Finance Report – The financial statements are reports collected by companies that detail the financial activities and the state of health of the company. Government agencies and accountants often review financial statements to ensure tax accuracy and purposes, funding or investment.

The main financial statements of non -profit companies include balance sheets, benefits and loss states, cash flows, and capital changes. Non -profit organizations use similar financial statements, although they have different names and transmit slightly different messages.

Finance Report

The internal and external parts use the company’s financial data to analyze the performance of the company and make predictions on the possible management of their price of the shares. One of the most important sources of reliable and auditing financial data is the annual report, which contains the company’s financial statements.

Add Detail To Financial Reports Within Business Central

Investors, market analysts, and creditors use financial statements to evaluate the financial position and potential for a company. The report of the three main financial statements are the balance, profit account and the loss and the cash flow account.

Not all financial statements are created based on the same accounting rules. The rules used by North -American companies are known as the principles of accounting, while the rules used by international companies are the International Financial Information Standards (IFRS). In addition, U.S. government agencies use different rules of financial information.

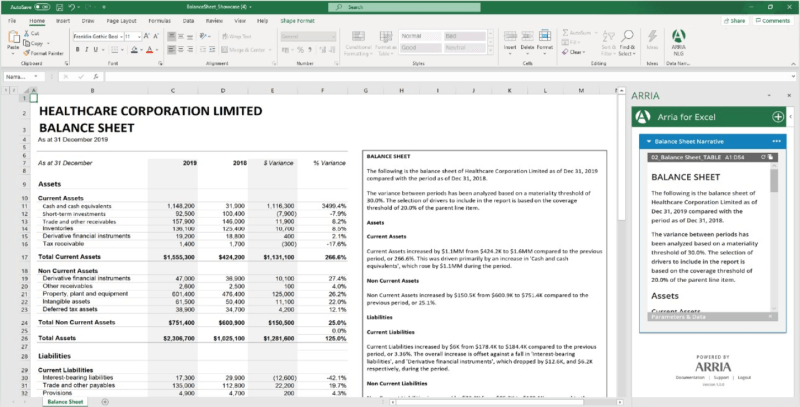

The company balance describes the assets, liabilities and interests of the company’s shareholders at a specific time and date. The date at the top of the balance indicates when this snapshot will be taken. This is usually the end of its annual complaint period. This is followed by a breakdown of the items in the balance sheet.

Unlike the balance, the results account usually covers a one -year or a quarter range. The declaration of benefits and loss describes the income, expenses, net income and benefits by action during the period.

Board Reporting For Startups

The main purpose of the results account is to transmit the details of the profitability and financial results of business activities; Execution and management.

Investors can also see the company management ability to control expenses to determine if the company’s efforts to reduce sales costs will increase the benefits over time.

Operational income is the income obtained through the sale of products or services of a company. The care income of the car manufacturers will be carried out through car production and sales. Operational income is generated by the company’s basic activities.

Non -operational income is the income obtained from non -fundamental business activities. This income does not exceed the main functions of the business. Examples of non -operational income include the following income:

Financial Statements: List Of Types And How To Read Them

Other revenue are revenue obtained from other activities. Other revenue may include long -term asset sale income (such as land, vehicles or subsidiaries).

The main expenses take place in the process of gaining income of the main activities of the company. The costs include:

The rates related to secondary activities include interest on paid loans or debt. The losses for the sale of assets are also recorded as expenses.

This is followed by part of the Declaration of Benefits and Losses, according to December 31, 2023.

Finance Report Dashbaord

The cash flow account (CFS) shows how a cash company wins and spends. The cash flow account complements the symbolic declaration of the balance sheet.

CFS allows investors to understand the operation of a company, where the fund comes from and how it is spent. CFS also provides information on whether the company is on a solid financial base.

The cash flow account consists of three sections that report various activities of the company through its cash.

:max_bytes(150000):strip_icc()/GettyImages-172202514-d0ed8243906e47208b08a376e0bcbdc7.jpg?strip=all)

CFS Operational Activities include the use of cash resources and money to operate a company and sell its products or services. Cash for operations includes any of the following changes:

Company Annual Financial Report Design Template Vector Image

These transactions also include salaries, income tax payments, payments of interest, rent and cash revenue and the sale of products or services.

Investment activities include any source and use of the company’s investment in its long -term future, including changes in equipment, assets or investments related to investment cash. This includes:

The cash of financing activities includes investors or banks, as well as cash paid to shareholders. Financing activities include:

It is then part of the cash flow declaration of the year 2023 reported by Exxonmobil Corporation for the year completed on December 31, 2023. We can see three areas of state flow of cash and their Results.

Weekly Financial Report Template

The description of the capital changes will monitor the total heritage over time. This information returns the balance to the same period; Investors use this information to understand the profitability of a company and its actions.

The formula for the capital changes of shareholders varies from company to company;

In the declaration of exxonmobil on changes in equity, the company also documented activities of acquisitions, arranged, depreciation based on incentives of shares and other financial activities. This information is for analytics how much money the company will keep for future growth instead of external allocations.

A declaration of comprehensive revenue is often a frequently used financial state that summarizes standard net income, while also integrating other complete revenue changes (leisure). Other consolidated income include all unrealized gains and losses that have not been reported to the profit and loss account.

Monthly Financial Report Template

Financial statements show changes in the company’s total revenue and even profits and losses not registered according to accounting rules. Investors and lenders can use this information to obtain a more detailed and complete understanding of the company’s financial situation.

In the following example, Exxonmobil has net revenue of more than $ 1 billion. Exxonmobil not only reported net revenue of $ 36 million, but also registered a total of $ 37.3 billion on considering other comprehensive income.

Document non -profit financial transactions in similar financial statements. However, non -profit is no shareholders and do not pay benefits. As a result, they use different financial statements to report their activities, income and expenses.

This is equivalent to the balance of an entity with a profit. The biggest difference is that non -profit organizations have no capital positions. All the remaining balances after all the assets are liquidated and the satisfaction liabilities are called “clean assets”.

Cgiar Financial Report Dashboards

This is equivalent to the declaration of results of an entity with a profit. The report monitors changes in operations over time, including information donations, aid, activity income and expenses to achieve everything.

The report is aimed at non -profit organizations. Declaration of functional rates reports on the expenses of a physical function (usually divided into administrative, planning or fundraising costs). This information is distributed to the public to explain that the proportion of expenses throughout the company is directly related to the mission of non -profit people.

This is equivalent to a cash flow declaration for a profit organization. Although the accounts listed may vary by nature of the non -profit organization, the declaration is divided into financing operations, investments and activities.

Although financial statements provide a lot of information about the company, they have limitations. These statements are often interpreted in different ways, so investors often draw different conclusions about the company’s financial performance.

Financial Report Vector Illustration With Data Charts, Graphs And Diagrams On Finance Transaction, Analysis And Statistic Online In Flat Background 32320976 Vector Art At Vecteezy

For example, some investors may want to buy shares, while others may want to see long -term invested funds. A company’s debt level can be good for an investor, while another may be concerned with the company’s debt level.

When analyzing financial statements, it is important to compare various periods to identify any trend and compare the company’s performance with colleagues in the same industry.

Finally, financial statements are only as reliable as information fumed in the report. Fraudulent or poorly documented financial activity or poor control leads to inaccurate financial statements designed to deceive users. Although audited financial statements are analyzed, users must place a certain level of confidence in the validity of the report and numbers shown.

The external auditor evaluates whether the company’s financial statements have been prepared in accordance with standardized accounting rules. In this way, all companies denounce their financial situation in the same way, which facilitates investors, lenders and others to understand their reports. The external auditor also guarantees that these financial statements are accurate, whether incidental or intentional, without any misconceptions or omissions.

Simple Monthly Financial Report Template In Google Sheets, Word, Pages, Google Docs

The three main types of financial statements are the balance sheets, benefits and loss states and cash flows. As a whole, these three statements show the assets and liabilities of the business, revenue and costs, as well as the cash flows of their operations, investments and funding activities.

Financial statements show the operation of the business. They provide information on how a company generates revenue, what revenue is, the cost of carrying out a business, the effective efficiency of its cash and the effectiveness of its assets and liabilities. Financial statements show how the company manages.

Financial statements are read in various different ways. First of all, financial statements can be combined