How To Get Cheap Car Insurance In California – Cheap car insurance for high -risk drivers in California (finding savings with these 10 companies in 2025) The top options for cheap car insurance for high -risk drivers in California are state farms, progressive and American family. State Farm drives the road with the cheapest high -risk insurance rates of $ 46/month and top customer service. High -risk drivers can reduce rates with use -based insurance discounts.

Rachel Bodine graduated from ba college in English. Since then he has worked as a writer in the insurance industry and has gained a deep knowledge of state and insurance laws and interest rates. Her research and writing focus on readers’ help to understand their insurance coverage and how to find savings. Her expert tips on insurance were presented on sites such as Photoenforced, all …

How To Get Cheap Car Insurance In California

Daniel Walker graduated with BS in the administration in 2005 and has executed his family’s insurance service, FCI Agency for over 15 years (BBB A+). He is licensed as an insurance agent to write real estate and accident insurance, such as home, life, automaker, umbrella and fire insurance. It has also been presented on sites such as reviews.com and Safeco. To ensure that our content is Accura …

Liability Only Auto Insurance

Advertisers Revelation: We try to help you make sure car insurance decisions. Comparison of markets should be easy. We are not connected to any car insurance provider and we cannot guarantee excerpts from any provider. Our partnerships do not affect our content. Our views are ours. To compare excerpts from many different companies, enter your postal code on this page to use the free offer tool. The more excerpts you compare, the more likely you to save.

Guidelines: We are a free online resource for those interested in learning more about car insurance. Our goal is to be an objective, third resource for all automatic insurance. We regularly update our site and all content is examined by automatic insurance experts.

Cheaper for drivers in CA: State Farm18, 155 reviews compare the prices → 4.3 Company Factsmin. Cover for high -risk drivers in California $ 46/moa.m. BESTA ++ complaint LeveellowPros & Cons Competitive Prices Flexible Cover Multiple Discounts High satisfaction rates → 4.3 Company Factsmin. Cover for high -risk drivers in California $ 57/moa.m. Besta+Complaint Measer Level and Cons Good Prices for high -risk drivers quickly, easy online snapshots Rewards Safe driving Many national coverage options for CA drivers: California coverage for high -risk drivers in California $ 75/moa.m. Bestacomplaint LeveellowPros & Cons lower than measures in your area lower than average average percentages based on your driver’s record a variety of discounts Multiple Cover Customer Service Customer Service Poor Revision for Handling Criticism

The top options for cheap automatic insurance for high -risk drivers in California are State Farm, Progressive and American Family. The state farm emerges as the number one of the best providers, offering a competitive rates of $ 46/month.

Wawanesa Insurance On X: “searching For Auto Insurance In California? 🚗 Consider Coverage Options, Customer Service, And Rates To Find A Provider That Fits Your Needs And Budget. Make Sure You’re Always

High -risk automatic car insurance in California is more expensive than average. These companies offer cheaper prices and excellent customer service that ensures that drivers receive support and guidance to maximize their savings.

Our top 10 companies: Cheap Automatic Insurance for high -risk drivers in California Companyrankmonthly ratesa.m. Bestbest forjump to pros/cons # 140Arigtrack Programsafeco #10 $ 160a+Comensy Cooragethe Hartford

These leading providers are superior to the integrated and affordable use -based automatic insurance, which monitors driving habits and kilometers to reward high -risk drivers that improve their driver files.

To find out if you can get cheaper car insurance rates, enter your postal code to our free offer tool above to directly compare prices from different companies near you.

Clca Social Media Resources And Digital Toolkit Materials

Looking for cheap high -risk car insurance in California? Our top 10 options offer competitive prices and valuable benefits tailored to your needs.

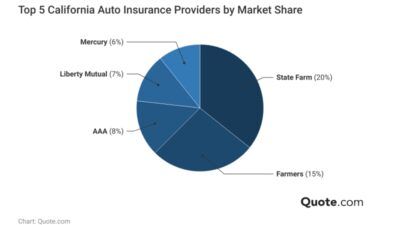

What is the best automatic insurance for high -risk drivers in California? This diagram compares monthly rates of insurance for high -risk drivers in California in various providers and coverage levels:

High -Risk California Automatic Insurance Monthly Price with Covering Level & Provider Insurance Companyminimum Coveragefull Coverage Allstate $ 110 $ 202 American Family $ 75 $ 137 Farmers $ 76 $ 167 $ 270 $ 214 $ 23 $ 121

The minimum coverage ranges from $ 46 with a state farm up to $ 160 with Hartford, while full coverage covers from $ 108 with a state farm to $ 270 with Hartford. Cheap high -risk car insurance companies in California include state exploitation, progressive and American family.

Can I Get A Rental Car Without Insurance California Car Rental Companies Insurance (cost Coverage)

State Farm is the top choice for high -risk drivers in California due to competitive prices and excellent customer service. Dani Best Licensed Insurance Producer

Choosing the right car insurance for a high -risk driver in California does not need to be overwhelming. Whether you prioritize minimum coverage or complete protection, keep reading to make a documented decision that is lined with your budget and insurance requirements.

Understanding what leads to high risk the cost of car insurance is vital in California, where rates are already high. Consider your credit, vehicle type, location and covered coverage levels, along with the driver. Each of these factors plays an important role in identifying your premiums:

You can strategically manage California’s car insurance costs by evaluating and possibly improving the driving file by maintaining a good credit result, choosing a vehicle with favorable insurance rates, understanding of regional insurance trends based on the location and choosing the appropriate coverage.

Its Researcher Sarah Catz Shared Her View About Cheap Car Insurance In California

Basics of automatic insurance include coverage for bodily harm, damage to real estate, collision and integrated car insurance, which ensures the financial impact of accidents and injuries. Discover the minimum insurance requirements in California to buy the correct coverage.

Finding an affordable high -risk insurance in California may be provocative, but there are still many car insurance discounts and savings that are not related to driving history:

For example, it is easy to save money by combining insurance contracts with multipolar discounts. The American family offers 25% of high -risk drivers who bind automated home insurance policies.

And since high -risk drivers often face higher rates due to past cases or driving behaviors, there are a number of tactics designed to reduce their insurance costs:

Average Cost Of Car Insurance In California

Insurers often use driving history to determine your level of risk and percentages. Focus on enhancing driving habits to avoid future accidents and traffic violations to restore rates to normal.

By maintaining a clean record over time, you can possibly qualify for lower premiums, as your insurers see as a more responsible driver. Consider enrollment in an insurance -based insurance program that monitors driving behavior, such as State Farm Drive Safe & Save.

Programs like these often offer discounts based on your real driving data, possibly reducing your overall premium. Learn how high -risk drivers can save 30% on Drive Safe and save review.

Remember to shop regularly and compare excerpts to make sure you have the best prices available. Leslie Kasperowicz Farmers CSR for 4 years

5 Ways To Reduce Your Car Insurance Premiums In California

With careful design and precautionary measures, you can find affordable car insurance that meets your needs while keeping your budget under control.

High -risk drivers in California often face steep car premiums due to traffic violations, accident accidents or other driving violations:

Whether they are State Farm budget -friendly prices, Progressive’s innovative Snapshot program, or excellent American Family’s customer support, there are sustainable choices for high -risk drivers.

Utilizing safe driver initiatives, technology monitoring and customer -focused services, you can significantly reduce high -risk car insurance rates in California.

California Auto Insurance Requirements & Policy: Everything You Must Know

High -risk drivers who may have a history of conflict, traffic violations or other issues must focus on policies that offer adequate protection in expenditure management. Find out how long an accident affects your car insurance rates.

The state farm, the progressive and the American family have cheap car insurance for high -risk drivers in California, with rates starting as low as $ 46 a month. These companies offer valuable programs and discounts for safe driving, excellent customer service and integrated coverage options.

The State Farm Excels for high -risk drivers in California, offering top customer service and strong safe driving incentives. Daniel Walker has a car holding permit

Whether you are looking for innovative monitoring applications or discounts, these California insurance companies provide a series of options to help high -risk drivers reduce their premiums while ensuring adequate protection.

Best Car Insurance Discounts For California State Employees In 2025 (save Up To 25% With These Companies)

Protect your vehicle at the best price by entering your postal code into the free Auto -Insurance Automatic Insurance Tool below.

The State Farm is often reported to have the cheapest car insurance for high -risk drivers in California, with prices starting as low as $ 46 a month.

High -risk drivers, including those with multiple traffic violations, DUIS or accidents in errors, are generally the most expensive to secure California.

The minimum car insurance claims in California include $ 15, 000 for injury/death to one person, 30, 000 dollars for injury/death to more than one person and $ 5, 000 for property damage.

Cheapest Car Insurance In California 2025

For high -risk drivers in California, it is recommended that you have full coverage, which includes the responsibility, complete coverage and collision coverage, along with the coverage of uninsured/insured cars and the coverage of medical payment.

The best insurance for high -risk drivers in California is usually offered by State Farm, Progressive,

How to get cheap teenage car insurance, how to get cheap car insurance in nyc, how to get a cheap insurance car, how to get cheap car insurance, how to get cheap car insurance in ontario, how to get cheap car insurance in florida, how to get very cheap car insurance, how to get car insurance in california, how to get cheap car insurance reddit, how to get really cheap car insurance, how to get cheap car insurance quotes, how to get super cheap car insurance