Insurance Coi Meaning – Insurance Certificate (COI), also known as a commercial insurance certificate, is a document used to demonstrate evidence of insurance protection. The document is issued by an insurance company and is usually displayed to third parties.

Insurance certificate is officially known as the Acord 25 form. In the form you will find the name of the policy holder and an insurance company that provides coverage. This form will also show the coverage that you have purchased, such as accountability insurance for general responsibilities, company owner policies, worker compensation and professional obligations.

Insurance Coi Meaning

Apart from the general requirements for insurance certificates, this is not a document that is legally binding. In fact, this functions rather than confirmation to prove proof of purchase.

Certificate Holder Vs Additional Insured For Home Inspectors

However, because the policyholder can cancel their coverage after the purchase, Coi does not guarantee that the registered policyholder has coverage. The only way to confirm coverage is to contact the insurance company directly and refer to COI information.

You might ask why other people want to know that you have insurance protection. Depending on your work, like working in someone’s home, they want to know if you will do the damage they want to make the whole.

The company insurance certificate holder is someone registered in the COI. This means that the person wants to monitor your insurance coverage and ensure that they are protected from those who are fully responsible.

Certificate holders want to know that you have insurance and are maintained actively in all contracts, not only at the beginning.

Outsource Certificate Of Insurance (coi) Processing Services

Your business insurance certificate will have your name as a policy holder. Double check to make sure your name is written correctly. If your business is in LLC, LLC must be registered as a policy holder. If you work under DBA, your personal name or DBA must be registered as a policy holder.

Certificates and other policyholders will also be registered in COI. Take the time to ensure the correct name and contact information. In order for the certificate to be registered as other insured, you must contact your insurance company to officially add it. You can confirm this by looking at the description of the operation or in the field of “Addl Int”. If you have questions, please contact your insurance company.

Finally, verify that your coverage is correct. Review with your strong limits on your policy and make sure your policy is active. The date of the rules must be in the future. The limit of your responsibility and further scope must meet your certificate qualifications.

Your insurance agent or broker is here to help all your insurance needs. If you need to find an agent or intermediary, visit our site to find agents. Insurance certificates show that the insurance contract is active and distributing its main property, including conditions.

Insurance Binders: What They Are And How They Work

Insurance certificates (COI) are documents issued by insurance companies or intermediaries. Coi confirms that the insurance contract is introduced and outlines the contracts. For example, the standard coi states the name of the policyholder, the date of policy effectiveness, type of coverage, policy limits and other important details of the policy.

Without coi, the company or supplier will have difficulty securing the client, because he may not want to take risks of any costs that can be caused by suppliers or providers.

Insurance certificates (COI) are used in situations where adequate responsibilities and losses are related and require COI, which in most business contexts. Insurance certificates are used to show insurance protection.

Small business owners and suppliers often have a coi, which proves that they have insurance that protects the responsibilities of accidents or injuries at work. When buying insurance accountability, insurance companies will usually provide insurance certificates.

Uploading Certificates Of Insurance Through The Ocr Scanner

Without coi, the company owner or supplier may have difficulty winning. Because many companies and individuals employ suppliers, clients want to know that the owner or supplier of the company has an insurance accountability so that they do not manage any risks if the supplier is responsible for damage, injury or non -standard jobs.

Companies that employ suppliers or other entities for services must get a copy of their coi and ensure that it is the latest.

Clients usually ask for a certificate directly from the insurance company and not from the company owner or supplier. The client must confirm that the name of the insured in the certificate is accurate coincidence or the supplier is considered.

The client must also examine the policy coverage date to ensure that the latest policy effectiveness date. The client must ensure a new certificate if the policy will end before completing the contract work.

Certificate Of Insurance (coi): When Do You Need One?

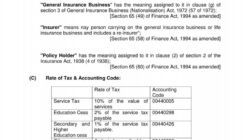

Insurance certificates contain separate sections for various types of responsibilities listed as common, car, umbrella, and compensation of workers. The term ‘insured’ applies to policyholders, a person or company that appears in the certificate in the certificate covered by insurance.

In addition to the level of certificate coverage, the name of the policyholder, post address, and explaining the operation carried out by insurance. The problem address of the insurance company is stated together with contact information for insurance agents or contact agents of people contact. If some insurance companies are involved, all names and contact information are registered.

When the client asks Coi, they become the certificate holder. Name and contact information client is displayed in the lower left corner, along with a statement that shows the obligation of the insurance company to inform the client about the policy cancellation.

Certificates briefly explain the policies and boundaries of the insured for each type of coverage. For example, part of the general obligation summarizes the six limits offered by the policy based on the category, indicating whether the scope is applied to claims or events. Because the state law determines the benefits provided by injured workers, the coverage of workers’ compensation will not show any limits. However, the responsibility of the employer must be borne.

Coi Insurance: Simplify Your Certificate Of Insurance (coi)

If you submit a coi from a supplier or company, they must be able to get it from your insurance company or give you contact information to your insurance company, so you can ask you to be sent directly to you. However, if you ask your dealer to give you coi, be careful. They documented cases of suppliers who sent fraud coi.

Simply put, if you rent an independent supplier or business for your service in your property, you must need an insurance certificate (COI). If you are a supplier or business, you must have a coi to prove to your client that you are insured.

It will be the safest to stick to any coi that you get without time limit, because you don’t know when the problem might appear at work that is done either in your place or that you have finished other people. The leading evidence of Coi will help solve all problems at this time.

You have to ask and get a coi before someone works at your home or property. If you have a written contract, it must contain insurance requirements, including the necessary coverage and limits verified by Coi.

What Is An Additional Insured Endorsement?

You may need an insurance certificate (COI) in many situations. In general, the client asks Coi directly from your insurance company to confirm that you have adequate insurance protection. If you rent a supplier, consider getting a coi from their insurance company, even if you have worked with them before, because their coverage might have changed.

This requires the writer to use primary sources to support their work. This includes white contributions, government data, original reports and interviews with experts in the field. If necessary, we also refer to original research from other leading publishers. Further information about the standards that we observe in accurate and impartial content production in the editorial policy we can learn more.

The offer that appears in this table comes from the partnership from which he receives compensation. This compensation can affect how and where the list appears. That does not include all offers available on the market.

Your life insurance can expire before you do it. This is how to fill the best insurance gap from a small business to postpone travel in July 2025 is expected to increase this summer in the summer – Happy insurance can protect your living vacation funds, it sounds like a savior – until you get the best life insurance with a mental allowance rejected? The doctor warns AI blocking your benefits of Medicare Advantage 5 Best Universal Life Insurance Companies the Best Insurance Company for 2025

Guide To Business Insurance Policies

The best car insurance for commercial vehicle insurance to pay for you again? This is a thing – this is what you should know the best dental insurance company in July 2025 the best insurance from a life insurance company from July 2025 10 The Best Life Insurance Company for July 2025 Hidden Costs to pass Household Insurance: “Can you lose your home” “Hoping” Hoping “Never Knowing”: How far do you save for car insurance? 4 The best insurance company for the insurance certificate in July 2025A (Coi) is a document that shows that people (or business) are insured. Displays the type of responsibility insurance that issued it, business name