Health Insurance Premium Monthly Or Yearly – My health insurance premiums are going to be more than 56% next year. It is the largest annual increase in monthly premiums I have ever had – far.

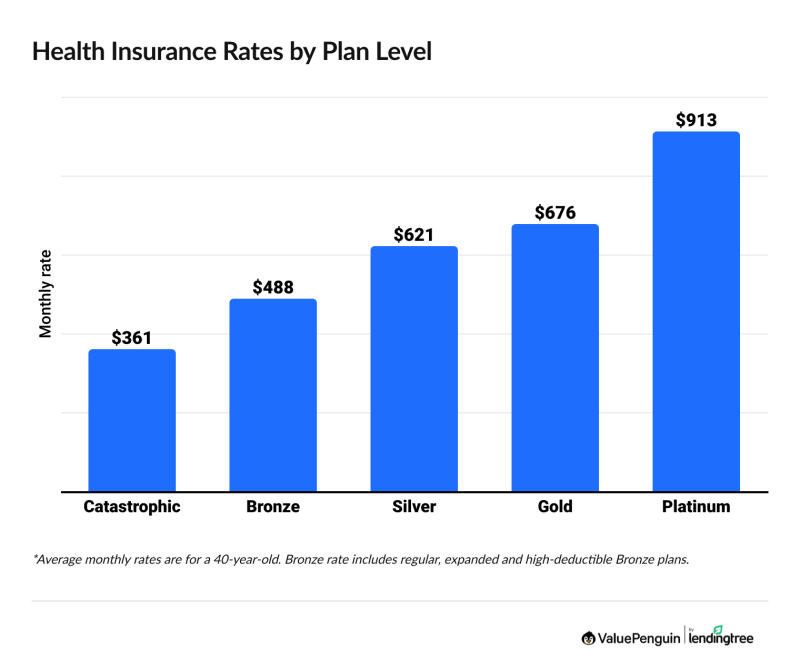

A few weeks ago, I assumed Obamacare may have been the first factor in American elections. The Law on Care (ACA) attacked the costs of health care and actually actually made health care much less accessible for most American citizens. That certainly didn’t use me for the past few years. See the chart of my 2005 to 2017 insurance premiums below.

Health Insurance Premium Monthly Or Yearly

The chart speaks only for themselves. As details of the affordable law on care realized over the last few years, I watched my health insurance premiums. In addition, my insurance company – Medica – reduced my coverage, lowered the amount that will pay for prescription drugs and have increased my deductions.

Hsa-compatible High-deductible Health Plans

In 2017, I will pay 455% or 5.5X every month for my premium health insurance than I paid 2005. years. I realize I was old and I understand that the higher year means a higher year means bigger premiums. But 455% increase is absurd.

So what causes this ocuilt price increases? There are dozens of factors, but the two point out: 1) offer and demand and 2) inefficiency.

I believe that people who have created and supported an affordable law on care had good intentions, but unfortunately they were not economically astute. ACA has added a range of costs to the health system without considering an offer and demand. There are a relatively fixed number of hospitals, doctors and other health workers. When you increase the number of people who have full access to medical providers and staff, the offer remains the same, but demand is growing. The result? Prices are increasing.

Health care costs increase over the board, which means manufacturers of medical products, pharmaceutical companies, hospitals and doctors can charge everything more. And some of them have to charge more. The requirements set to hospitals and doctors, for example, require to spend more money. So to increase their prices to cover costs. Insurance companies must pay more for medical services. And how do they cover costs? Increase premiums.

On Phonepe, You Can Now Pay Your Health Insurance Premium Monthly, Not Yearly. That’s Right! , Lighten The Burden Of Paying A Lumpsum Annual Premium, With Monthly Premiums Starting From As Low As Rs.

Of course, insurance companies could fight pricing increases so more efficiently launching its companies. But they don’t have to. Lack of competition in the health insurance industry is a mysteriously absent, especially in the capitalist country like the United States. Health insurance companies have close monopolies in their countries and therefore do not have many competitors to force them to keep their costs. So how do they increase their profits without reducing costs? Increase premiums.

Medica is one of the most unexecutive companies I’ve ever seen. For example, almost every year, I’m asking me to apply for paperless statements – something that would save them money and be more suitable for me. But they never did it. They refuse to update their system. In fact, I had to fax them and send my answer to me. Even in 2016 years do not use email.

I am not the only one who experienced the inefficiency of the first-hand mic. Almost every healthcare professional I visited in the last few years is constantly frustrated by Medico. They lose paperwork, are not called when they say they will last for months to process some claims. The number of internal problems would cause almost any other corporation to go out of work. But the medica has a non-such secret way to fight their inefficiency. Increase premiums.

The primary example of medical awful management is the program that launched a few years ago called “healthy savings”.

How Much Does Long-term Care Insurance Cost?

I first learned about this program in the medica letter sent me around the time it was passed by extensions. The letter stated that Midica would no longer provide me with a monthly discount in the amount of $ 20 for a gym membership. It is said that I can save even more money with my new healthy savings program, who would give me discounts for making healthy purchase decisions.

It sounded ok because I set a point to buy healthy food – a lot of fruits and vegetables, fresh (not frozen) meals and food without preservatives. It is usually more for these types of food compared to cheap, less healthy options. My diet accounts are usually in the range of $ 100 to $ 150, but I’ve never saved more than $ 2.50 using my healthy savings card. Most of the time, the cashier scans my card and save $ 0.00. A healthy savings program definitely not reimbursed $ 240 each year, I am no longer compensating for attending a fitness center. In fact, I don’t think I’ve saved more than $ 20 in the last five years.

The amount of MEDIC money spent the establishment of this program, would force most companies to go bankrupt. But it is not too hard to understand their way of subsidizing such a mass failure. Increase premiums.

Most of this article was specific to the organizational catastrophe that is medica. But Medica is a microcosm a much bigger problem – health insurance industry. Lack of competition on the market means there are several other insurance babes across the country that raises premiums to make their profit intact. Level health action is required to solve this problem if it was really affordable health care.

Insider Hacks That Can Save You Money On Health Insurance

While waste is not cleaned from the system and competition is entered on the market, insurance companies will continue to do what are good. Increase Premiums.an Premium Insurance is a fixed amount of money you pay to actively maintain your policy. Premiums refer to all insurance products, including your car and house cover.

If you remove private health insurance, you will pay a monthly or annual premium for the length of the term policy (usually a year).

You can restore your policy with your current service provider at the end of the term or look for a new plan in second place. Either way, you will need to pay for the premiums if you want to continue with private health insurance.

Although this figure is average in the entire series of age groups, the premium you pay could look very different depending on your circumstances. With that in mind, if you consider PMI and are worried about costs, do not assume that politics out of reach is simply based on average.

Insurance Premium Defined, How It’s Calculated, And Types

The average prices from our research are for new policies, usually with a significant discount without requirements (because most providers begin with high discount levels). If you claim your policy and grow old (all of us), your reconstruction premiums will probably be greater than our research average.

Most premiums are paid monthly, but you should be able to pay your policy per year – just talk to your provider if it is something you would like to do.

Insurance is basically a risk and how likely you are to apply. The likelihood that you are a joke a request then reflects on your premium (the Chances are Chance, that is the larger your premium).

As a rule, health insurance premium increases as we grow older because we become more vulnerable to disease and injuries.

Medishield Life Premiums To Increase As Government Expands National Health Insurance Scheme

When we looked at the quotes from eight leading insurers, we found that premiums increased significantly from 50 years and continued to increase afterwards:

* Health insurance prices above are averages hundreds of citations for new policies; If you claim your policy, reconstruction premiums will probably be higher than the above. See the next section for more.

If you have made more requests in recent years, you can expect to pay more compared to someone who is not. When you claim, assuming that you do not have a protected discount without requirements, you reduce the level by unsupporting non-requests, reducing the discount you receive on your policy.

If you suffered from various diseases in the past or are prone to injuries, it could affect your premium and you can pay more.

Definitions And Meanings Of Health Care And Health Insurance Terms

It can even be excluded from your policy depending on how much your illness was or how much your condition is. In other words, your insurer will not cover you for this specific hard.

Smoking or using the nicemon replacement products such as peripherals can increase your premium, and most insurers will ask you if you use any product based on nicotine before you make a policy.

Although more cheering and other gear products are largely considered less harmful than smoking, long-term effects remain relatively unknown, so insurers treat the same as cigarettes at this moment.

Health insurance plans differ depending on the provider, but in most cases you will be able to choose from different levels of cover, for example, from basic, medium or comprehensive policy. These different plans usually determine the type of treatment you can access.

Health Insurance: Plans & Policies In India

Some insurers will allow you to add additional fee functions (such as alternative or complementary treatments).

As you would expect, it’s more treatments and features your policy includes