Florida Auto Insurance Update – You need insurance to register a car in Florida. Yes, Florida’s law requires you to have insurance to register a car. Here’s what you need to know briefly.

Car registration and insurance in Florida may seem complex, but it should not be. Whether you are a new car owner or just moved to sunlight, understanding your obligations for insurance and registration is the first step to ensure the right side of the law. Insurance in Florida is not just a proposal. It is a legal requirement for vehicle registration. This means that before enjoying the path of the Florida road, it is necessary to ensure the coverage of law insurance according to state laws. This coverage not only protects you, but also to others.

Florida Auto Insurance Update

In Oyer, Macroviak and Associates, we understand that each family or business owner wants insurance solutions to their unique needs without breaking the bank. Insurance requirements and vehicles registration processes are very important for all drivers in Florida to ensure the compliance of state laws and protect the possible financial flaws of insecure machinery.

Car Insurance Requirements In Florida For #currrent_year (fl State-mandated Coverage Guide)

Since 1953, we have helped thousands of customers save money on insurance coverage while we do all the work. Let’s go shopping your policy with “30” rated companies.

Car insurance water cruise should not be complicated in Florida. Let’s destroy what you need to know in a simple way.

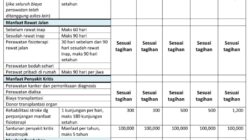

FLorida Protection of Personal Injuries (PIP) is your friend in a car accident. It includes 80% of your medical bills, regardless of who caused the accident. Whether you are guilty or the other driver, Pip has received your back. Do you need at least $ 10, 000 tube coverage? This helps to make sure you have not left the accident after an accident.

Next is the obligation to damage property (PDL). This coverage is designed for damage caused by someone else’s property. Again, Florida’s law requires you to have a minimum of $ 10, 000 PDL. So if you accidentally hit someone’s fence, PDL helps cover repair costs.

Johnson & Boge Insurance Group

While the pipe and PDL show the stars in Florida, it is important to talk about covering responsibility. This type of insurance is more about protecting you from the financial effects, if you are found guilty, causing damage to others or cause injury. It’s like a security network, ensuring that you are not stuck to pay all your pocket costs.

To summarize in Florida, it’s 10 dollars to be bare on the road, and $ 10,000 in PDL. This is just a minimum. Depending on your situation, you may want to consider higher boundaries to give you more protection.

Why is this important? Well, accidents happen. And when they do, the last thing you want is to worry about how you will pay for damage or medical fees. Florida Insurance Requirements are designed to give you a level of fundamental protection so that you can focus on what is really important to get back to your feet.

So you need insurance to register a car in Florida? Absolutely And not only any insurance but also a policy that meets the Special Pip and PDL requirements of Florida. This ensures that you and others will be protected in the event of an accident.

Auto Insurance Affordability: Cost Drivers In Florida

Navigation car insurance may seem awful, but it all concerns if they are unexpected. With the right coverage you just don’t meet the law. You are also looking out of your future you and on the road to others.

So you are ready to register your car in Florida. Perfect here’s what you need to know to make the process as smooth as possible.

Proof of insurance. First things first need insurance to register a car in Florida. Absolutely Florida Law requires you to display insurance proof before you register your car. This means that you need at least $ 10, 000 US Personal Injury Protection (PIP) and $ 10, 000 Property for damage (PDL) coverage.

Title Certificate Application: You need to apply for a title certificate to register your car. This is your official assertion belonging to the vehicle. You complete a form that asks details about your car as its improvement, model and year.

Best Car Insurance Discounts For State Of Florida Employees In 2025 (save Up To 25% With These Companies)

Registration fees. Like the most, it’s not free to register your car. Payments may vary, so it is a good idea to check the latest expenditures on the Safety and Vehicle Safety of the Florida Highway or Your Local DMV Office.

Evidence of identity. You have to prove that you are who say you are. A valid driver’s license, State ID or Passport must do the trick.

HSMV Form 82040. This is the official application form of the title certificate. You have to complete it completely. It includes your vehicle information, your insurance details and your personal information departments.

Florida car insurance documents. These documents prove you have the necessary insurance coverage. Make sure your insurance card or policy have your name, effective policy dates and the details of coverage.

Best Auto Insurance For Seniors In Florida (top 10 Companies Ranked For 2025)

Self-insurance certificate. If you are self-insured you need to show your self-insurance certificate. This is not widespread for most drivers, but it is an option if you meet certain criteria set by the state.

All these documents are ready when you go to your car, will make the process much faster and easier. If you are missing something, you may need to return another day, and no one wants it.

So collect your documents, make sure your insurance is relevant and travel to your local DMV or Tax Collector Office, which runs vehicles registration. If you have any questions, the experts of Oyer, Macoviak and Associates are always here to help you guide in that process.

The short answer is not. In Florida, you must have insurance to register your car. This rule is strict and there are no exceptions. You need to show proof of insurance before you register for your car. This is an important step in the process.

Bundling Insurance For Maximum Savings In Florida

Let’s talk about what happens if you don’t do the rules. If you allow your insurance to stop or try to drive without minimal required insurance, you are some difficulties. Here’s what you can meet.

Driving insecure is not only risky, it is against the law. If you caught, you can have penalties from $ 150 for the first crime. Fines are growing with each crime, reaching $ 500. Also, you need to provide insurance evidence before you restore everything.

Summing up to avoid sanctions and keep your driving privileges in Florida, make sure you need the required insurance before you try to register your car. It’s just not a good idea. It’s the law. If you need help to understand what insurance you need, Oyer, Macoviak and Associates can guide you through demands and help you find a policy that meets state laws and your needs.

If you are not Florida Native but you find you living or working in the sun’s sun, you may be interested in car insurance and registration. Whether you are here for the season, you have made your new home, there are some basic things you need to know.

Florida Sr-22 Auto Insurance Tampa Brandon Riverview Florida

Moving can be heated and easy to ignore certain details. If you leave Florida, there are a few steps you need to follow so that you do not run on any law or excessive costs.

The key to a flat transition, be moving from Florida, plans forward. Make sure your insurance coverage is always up to date and meets your current situation requirements. If you are not sure about the steps you need to take, Oyer, Macoviak and Associates specialists are ready to help. They can give advice on how to comply with Florida insurance laws and support your new policy in finding relevant policy. Do not hesitate to lead to guidance to ensure that you stay on the right side and your car is properly insured and registered, no matter where you are.

In the next section, we will dive into several frequently asked questions about car registration and insurance in Florida to clean any long-lasting confusion.

Frequently Asked Questions In Floridado, I need insurance on car registration and insurance in Florida to re-register.

Florida Car Insurance

Yes, you absolutely need insurance to re-register your car in Florida. Before you update your registration, Florida’s law requires you to display Profile Insurance Protection (PDL) Insurance (PDL) Property Protection (PDL) Insurance. It is important to make sure that your insurance policy is up to date and meets the requirements of the minimum coverage of the state. Without it, you can’t continue to re-register your car.

– Personal Injury Protection (PIP): $ 10,000. This coverage helps pay for your and your passenger’s medical expenses, no matter who caused the accident.

– Responsibility for damage (PDL), $ 10, 000. This pays you or another person to run another person.

These are absolute minimums. However considering the value of medical care