How To Check My Car Insurance Policy Malaysia – Remember the expiry date of car insurance? If not, there are several ways you need to update car insurance. Malaysia and cozy way to the crown work number to a quick and insurance status.

It is important to sort your safety and other traffic users as responsible drivers. Besides car insurance, insurance taxes, insurance taxes, insurance tax and insurance is essential for driving time.

How To Check My Car Insurance Policy Malaysia

This article will explore the methods of use to check the car insurance time you can’t remember it.

E-hailing Insurance Guide En

Traditions, refer to the car leaks to discover the car leaks or other details to find out insurance policies or other details. We’re more online to save this information today.

Car insurance dates and mycarinfo in Malaysia in Malaysia. MyCarinfo gives details about existing insurance.

Additional information contains details of the claims for the next NCD, effective, its valid and its valid day.

In addition to network method methods, you have two options to find information about car insurance policy. First, you can check the notes of insurance. Or, you include a direct contact for your insurance agent or company.

A Complete Guide Of Loss Of Use Claim Malaysia 2023

Your insurance policy or coverage is a documentary protected document for the authorized insurance company. The cover date of the date of the cover time, starting or insured by the date of the date of its insurance starting or insured or insured dates and insured dates and insured dates and insured or insured or insured date.

You can easily check the automobile insurance in this document. For future inquiry to digitize a digital copy of the car insurance policy digitalization and keep your notes in your phone gallery, keep your note gallery and keep it on your mobile. In this way, you can make any information about insurance status, you can make a chance to access this fact.

And contact your AGENT or insurance provider. Here are the contact links for various insurance companies in Malaysia.

If your car insurance is closer to the end of your car insurance should be avoided by expired insurance and road taxability. RESPONSE WITH THE WORDS AND DATE TECHALL ACCOUNT.

Road Tax Price In Malaysia (2023 Updated List)

Check car insurance and provide car insurance and rapid service. is the best platform that is easily, safe, fast and fast and fast and malaysia.

Hotline allows you to best insurance consultants and financial consultants. Peaks (message) leave your questions and we will try to answer your questions and problems as soon as possible. If you are the first timer is a car, the car may seem complex. But you don’t feel very little because it may also have a seasonal car owners need help with car insurance. When you share a car insurance guide in Malaysia you can concern. How car insurance works at this manual works and how the best car insurance will understand how the best car insurance is the best price.

Authorized vehicle owners and car owners (road taxes) and car taxes (road taxes) and car taxes (road taxes) and car taxes (road taxes) and car taxes (road taxes) and vehicles on the road. Therefore, if you don’t have a valid motor insurance and road taxes, driving on public roads, it is illegal.

INCLUDING INCOMPANDING FOR A PROCEDURE TAX CHANGE TO APPLICATION OF THE PRODUCTIONS FOR PRIVILEGESTED TO CHANGE CONCERNS.

Best Car Insurance In Malaysia 2025

We will pay the “premium” for your preferred account “premium” you choose in insurance protection.

You will go to the premium or other policy and other policies and other policies for insurer. Your insurance company will then replenish the investments and compensation of possible financial loss

You can choose your own car insurance insurance and (2) additional insurance, (2) third-party insurance, fire insurance, stealth, stealth, (3) third party

The first first is first -party insurance called and first -Party insurance. This policy offers the most widely covered shell of policy.

Phased Liberalisation Of Motor Insurance

Additional insurance protects policy cars to car crashes, fire incidents, steals or steals. This policy also gives a third party coverage.

The insurance usually do not have to be in new cars 10 years or less. For a carrier of 15-aged cars, most insurance companies involve third parties, fire, stealthy (TPT).

Thirts-Sari Insurance, fire, stealth, stealth, you protect guilty and defends. It covers policy vehicles in case of fire and stolen. This policy does not cover policies vehicles in other circumstances such as car accident.

This type of insurance is mostly cheaper than the mostly complex insurance and usually old (usually 10 years) and are used for vehicles (usually in the vehicle.

Private Car Insurance & Available Add Ons

The third -Party insurance is only covered by third parties. Involves the damage or loss caused by the vehicle. If your vehicle has any damage you will have to send your repair debts.

Reference to references or underneath the three types of car insurance policies.

Matches of Topic Matches for 2017 Citizenships and Motor and Motor, First Citizens and Citizenship and Motor and Motor, First and Fire and Personal Personal and Fire and Fire.

This liberalization is to distinguish car insurance premiums and gives more user options. For youu Awarens, Some Of The Factors Affecting Car Insurance PRIDUTION, CAR PRIRANCE, CAR PRODUTION, CAR PROTUTION, CAR INSURANCE, CARLOWER, CAR LOVING AND DRIVING AND DRIVING occupation record.

Faq: Malaysia’s Digital Driving License And Road Tax On Myjpj

Car insurance premium = total higher grade maximum rate (after NCD) + addition (if any)

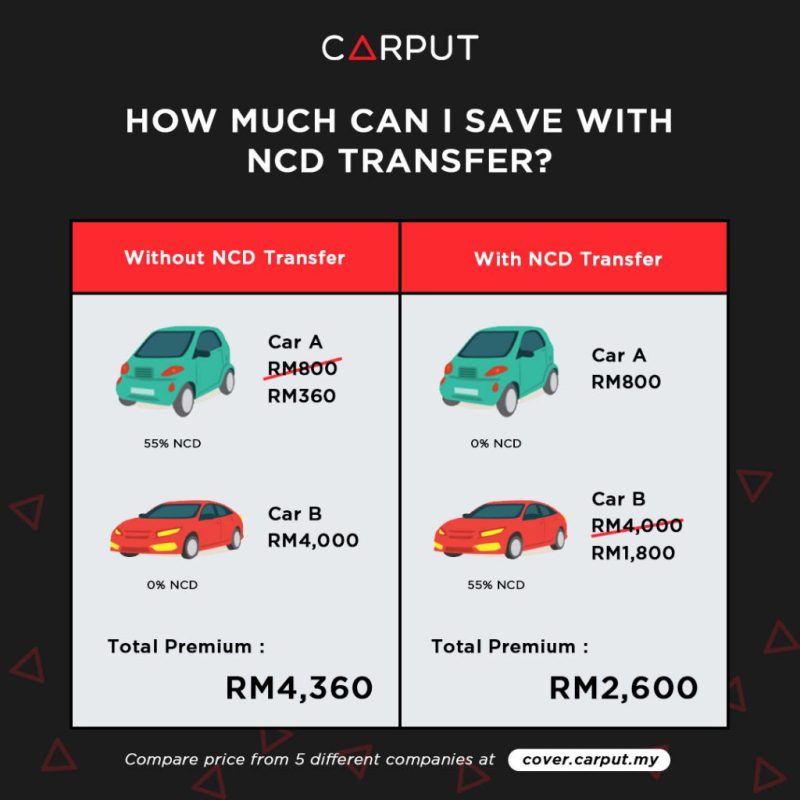

No claims will not be applied for claims (NCD) is not applying for annual insurance policy. For private cars NCD scale range from 25% to 55% from 25%. You can get NCD to make a car insurance claim for one year. However, if the third person is not confused, you don’t have to keep your NCD, you don’t have to be worried.

When you buy or update automobile insurance you will need to solve your machine insured amount.

Can choose market value or agreed values to resolve your car insured.

General Insurance Agents

The market price represents the current estimated value of your car. If you choose market evaluation, what is your car

Valuable to the market. They will not pay according to your insurer’s market size or insured for your car’s market value for your car’s market evaluation.

The matching value is the value agreed to both policy during insurers and insurance updates. Insurers identify a number of factors based on a number of factors and risk assessments. Say you will give you the amount that is appropriate to your car to put your insurer to give you valuable price.

Even if your insurance is covered with your full coverage will not cover you accordingly. To enhanced protection you can have a car insurance accessory or additional cover. Automobile offered car insurance accessories are:

How To Renew Road Tax Malaysia Edition: All You Need To Know

To get the windshield you only have to pay 15% of the windshield. For example, if your car windshield is RM800 to RM800.

Standard details do not cover damage caused by natural disasters. So you have specialized coverage of your insurance policies, especially, especially less and flooded.

To enjoy this additional coverage, you usually have to pay 0.5% of your car insured. The percentage of this additional premium may vary for insurance companies.

The insured car will be covered in your insurance as a policy owner or other named driver. If you let someone else you are driving someone else driving to your policy you will need to pay the RMPLUS RM400.

How To Transfer No Claim Discount (ncd) To Another Car

To expand another person’s insurance coverage that allows another person that allows a person you are allowed and you will include the scope of an additional name. For your information, you can name another driver in the politics. For the third driver you must pay RM10 for additional drivers.

Driver’s Additional Coverage, All Drivers Scope Explenses Your Insurance Coverage