutional portfolio manager, because the entities must balance the need for profitability with the imperative of preserved capital to meet future obligations.

Investment approaches of institutional investors are usually conservative in relation to individual investors, focusing on long-term stability, capital conservation and future obligations. Indeed, any type of institutional investor has various strategies and goals, but all share a common goal responsibly reportly large capital gatherings to meet the needs of their stakeholders.

Passive management is a long-term set-it-I-forgotten strategy. May include investing in one or more etfs. This is usually called indexing or indexing investment. Those who build indexed portfolios can use modern portfolio theory to help you optimize the mix.

Active management includes an attempt to win the performance of the index active by purchasing and selling individual shares and other assets. The money from the closed team is mainly actively managed, as many mutual funds. Active managers can use any of the wide range of quantitative or qualitative models to assist in their assessment of potential investment.

Green Check Unveils Groundbreaking Portfolio Management Feature To Empower Financial Institutions With Unparalleled Insights And Program Control

Investors that use the active management approach to fund managers or intermediaries to buy and sell actions in an attempt except a certain index in 500 seconds and jadard. Often the investors will also use portfolio Management software to help them with the practicing of their investment.

The active managed investment fund has an individual portfolio manager, sovereign or team of managers that actively investment investment decisions for the fund. The success of the active managed fund depends on the combination of deep research, market predictions of the portfolio manager or the managerial team.

Portfeel managers dealing with active investment pay attention to market trends, shifts in economics, changes in the political landscape and news affecting companies. The data is used during purchase or sales of investments to use the irregularities in the market. Active managers claim that the processes will strengthen the potential for a refund greater than the achieved by simply monitoring the parts on a certain index.

Attempt to win the market inevitably involves market risk. Indexing eliminates this special risk, because it is less likely human error in choosing index stocks. Index money is also created frequent, which means that they have lower cost ratio and are more taxpayers than actively managed money.

Portfolio On Google Finance Not Updating “value” Column

The passive portfolio management, also headed to the Asiax fanmentagement, aims to duplicate the Bonchmark Return Indexor Market Market. Maximum listed, using the same weighting which represents in the index.

The passive strategy portfolio can be structured as an etf, mutual fund or audit investment trust. The indexed assets are branded as passively managed because each has a portfolio manager whose job is a repeal index and not to choose property purchased or sales.

Another critical element of Portfolio management is the concept of discretion and non-discreditation. This portfolio management approach dictates which the third parties may be allowed in connection with your portfolio.

The discretionary or non-discretional style of management is only relevant if you have a standalone broker that manages your portfolio. If you want the broker to make trading that you explicitly approve, you must opt for an indiscretting investment account. The broker may recommend you strategy and suggest investment moves. However, without your approval, the broker is a simple advisor to follow your instructions.

How Do I Work Here How Do I Withdraw Money From Google Finance

Meanwhile, some investors prefer to ask all decisions in the hands of their broker or financial manager. In the situations, the financial advisor can buy or sell securities without the investor’s approval. The advisor after a fidusary responsibility for action in the best interest of the client when managing their portfolio.

The key to efficient portfolio management is a long-term combination of assets. In general, it means stocks, bonds and cash equivalents such as deposit certificates. There are other named alternative investments, such as real estate, goods, derivatives and creputics.

The distribution of assets is based on understanding that different types of assets do not move at a concert, and some are volatile than others. A mixture of assets presents balance and protects against risk.

Investors with a more aggressive profile balance your portfolio more to volatile investments, such as growth stocks. Investors with a conservative profile extent their portfolios to stable investments such as bonds and blue chips.

What Is A Portfolio?

Replaced records last gains and opens new prospects while the portfolio continues in accordance with the original risk recovery profile.

The only security in investment is that it is impossible to always predict the winners and losers. The Proent Approach is to create a basket of investments that provide wide exposure in different means.

Diversification includes the expansion of risks and rewards of individual securities in the asset class or between the asset class. Since it is difficult to know which Suhkcom class or sector is likely to surpass another, diversification seeking to record a return of different sectors over time, and reduced volatility.

Rebalines returns the portfolio to the original allocation of the target with regular intervals, usually annually. This is performed to restore the original mixture of assets when the market movements push it from the killer.

Investment Portfolio Financial Performance Report Pictures Pdf

For example, a portfolio that starts with 70% of the capital and 30% of the fixed income distribution could, still extended market rally,