Health Insurance Premium Tax Benefit – Get a maximum tax refund! 100% Accuracy | No Notifications Receive your maximum tax refund! 100% Accuracy | 60% off notification stress! Use the code maxref file to get 60% off! Use the code maxref file now

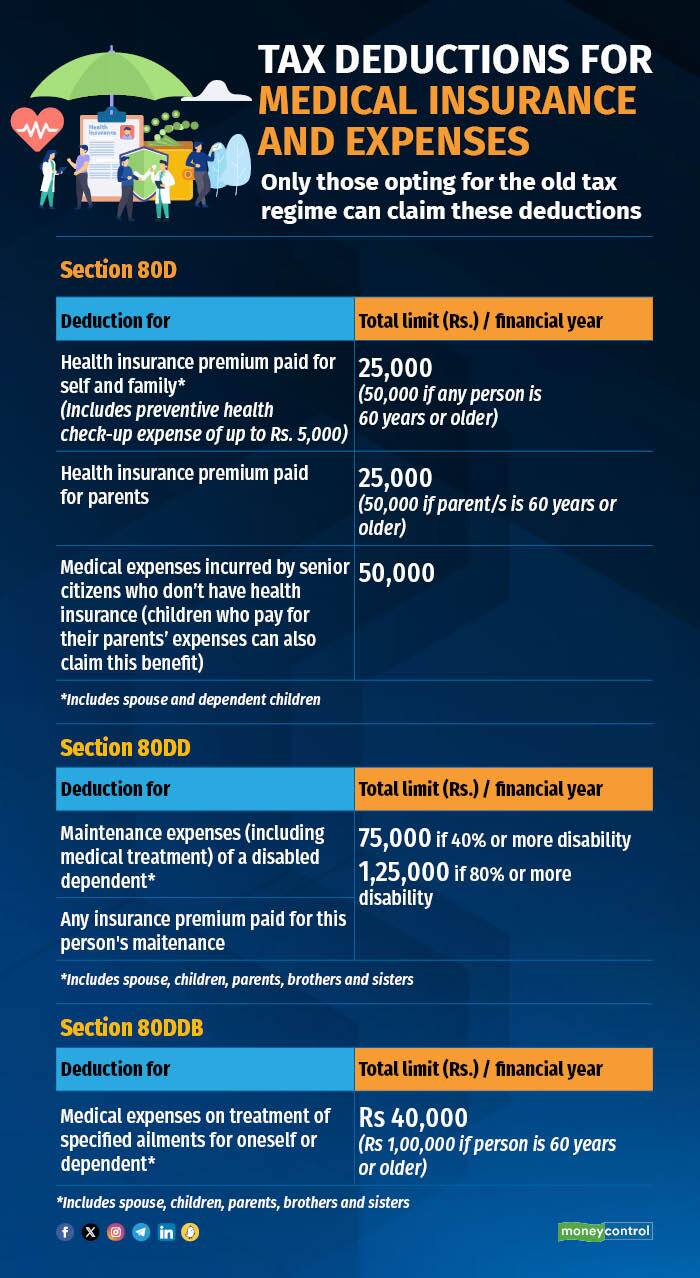

In Section 80D, you can claim deductions on medical premiums paid by taxpayers up to Rs. 1 lakh. Deductions can be claimed for yourself, your spouse, your dependent children, or your parents. Up to Rs. A premium of 25,000 is charged for yourself and you can claim a deduction of Rs. 50,000 can be billed for the self, spouse, children, parents.

Health Insurance Premium Tax Benefit

For seniors, the maximum limit will be relaxed to Rs.50,000. Aside from premiums, you can claim medical costs and preventive health checkups for seniors in this section.

Deduction Of Medical Insurance U/s 80d Of The Income Tax Act, 1961

Section 80D of the Income Tax Act allows individuals and Hindu unsplitting families (HUFs) to claim tax deductions on health insurance premiums they have paid. This deduction is covered by insurance taken for yourself, your spouse, your children and parents. You can also request a deduction for preventive health tests and top-up health plan subject to specified restrictions.

Rahul paid a health insurance premium of Rs 23,000 for health insurance for his wife and dependent children. He also conducted a medical check-up for himself and paid Rs 5,000.

Rahul can claim a maximum deduction of Rs 25,000 under Section 80D of the Income Tax Act. Rs 23,000 is paid for insurance premiums and Rs 2,000 is permitted for health checks. In this case, the overall deduction cannot exceed 25,000, so the deduction for preventive health checks is limited to Rs 2,000.

The deduction permitted under Section 80D is Rs 25,000 for the fiscal year. For senior residents, the permitted deduction limit is Rs 50,000.

Can Couples Split Health Insurance Premiums For Tax Benefits?

*The deduction for preventive checks up to Rs 5,000 is within the overall limit of 25,000/50,000. Please note that “family” in this section only includes spouses and dependents.

If the elderly are non-residents or the assessee is non-residents, the extension limit of Rs.50,000 will not apply.

Rohan is 45 years old and his father is 75 years old. Rohan medically covers himself and his father, which pays premiums of Rs 30,000 and Rs 35,000, respectively. What is the maximum amount that can be claimed through a deduction under Section 80D?

Rohan can claim up to 25,000 for the premiums paid in his policy. For policies taken for the elderly, the father, Rohan can charge up to Rs 50,000. The deductions given are 25,000 and 35,000 Rs. Therefore, he will have a deduction for that year of Rs 60,000.

Section 80d: Deductions For Medical & Health Insurance

According to Section 80D, taxpayers can claim tax deductions on premiums paid to their own, spouse, parents, and dependents’ health insurance. Individuals and HUFs can claim this deduction. This also covers medical expenses incurred by the elderly.

If you have a salary, you can also claim an 80D deduction by submitting a premium receipt or medical expenses to your employer, or you can also request it while filing an Income Tax Return (ITR).

Only individuals and HUFs can claim deductions based on Section 80D. Deductions for self, spouse, dependents and children are permitted. However, the higher limits of the deduction are available to senior residents and not to senior non-resident residents.

Yes. You can claim a deduction for medical expenses incurred for parents up to Rs 50,000 with satisfaction with certain conditions.

Section 80d Of Income Tax Act: Deductions Under Medical Insurance, Limit, Eligibility And Policies

Most health insurance plans, including individual health plans, family floater plans, and serious illness plans, are eligible for deductions under Section 80D. However, it is important to ensure that the plan is recognized under the law and is intended for the purposes of health insurance or a preventative health check.

If I pay taxes under the new tax system, can I claim a deduction under Section 80D of Paying Medical Insurance Premiums?

No, individuals or HUFs cannot claim a deduction under SEC 80D to pay premiums if they choose to pay taxes under the new tax scheme, as the deduction is only available under the old tax scheme.

No, if refunded by your employer, it will be an expense to your employer and cannot be charged as a deduction.

The Tax Benefits Of Long-term Care Insurance For Businesses

Yes, individuals or HUFs can claim a Section 80D deduction if they receive treatment from abroad. There are no such restrictions mentioned in the law.

Yes, individuals may request a tax deduction of up to Rs.25,000 for contributions to the Central Government Health Scheme (CGHS) or other notice schemes. However, contributions made on behalf of parents are not eligible for this deduction.

In most cases, parents can charge 50,000, and 25,000 Rs. However, if you and your parents are elderly, you can charge Rs 50,000 for yourself and Rs 50,000 for your parents.

I am a Certified Public Accountant, I am well versed in and out of income tax, GST, and balance my book. The numbers are mine. You can sift your financial statements and tax codes in the best possible condition. But there is another aspect to me – the aspect that thrives in words, not numbers. read more

Section 80d: Deductions For Medical & Health Insurance

Income Tax Deduction List – Deductions for Section 80C, 80cccc, 80cccd & 80d – 2024-25 (AY 2025-26)

Sukanya Samriddhi Yojana (SSY) – Interest Rate 2024-25, Tax Benefits, Eligibility, Bank List, Age Restrictions, Other Details

ICICI Prudential Technology Fund Direct Planning Growth Digital India Fund Direct Planning Blueship Fund Growth Growth Rate Growth Bir Rasan Life Tax Relief 96 Growth Bir Rasan Life Digital India Fund Direct Planning Growth Tax Planning Growth

SBI Mutual Fundnippon India Mutual FundHDFC Mutual Funduti Mutual FundKotak Mahindra Mutual Fundici Prudential Mutual Fundaditya Birla Mutual Fundaxis Mutual Fund

Understanding The “family Glitch”- Choosing Your Health Insurance

Stock Market Liveyes Bank Share Pricebi Share Priseirctc Share Prishitc Share PricetC

Clear provides tax and financial solutions to individuals, businesses, organizations and certified public accountants in India. Clear serves over 1.5 million happy customers, over 20,000 CAS & tax professionals, and over 10,000 businesses across India.

Efiling Income Tax Returns (ITRs) are easy on the clearing platform. Simply upload Form 16 to request a deduction and bring your acknowledgement number online. You can efile income tax returns for income from salary, housing property, capital gains, business and occupation, and income from income from other sources. Additionally, you can file a TDS return, generate Form-16, use tax calculation software, verify your HRA claim, refund status, and generate rent for your income tax return.

CAS, experts and businesses can clarify their GST Software & Certification courses. Our GST software helps CAS, tax professionals and businesses manage returns and invoices in an easy way. Our Product and Service Tax Courses include tutorial videos, guides and expert assistance to help you master product and service tax. Clear also helps you register your business for the Goods and Services Tax Act.

Why Pay More Taxes When You Can Save Big With Health Insurance? Invest In Your Health While Enjoying Attractive Tax Benefits. . . For More Details Call @9773775775 & Click On The

You can clearly save taxes by investing in tax savings (ELS) online. Our experts can offer the best funds and get a high return by investing directly or through SIP. Download black for each app to file to return from mobile phone. Medical emergency can occur anytime, anywhere. Health insurance is one of the best options to reduce risks associated with medical emergency situations. In a medical emergency, taxpayers can request a refund from their health insurance provider for medical expenses incurred. The amount refunded may be claimed as a deduction under Section 80D of the Income Tax Act, subject to the specified maximum 80D deduction limit. The government is allowing deductions under Section 80D as it encourages everyone to purchase medical insurance. This article covers section 80D deductions, deduction restrictions under section 80D, and more.

Section 80D of the Income Tax Act allows an individual or HUF to claim a deduction for medical premiums paid during the fiscal year. Section 80D provides deductions for the following expenditures:

Section 80D offers tax credits up to Rs. Health insurance premiums paid by individuals and HUF in the fiscal year were 25,000. The deduction increases to Rs. For elderly people over 60 years old, 50,000.

Note: – This deduction can be claimed above the 1.5 lakh limit deduction charged under Section 80C. This deduction is only available under the old tax system.

Health Insurance: Health Insurance Deductions And Your Net Pay: What S The Cost

To claim the Deduction U/S Section 80D, you must pay the premium in a non-cash mode. Preventive hygiene testing expenses can be incurred in cash. The following premium deductions are permitted in Section 80D –

Preventive health checks identify illnesses and work at an early level through regular health checks. It is held once or twice a year