Home Insurance Rates Going Up – Connect some of the U.Ss insurance companies. So far, they have green knowledge

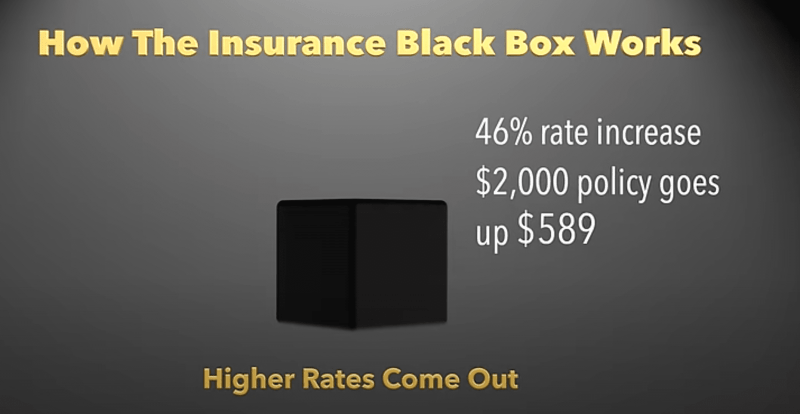

The insurance companies ask the authorities to be allowed interest rates across the country, and in many cases, they receive what they want. That is why.

Home Insurance Rates Going Up

Charlotte, North Carolina – Careful ownership costs, including domestic insurance, increase as some of the senior committeners drive serious growth.

Secret Algorithms To Raise Home Insurance Rates, No Requirement For New Coverage, Under Lara Regulations I

Insurance companies ask management to raise values due to weather continuously with weather affairs. In many cases, these companies receive what they want. The rulers said that because they are worried that companies will leave the entire area if they do not make recommendations.

Administrators will agree to 98.8% in insurance, by the Wall Street journal. From January 2023, 13 countries allowed interest rates between 25% and 36%.

North Carolina, things are very better for homeowners. The TE’s heel has read 15% -20% growth, while the South Carolina crowa has 10% of% only%.

But as inflation and climate change leads to bad weather, people can follow the way we see across the country.

Will That Cause My Homeowners Insurance Premium To Go Up? — Vip Adjusting

You can play Charlotte to rooko, Amazon Filow TV, and the Apple TVs tools, you just download the app.

It is a political event each week and Dig Thompson in Charlotte, North Carolina, South Cateleleina, and beyond. Listen to Predcts each week.

All charlotte positions are free and available to spread and transfer. You can listen to Android, IPhone, Amazon, and other technologies online. We joined it from North Carolina, South Carolina or Go, wherever the pish screen is 25 times by the experience of claims. Carl’s work is to enable them to protect their financial security by knowing his personal customers, making themselves match insurance products.

Everything is very worth these days, from groceries to gasoline, and unfortunately, insurance of landlord ownership. Insurance premiums are expected to increase approximately 9% this year, according to the guide. .

How Will Inflation Impact My Home And Auto Insurance?

In the Rocky insurance, we prefer to help people find the owner required for an affordable price. Then, after discussing the premium if the Prruurs risa, we will share the tips to reduce your insurance costs.

We mentioned that insurance premiums increased by about 7% in 2022 and can increase by 9% this year, but what is this?

According to the insurance information (III), in 2019, the Incrium of the Incrian Home Insurance Homes in Colorado is $ 1,618. Now, the average value is $ 2153. It breaks within 12 months, colorado people pay $ 44 in their monthly insurance month. So what is the cause of this burning?

The most common reason to grow domestic insurance premises change. Your needs change over time, so you can add to add or improve the existing cover. If you do claims the claim last year, your insurance premises can climb.

What’s Behind Rising Home Insurance Rates

While these items can affect your premiums, they do not specify the increase in customer insurance price. Here are some reasons why insurance premises have been built a few years ago:

The current part of the highest costs of building is to have a significant impact on insurance premiums. As building costs continue to rise, people who have home owners find it more difficult to pay for repairs and rebuilding after potential damage to the home.

This inside leads to insurance insurance insurance to pay additional costs. Increasing costs of materials and reasons for the most reason to get out of construction costs, and all products feel the impact of the situation.

Increasing temperatures and extreme climate events also play a role in the cost of owners of owners. Fire and lightning caused the loss of an owner of an appointment between 2016 and 2020, in losses over $ 77,000 each claim, according to the III claim. However, the missing spices are very common with wind and hail, with an internal claim for $ 11,000.

Flanagan Mills Agency

As the storm is strong and more common, insurance companies deal with claim costs. This means that they should lift subs to cover these costs unexpected.

Else that would affect your local premium. According to the national community organization, medium years to live in the United States is 39 years old. Old homes remain safe and you may need additional maintenance. For example, the ancient roof can endanger the leak or damage to water. Insurance companies take these stories when planning premiums.

Although there are some things we cannot control as the owners of the owner insurance, there are few steps you can take your premium.

Comparing prices for different providers is one of the best ways to ensure that you receive insurance. Different companies have different things and discounts can be read in other cases. Purchase will give you better understanding of what is available at the market to know which policy is relevant to you.

Home Insurance Calculator: Estimate Your Rates

Simple logical way with a reliable insurance supplier will be a plan for the country’s largest, usually in the Price of Part.

The limits of exacerbation or reduce unwanted cover will reduce premiums. However, it is important to remember that if an event occurred, you will have to pay more on compensation. Therefore, it is better to work with professionals to get the right balance between covering and cost to ensure that you are fully secure.

Many insurance funders provide security features, smoking equipment, anti-deduction warnings, and discounts that bind different policies together. To sign any discount provided by the provider can help you find the lower premium. Contact your insurance company directly to see discounts.

If you are worried about the increase in home owners insurance, please contact our friendly team immediately. We can help you compare prices to find an affordable plan while providing secretly. Because we work with many carriers, our purpose is to find the best plan for your budget and how you live.

Reasons Your Homeowner Insurance May Have Gone Up

Rockies Insurance Alliance is pride using colorado as family insurance insurance, cars, life and more.

The car accidents are common in the roads and roads in the United States and can have a traumatic consequences to those involved. Test your vehicle accident information for these questions and find out that they are surprising and the facts that can save lives. Insult insurance in housing advertising, such as the Chief Cosegic Johnu Rashnhes 33% on domestic insurance is between 20. This is a reason.

If you purchased a rental property before 2015, you can pay thousands of dollars in taxes during selling, not to talk to lose money. An effective way to retire for employers, toilets and rent rent witness.

Join the Homes Hio Arubin of the Surubin Special Webinar recorded is 721 billion and retirement forms. More than 150 experienced landowners have successfully accepted this plan to reduce their tax burden, earning the cash flows without the ownership, and to control the property and their property.

Home Insurance Cost Florida: Top 10 Essential Facts 2024

The nomination team combines the financial and real estate of organizations such as J.P. Morgan, National Prevention’s World Advisors in the world and the advancement of staying. Now use this special webinar.

The annual home insurance premium in U.S.

Over the past few years, disasters and climate risks are linked to the highest costs of being replaced due to increased construction costs and helped raise up domestic insurance premiums.

Better understanding, I applied for John Rogers, the Head of Data and the Accounting Officer and the Analysis of Horelagic in New York Editing Data. Compared with colalogic, a few companies understand that the risk of disaster / weather risk affects the advertisement, providing insurance by testing materials and climate value related to the weather cost. With its data, avilaGICs and dangerous solutions, corrgic gives insurance and investors to evaluate natural hazards such as floods, hurricanes, hurricanes.

Homes For Sale In Southwest Florida Pile Up As Buyers Fret High Insurance Costs

In the rest of the forest reservity, we will cover the slideshow on the slideshow shown by talking again (and certain ideas).

Over the past three years, Florida and other places have been rich 68%, which makes it very difficult for homeowners and those trying to enter the market, “Roger told the soils.

“There are many reasons.

Are car insurance rates going up, why are home insurance rates going up, are insurance rates going up, why are insurance rates going up, insurance rates going up, are auto insurance rates going up, car insurance rates going up, progressive rates going up, allstate rates going up, home insurance going up, homeowners insurance rates going up, geico rates going up