Finance Vs Lease – Ltd> van blog> funding> financial rental – contract rent: all combines customers must know

Between the financial jargons, the structure for agreements and advertising for less printing, with leasing, has never been more important to know what you register.

Finance Vs Lease

Contracting compliance and lease agreements are the two main types of agreements on business leasing of representatives and financial companies can offer.

Finance Vs Operating Lease

They both fulfill a similar purpose so that you can take advantage of new vehicles at a lower monthly price.

But they also have some important differences in important for you to know before spending tens of thousands of pounds on a new vehicle.

In this guide, we will break the most important things you need to know about the employed contract to help you decide which option is best for you.

The financial lease is a type of financial arrangement that extends the cost of a new vehicle in affordable monthly payments.

Finance Leases: A Comprehensive Guide

Customers will pay a preset and then each month’s refund during the agreed term (usually 24-60 months) and the ability to pay balloons at the end.

The life will set annual mileage to calculate how much the vehicle will be valid at the end of the semester.

For example: The van works 5,000 miles a year will have a larger balloon than one 20,000 million per year.

This is because the van is more worthy at the end of the term due to the smaller mileage.

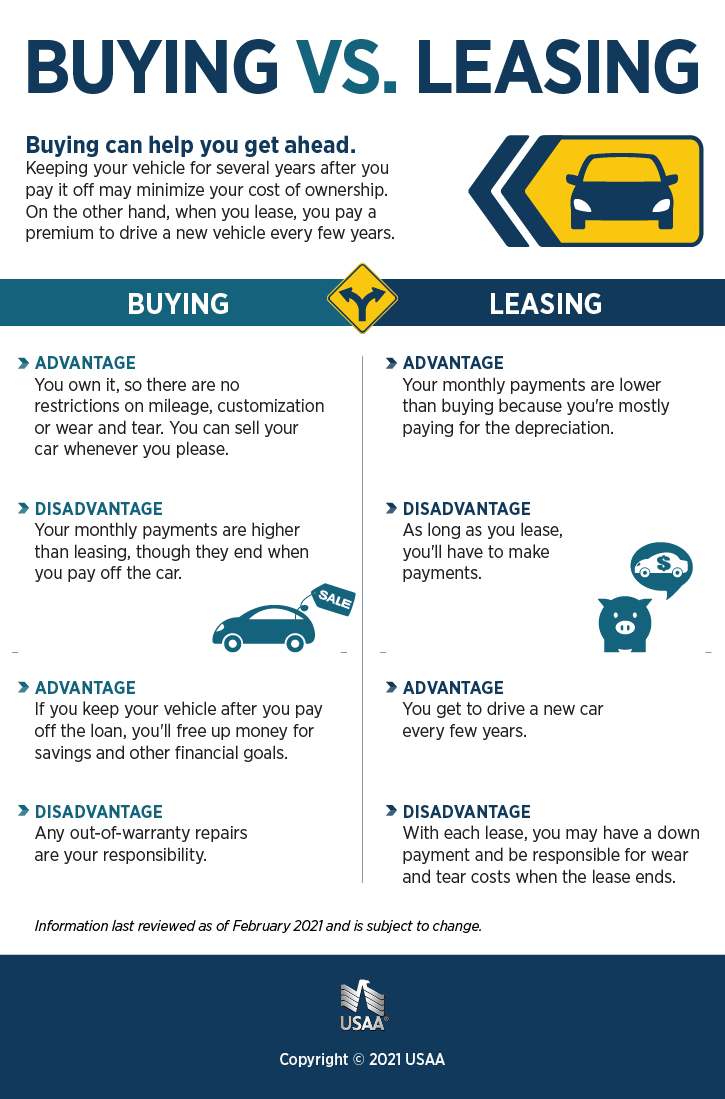

Buying Vs. Leasing A Car

It can determine if you will be in positive or negative capital when you pay the balloons at the end.

So when you come to sell it you have to give them 2.5% as much as you sell it.

At the end of the financial lease agreement, the balloon payment automatically goes to your account. However, you can sell the vehicle before this, solve the balance and use any backup changes to put on the next. Then rinse and repeat.

First, you have to pay a financial company 2.5% from £ 10,000,000 when you sell a vehicle – which is £ 250.

Accountant Explains: Leasing Vs. Financing A Car For Maximum Tax Deductions In 2025

You now have 3, 750 pounds to do this like you. Which, for example, uses a deposit at the next van.

Customers pay the deposit (known as the first rent) and then a number of monthly payments for the set. These conditions can be reached anywhere from 12 to 60 months.

Annual mileage will be used and can be charged for them. You can also face fees for any vehicle damage when you return.

Some packages even include services and maintenance, thus and why many large float operators choose a rental contract when renting their vehicles.

What Is The Difference Between Lease Vs. Rent?

However, some companies may be more suitable for simply handing over the vehicle at the end of the agreement.

It depends on what you want to submit your agreement. If your vehicle owner at the end of the agreement sounds best for you, it is worth seeing to buy rent.

Both options give users access to brand new vehicles at lower monthly repayments from the lease.

And the commitment to the business agreement and the lease is taxable taxes. This means that you can compensate for monthly repayments against all taxable profits throughout the period.

Buying Vs. Leasing Jeep

However, the contracts for the rental agreement for financing and contracts extend VAT throughout the period, which means that your costs are lower.

But with the lease agreement, if you want to continue using your vehicle after your period, you can pay secondary rental fee each year.

Whether it is the length of the semester, the annual amount for mileage or deposit amount, both types of agreements can be adapted as a variety of business needs.

The balloon is a lump sum at the end of the agreement that allows fewer monthly repayments throughout the period.

Autofair Ford Manchester

As mentioned earlier, you store 97.5% of resale values for vehicles with the rental financing agreement, and the remaining 2.5% return the lender.

Contract contract, the vehicle returns to the lender at the end of the semester and the customer has no capital in the vehicle.

When demand is high and accessibility is barely, the vehicle’s price will be higher. When demand is low and there is an abundance of stock, prices will be lower.

When you arrive to sell your vehicle at the end of the rental financing agreement, you are due to this fluctuation.

Fca Decision On Car Dealer Finance Clouds The Issue For Car Leasing Brokers

You have reached the end of your agreement and the market is strong. With 70,000 miles on the clock, your van is worth 12,000,000.

You pay 2.5% of October 12,000 and leave you to 11, 700 kg. When you pay the balloon and solve the remaining economy, you now went with 3, 700 to do with you.

Your deal will come to the end and you also performed 70,000 miles. But this time your van is worth 9,000 pounds.

For the financial company, you pay 2.5%and leave you from £ 8, 775. This means that after you fix the remaining balance and the balloon you were just 775 kg.

Is It Better To Rent Or Buy A Car Purchase

Since there is no payment of balloons and return the vehicle back to the lender, which you do not affect the increase or reduction of the value of your van.

NOTE: We have ongoing aware of paying Balloo’s low. In this way, there is a much greater chance that you will return more money at the end of your agreement.

We hope you move this more informed about insolutions and outcome about each agreement and now you are ready to choose the best option for your business.

If you have further questions or ideas for the topics you want to cover in the future, feel free to leave a comment below!

What Is Car Leasing? Is It Better Than Pcp?

For more help with financing of vans and purchases, be sure to check our full collection of guides and useful content today.

Whether the leading experts in the UK in combination combinations. Since 2006. We combine its decades of experience in commercial vehicles to offer work throughout the UK, the vehicles needed to start the business. From refrigerators and cottages for herds to the transfer of animals and converted conversions. Winners of several industry awards, including “Annual Converters” in Whatwana? Awards and energy -efficient technology during the year at Avard’s 2024. Clean Energy Awards.ltd> Van Blog> Finance Friday> Financial Lease or Rent Hopping: What is it for you?

Whether you are looking for a panel board, crew cabins, cooling or transformation of the converter, you can see the terms of the financial rent and rent shopping wherever you look when it comes to financing vehicles. We are many questions about what the difference between the two, so we explained the best we can in Sunday financing on Friday. There are even fast tables to quickly compare the differences.

The financial lease is a method for finance assets through regular monthly payments with minimal costs in advance. The vehicle is eventually owned by the finance company and then hired you.

Financial Lease Vs Operating Lease

The first payment in the rental financing contract will be £ 1500 from £ 1500 + VAT, although you can decide to pay more for lower monthly payments. Monthly payments since then a picture of + VAT agreed. This differs in the employment of purchase, where you pay all VAT vehicles at once. In the end, there are also options for the balloon, which we will explain later.

Since you do not own a vehicle, there are three things that can happen at the end of your lease:

If, at the end of the lease, you decide to be quite like a van and want to keep it, finance companies can arrange something called Peppers Lease. Biber nation rental can be up to three years after the end of the original rental period.

Annual payment of a vehicle on leasing of a Pibertube, just one month of what you paid earlier. For example, if you paid 250 pounds for each month at the rental period, you would pay 250+ VAT for the year after the lease, and yet if you decided to transfer it in a year later.

🚗 Finance Vs. Lease Unless You’re A Millionaire Paying Cash Upfront, You Can Buy A Vehicle In Two Ways: Finance It Or Lease It. Both These Methods Have Pros And Cons Depending On What You Want And

Once your pepper rental is completed, then the van is sold as above, where you get excess.

The lease is good because they offer great flexibility. You can build capital in a vehicle without possession. Several options at the end of the contract offer many choices for what you do after the lease is completed. The monthly rent is up to 100% of deductible taxes, and adding balloons can reduce monthly payments.

Lease Finances is not as good if you want to own a vehicle because a van will own a financial company that rents it to you. If you decide to take the payment of balloons, there is always a risk that the value of the vehicle will not be as much as