Health Care Premium Tax Deduction – In accordance with Article 80d of Personal Income Tax Act, individuals and HUF may require haircuts paid for health insurance.

In these unprecedented, we all found that “our health was our wealth” and that we would preserve us protected from these uncertain times, we have taken all possible measures to fulfill health expenditures if necessary. In addition, the legislative body for promoting health planning and well -being of people has introduced paragraph of 80d of personal income tax law. This section allows for health insurance and medical expenditures that people have.

Health Care Premium Tax Deduction

This provides double benefits to the person – one for the insured or his family members, and the other is a tax benefit for the person.

Aca Marketplace Subsidies Expiration

In accordance with Article 80d of Personal Income Tax Act, a person may request a deduction of the premium paid for health insurance.

If persons may require a deduction in accordance with the 80d section – an individual (Indian/foreign citizen) for themselves, spouses, dependent children and parents (whether they are dependent or not).

The deduction according to the 80d section can only require if it decides on the old tax regime.

– health expenditures for the health of the elderly (60 years or more) who are not covered by any health insurance scheme.

Form 1098 And Health Insurance Premiums: Claiming Tax Credits

– Contribution to the central government’s health scheme or any scheme as notified by the Government.

Note: Section 80D also includes a deduction of 5,000 RS for possible payments for preventative medical examinations. This deduction will be in the total limit of 25,000 000 000 / RS 50 000, such as an example.

Amitabh (55) is a taxpayer. Other members of his family are – Jaya (53 years, Amitabh’s wife), Abhishek and Aishwarya (dependent children) and parents. The following expenditures for Amitabh for 2022-23:

The largest border is Rs. 50000. From, Rs. 49, 000 used, remaining Rs. 1 000 can only be required. However, a preventative medical examination has a total limit of 5000 already used for itself and family, so no amount can be required now

High Medical Inflation Calls For Higher Tax Deductions For Medical Expenses, Say Experts

The premium for health insurance paid for a brother, sister, grandparents, aunts, uncles or any other relative cannot be claimed as a deduction for a tax benefit.

In the case of work by VI and your parents, you can both request a deduction as much as everyone pays.

If you have any suggestions/feedback, please let us know in a chat box. If you want more updates on taxation, financial and legal matters, join our group on WhatsApp, Telegram channel or follow us on Facebook, Instagram, Twitter and Linkedin!

Views are personal to the author and owe no responsibility for the information submitted! If you are running payments for your small business, there is a good chance that you may also consider haircuts before taxing. This can be a complicated topic, especially if you first deal with health insurance for your team. Alternatively, you can set yourself up by understanding how health insurance and taxes are intersecting and how best to support your hourly employees. Is health insurance employees from taxation?

High Deductible Health Plan (hdhp) Pros And Cons

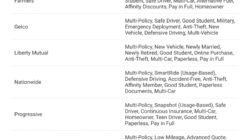

Most health insurance premiums sponsored by the employer are before taxing both employees and employers. For example, if you offer a qualified plan of department 125 (such as a café plan), your premiums will be before taxing. This means that neither employers’ contributions nor employee deductions will be subject to salaries, which can mean large tax savings for your business and your employees.

When implementing payrolls, file any necessary contributions and haircuts before calculating and driving taxes. You can then spend this money on premium payments on time for your plans.

It is also a good idea to check whether you correctly state your contributions on payment, so employees have a record of how much money they make in their insurance.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png?strip=all)

There are other health benefits that you can offer to your employees who are qualified for deductions before taxing. Some examples include:

Term Insurance Tax Benefits: Can You Claim Both 80c & 80d?

Generally, health insurance sponsored by the employer has premiums before taxing, but there is a noticeable exception that is the health insurance of S-Corporation owners.

If you are more than 2% S-CORP shareholder and your company pays for all premiums for health and accidents, these premiums are subject to taxes such as regular salaries. Therefore, make sure that wages do not make haircuts or contributions before taxing and include the costs of these premiums in your taxable salary base.

Small companies with less than 50 employees do not have to offer health insurance in accordance with the Access Care Act (ACA). However, it is still a good practice to cover your employees: they will benefit from lower taxable income and health costs, you will attract and retain more employees and get tax breaks for yourself.

It is also worth mentioning that you can qualify for group health insurance if your business has between one and 50 employees. In addition, you have to have at least one employee who works full -time and is not a family member.

Claim Medical Expenses On Your Taxes

The percentage of employers’ payment also depends on what the employees want to include in their plan and what kind of coverage they need.

The start of the health insurance process for small businesses can be daunting. Here are a few steps that you can follow if you don’t know where to start:

Like many other health insurance related issues, the answer “depends.” Fortunately, as the owner of a small business, you have a smaller number of employees that you need to consider. You probably know them well and you can adapt your health insurance plan to their special needs.

Younger employees without dependents, good overall health and lower savings can prefer a plan with minor premiums. For example, shops or restaurants that have many student workers. Disadvantages along the way are higher costs of payment and unpredictability with employees’ health costs for the year.

Health Savings Account (hsa): How Hsas Work, Contribution Rules

Then there is a reverse situation. Higher premiums represent lower haircuts and more affordable hospital and health accounts. This is a more attractive option for employees with families and those over 55. In this demographic data, minor health problems are less likely to occur and health accounts can accumulate faster.

ACA does not require employers to pay a certain percentage of premiums of their employees. Nevertheless, many countries require employers to pay at least 50%, so check your state laws to make sure.

But employers pay more than half of the health insurance premiums anyway. According to KFF, employers pay an average of about 83% for uniform coverage. Remember that in many cases you are competing with other companies for the same employee pool. You can keep yourself competitive by offering attractive health insurance coverage.

In addition, small businesses have smaller profits and cannot afford to continue to hire too little performance. You need top talent not to lose money with low productivity and high traffic.

Deduction Of Medical Insurance U/s 80d Of The Income Tax Act, 1961

Let’s say your employees earn $ 2,000 a month, their monthly premium is $ 500 and pay 25% of the cost:

Remember, you have to deduct health insurance before deducting. You then calculate the 7.65 FICA level based on adjusted gross income. This is $ 1, $ 875 in the example above, not $ 2,000.

Remember to explain to employees that they cannot claim these premiums in the tax return because they have already received a tax benefit.

In general, employers can offer different health insurance plans for different employees. For example, you can decide to offer the health insurance company only to full -time employees or more health benefits to higher staff.

Irs Form 1095-a Instructions

However, you need to be based on employment criteria such as working hours, location and experience. You will open up to a discrimination lawsuit if you handle employees differently for any other reason.

You should also not deal with people within the same category. For example, you cannot highlight one full -time worker and give them special hearing.

If you have self-employed people who work for you-in a salon or tattoo-bodo responsible for your own health insurance.

Health insurance plans can include dental and vision, but usually do not. Employers need to add them separately most of the time. But keep in mind that enrollment for this kind of insurance is still ongoing, not just at the end of the year.

Tax Exemption On Health Insurance Premium

Consider finding a health care plan that includes a dental or vision or gives you the opportunity to add them later. Your employee’s dental and visual health is crucial, especially since most modern companies include steep in screens. Routine meetings mean early detection of problems and ensuring that employees can effectively do their job.

IRS establishes annual ceilings for contributions to the plans before taxation, such as flexible expenditure bills (FSA) and health savings accounts (HSA).

Make sure you review the latest IRS and state directives to plan your medical consumption carefully and take advantage of all available tax advantage.

Hopefully, you can now better understand the haircuts before taxing and health insurance. Maybe you still feel the pressure on choosing the right insurance provider. There is a lot to go through and more that could go wrong – for example, that they accidentally leave employees unsecured or get ugly IRS fines.

Every Individual Or Huf Can Claim A Deduction From Their Total Income For Medical Insurance Premiums Paid In Any Given Year Under Section 80d. This Deduction Is Also Available For Top-up Health

Inhale because we think we have the answer. Homebase Salary Function allows for owners of small businesses and managers like you automatically calculate their payments, including