Insurance Companies For Auto And Home – At Blake Insurance Group, we respect your privacy. Your personal information is used for quotation purposes only and is not shared or sold

Optional orders are recommended – a comprehensive collision, UIM, Medpay, Rent Adspayet, and Roadside Support – for additional protection, especially given the accident rates and the high bearing of New York.

Insurance Companies For Auto And Home

Customer Service: Travelers, Erie, and USAA stand out for satisfaction and claims; Geico and Allstate excel in digital equipment and affordability

We Work With Caa, And Other Insurance Companies, To Find You The Best Rate For Your Home, Auto, Business Insurance And More., Connect With Us On Your 2025 Insurance Renewal And See How We Can Help! ✨

New York insurance market is solid but costly. To save, drivers should shop around annually, bundled policies, register in telematics, and practice safe driving.

Compare a caretaker for car insurance in New Mexico – see rates, coverage, and which insurer is best for you.

The leading insurers in New York are Geico, Allstate, Liberty Mutual, State Farm, Farmers, Kemper, Progressive, USAA (for military and families), Erie, and passengers.

All large insurers provide the required liability, protect personal injuries (PIP), and uninsured motorist attention. Optional covenants include collision, comprehensive motorist, without insurance, medical payments, rental adspayment, and roadside support.

Valchoice Takes On The Insurance Industry With The First Comprehensive Platform For Rating And Selecting Car And Home Insurance

Yes. State Farm (Drive Safe & Save), Progressive (Snapshot), Intellidrive (Intellidrive), and Allstate (DriveWise) offer telematics programs that can reward safe driving with discounts.

Common reductions include multi-policy reductions, safe driver, good student, low miles, protective driving, group and military discounts. Some companies also offer the forgiveness of accidents and loyalty discounts.

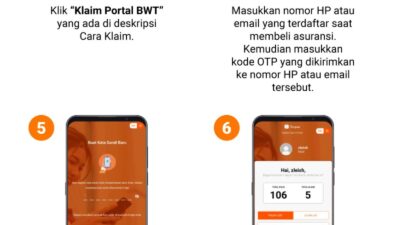

You can file a claim on -lein, via mobile app, phone, or with your local agent. Most insurers have a 24/7 claims service and digital equipment for tracking your claim status.

Travelers, Erie, and USAA consistently receive high marks for customer satisfaction and claims experience. Geico and allstate are strong for digital equipment and affordability, while State Farm is known for agent support.

Home Insurance Company In Portage

The full cover average between $ 2, 510 and $ 4, 031 per year, depending on the location and driver profile. Minimum coverage usually ranges from $ 1, 392 to $ 1, 729 per year.

Rates are influenced by your location, age, gender, driving record, credit score, vehicle type, claims history, and comment options. Urban and younger drivers pay the highest rates.

Yes. Shop around, maintain a clean driving record, bundle policies, follow protective driving courses, and consider telematics programs to maximize discounts.

All the best insurers in New York are rated higher or higher by large financial grading agencies, citing strong claims.25 property and casualties insurance companies in the USA- according to the National Association of Insurance Commissioners (NAIC) in 2024, there are 25 largest property and casualty insurance companies in the USA. These companies typically have written premiums that total billions of US dollars. Property and Insurance Insurance Insurance (also known as P&C insurance) are types of insurance that help protect you and your property. Property and injured insurance (P&C) provides attention for physical properties such as homes, cars and other properties. These insurances also include the scope of liability, which helps protect you if you are legally detected responsible for an accident that causes injuries to another person or damage to their property.

Patriot Home And Auto Insurance

All data was commonly obtained by the National Association of Insurance Commissioners (NAIC) database in 2024. Functionally, the National Association of Insurance Commissioners (NAIC), established in 1871, provides expertise, data and analysis to the industry’s Insurance Commissioners effectively and consumer protection.

Many individuals in the United States of America (USA) rely on insurance companies to mitigate the unpredictable risks associated with property and injured. Statistically, in 2023, the total direct premium written by all insurance companies in the USA market was USD 960, 527 million. Meanwhile, the total direct premium earned at USD 919, 859 million USD market.

Here are the ranks of 25 largest property and casualties insurance companies (P&C) in the USA in 2023. All data from the published market share data report of National Insurance Commissioners was obtained in 2024. This rank was organized based on a direct premium written in property and injury (P&C).

State Farm Insurance is one of the largest property and casualties insurance companies (P&C) located in Bloomington, Illinois, USA. Historically, George J. Mechle built this corporation in June 1922. George is a retired farmer who is widely regarded as one of the most powerful figures in the insurance business. With the development of his business, the State Farm employs over 57, 000 people. In terms of financial scales of financial intuition in the USA, State Farm Insurance has a ++ financial scales of A.M. Best®, AA1 of Moody’s®, and AA from Standard & Poor. Based on the National Association of Insurance Commissioners (NAIC) report in 2023, he gained direct premium state farm insurance written about USD 93.7 billion and won a direct premium approximately USD 88.6 billion.

A&k Insurance Is Specialized In Providing Tailored Coverage Solutions For Auto, Home, And Commercial Insurance Needs. With Partnerships Across 30+ Top-rated Insurance Carriers, We Work For You, Not

The innovative group of insurance companies began in the insurance business in 1937. In addition, the founders of progressive insurance companies were Joseph Lewis and Jack Green. Financially, in 2022, along with business development, progressive insurance revenue was around $ 49.5 billion in the meantime net income reached $ 721 million. In addition, in 2023, a total cutting -edge assets were $ 59.7 billion. Furthermore, in the property and injured industry (P&C), the company won a direct premium cutting -edge insurance written in USD 62.7 billion and won a direct premium approximately USD 59.8 billion.

Berkshire Hathaway is a holding corporation operating in a variety of industries, including insurance. Historically, Berkshire Hathaway was created in 1839 by Oliver Chace, but developed by Warren Buffett with the help of Charlie Munger. According to the 2022 annual report, this corporation had 948 billion US dollars in assets and 322 billion US dollars in revenue. Berkshire Hathaway owns various sub -company insurance companies in the insurance business, including a national indemnity company, a government workers’ insurance company (GEICO), General Re, and others.

Statistically, Berkshire Hathaway is still one of the largest insurance companies in the property and casualties industries (P&C). According to the National Association of Insurance Commissioners (NAIC) in 2023, Berkshire Hathaway won the direct premium written about USD 58.6 billion and a direct premium gained approximately USD 57.2 US dollars in 2023.

Allstate Corporation is an American insurance company and has become one of the largest insurance companies in the property and casualties insurance industry in the United States of America (USA). Historically, allstate was launched on April 17, 1931, as a holding company, his business is conducted primarily through allstate insurance company and other sub -companies. Financially, in 2023, the financial performance of allstate reflected the strengths and challenges in the industry. Total assets were recorded in USD 103 billion, while total liabilities reached USD 85 billion, indicating a stable but prompted financial structure. According to the National Association of Insurance Commissioners (NAIC) market share report, the direct premium written from allstate USD insurance reached 50 billion and won a direct premium USD 48.1 billion.

Home, Auto & Business Insurance In New Hampshire

Liberty Mutual Insurance became still one of the largest properties and injured (P&C) in the USA. In operation, Liberty Mutual Insurance still has its headquarters in Berkeley Street, Boston, Massachusetts. Due to its development in insurance, Liberty Mutual Insurance Company has employed over 50, 000 people in 29 countries. Financially, in 2023 according to its annual report, the Liberty Mutual maintained a solid financial base, with total assets priced at USD 165 billion and total obligations at USD 140 billion. According to the National Association of Insurance Commissioners (NAIC) in 2023, Direct Premium Liberty Mutuals written about USD 44.4 billion won.

The passenger insurance companies/ passenger companies were established in 2004 with the merger between St. Paul, Inc., and Travelers. Along with business development, passengers have more than 30, 000 employees and 13, 500 independent agents and brokers in the United States, Canada, the United Kingdom and Ireland. According to its annual report in 2022, Travellers Insurance has approximately $ 115, 717 million. Meanwhile, passenger insurance revenue was $ 36, 884 million with a net income of about $ 2, 842 million. Based on the National Association of Insurance Commissioners (NAIC) report, the direct premium written of USD passengers reached 38.5 billion.

The United Services Automobile Association (USAA) is one of the largest property and casualties insurance companies (P&C) in the United States of America (USA). USAA headquarters are in San Antonio, Texas, United States. Until 2022, this company employed 37, 000 people. Financially, according to the income statement in 2022, USD USD USD revenue reached 36 billion. Furthermore, based on the balance sheet of the annual report, USAA assets were around USD 204, 005 million. Furthermore, in 2023, the USA won direct premium written about USD 31.9 billion.

Chubb is one of the World Property and Insurance Companies (P&C) in the United States with operations in 54 countries. Chubb actively has executive offices in Zurich, New York, London, Paris, and other locations, and employs around 40, 000 people worldwide. In terms of the financial score, Chubb has financial scales of AA from Standard & Poor and A ++ from a.m. Best. Financially, in the National Association of Insurance (NAIC) report, Chubb won a direct premium written about USD 31.1 billion.

Secrets To Selling More Car & Home Insurance: Auto Ireland

Farmers Insurance is one of the largest property and casualties insurance companies (P&C) in the United States. Historically, the journey of this company was started in 1928 with the

Best insurance companies for home and auto bundle, top 5 auto and home insurance companies, insurance companies for auto insurance, best rated auto and home insurance companies, home and auto insurance companies near me, top auto and home insurance companies, looking for auto insurance companies, compare home and auto insurance companies, best insurance companies for bundling home and auto, good home and auto insurance companies, homeowners and auto insurance companies, good insurance companies for home and auto