Insurance Company Balance Sheet Format – Insurance is a financial product sold by insurance companies that protect people (and companies) from unexpected losses or damage. Insurance companies are capable of offering this product by spreading personal risks among a large group of people, so if something bad happens for a person, like a serious car accident, the insurance company helps to cover the cost of repair or replacement. In return for paying insurance premiums, people receive more financial security, knowing that they do not face significant financial burden alone.

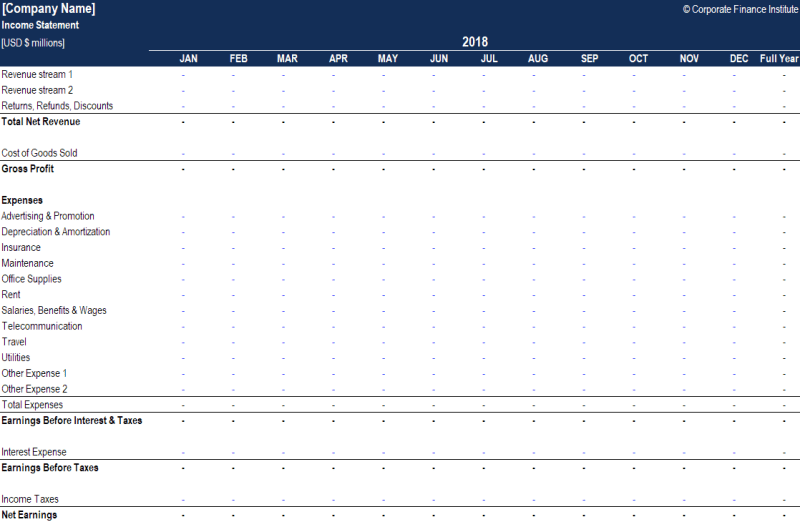

The main financial statements for insurance companies are similar to most other companies: (1) balance sheet, (2) income statement, and (3) cash flow statement. Each financial statement provides important financial information for both the internal and external stakeholders of the insurance company.

Insurance Company Balance Sheet Format

Note that the balance sheet is the first financial statements in the list above. This is different from how we generally list financial statements. This is because as a financial institution, the operation and income details of insurance companies are heavyly operated by their balance sheet, more than regular companies that produce material goods or services.

Solved The Completed Financial Statement Columns Of The

This is not to say that the balance sheet is the only financial statement that matters. Like all other companies, financial analysts use all three main financial statements to analyze the results and health of insurance companies.

It is necessary to understand the financial health of insurance companies, not only for companies, but also for investors, regulatory bodies and comprehensive economy. This is also important for customers of insurance companies, which want to ensure that the company can respect its obligations in case of accidents.

The “float” of an insurance company is a very important subject that is important and important for understanding the business model of an insurance company.

The float refers to insurance companies’ premiums paid by customers. These funds are not immediately paid as insurance claims. Instead, insurance companies use float to invest in securities to generate investment income. Unlike banks, which will sometimes pay interest to depositors, insurance companies generally do not pay interest to customers on premiums. Because of this, the insurance premium effectively provides a source of low cost or even free funding to the insurance company.

Free Balance Sheet Template Download

The insurance collects a pool of the insurance premium paid by the policyholders, forming a float. The float is then invested by insurance companies to generate additional income, usually through bonds, stocks and other assets.

When policy holders file insurance claims for covered programs such as accidents or property damage, the insurance company uses money from float to pay these claims. And by spreading risks in a large group and investing premium, the insurance companies ensured that they have financial resources for policyholders to meet their obligations, while also earning investment returns to maintain their operations and increase their businesses.

Because it is very difficult to predict claims, insurance companies should maintain enough reserves to cover claims. It is also a practical requirement as well as a regulatory requirement. These reserves are in the form of equity, or stock, capital.

Equity acts as a buffer against more and more expected damage. The appropriate amount of equity buffer is determined by the applied regulatory officers as well as internal modeling of the insurance company.

How To Create A Personal Balance Sheet

As previously discussed, it is very difficult to predict claims. Even after an accident, the insurance company may take some time before being notified. Additionally, the insurance company usually would like to check any claims to ensure that they are proper, covered, and not fraud. Due to these factors, it is difficult for the insurance company to estimate any claim related expenses. However, the insurer must do this to follow the matching theory of accounting.

Because of this, insurance companies should estimate potential claims and record it as expenses on income details. It has been estimated, but not reported (IBNR). Since this is an estimate, it will eventually be adjusted up or down depending on the actual claims.

When the claims are reported, they become part of the cost of claims. Combining it with IBNR reveals the total cost of claims in the accounting period given.

The insurance industry operates similar to the airline industry in which we pay the upfront for future service. General accounting theory is to allocate premiums during the policy period and not immediately on the sale of the policy.

Hubspot For Startups Financial Statement Template

As previously discussed, insurance companies receive premium well before they are paid in claims (float). Meanwhile, insurance companies float in various investments to earn some income or profit. While specific accounting may vary on the basis of standard investment, many investments are measured at a reasonable price. This means that if these investment price increases, the insurance company will show an unrealistic benefit on income details. Of course, if investment falls, it will cause an untruth loss.

Note that not all investment affect income details. Some unrealistic benefits or disadvantages are recognized in other comprehensive income.

Insurance companies should be solvent so that they are able to fulfill any claim financially. As that part, insurers should maintain adequate equity reserves and will generally invest in fixed income investment.

Fixed income investment, especially high-grade bonds such as government and corporate bonds, usually offer stable and estimated returns. Estimated cash flow from bonds helps to ensure that funds are available when the claims are required to be paid.

Part B: Prepare Financial Statements, Equity, Balance Sheet, Cash Flows

Insurance companies need to be profitable to increase business, as well as to ensure that they are capable of paying claims. Profits can also come in the form of insults with insurance policies as well as profitable investments. In any way, profitability increases equity capital, ensuring that the insurer can respect his financial obligations.

Insurance is in the business of risk, so appropriate risk management is important for insurance companies. Risk management is important to ensure solvency and financial stability, properly understanding the risk of different claims (and correctly pricing those risks), regulatory compliance, and maintaining customer confidence and reputation between many other aspects.

An insurance company can be analyzed based on many of the same metrics that we will use while analyzing a regular, operating company. For example, the return on equity can be calculated with another company. However, there are also various insurance-specific financial ratios. Some more common are included in the following:

Loss ratio: The loss ratio is calculated by dividing the damage done by the earned premium. The higher this ratio, the lower the insurance underwriting profitability and vice versa.

Format Of Balance Sheet (explained With Pdf)

Expenditure ratio: Expenditure ratio is calculated by dividing the costs associated with underwriting and servicing premiums obtained by earned premium. Like the loss ratio, the lower it will be as low.

Combined ratio: This ratio is calculated by generating any expenses directly to an insurance premium and dividing these expenses by earned premium generated in a specific period. Alternatively, the joint ratio can be calculated by adding the loss ratio to the expense ratio.

In other words, the joint ratio is the formula (commission + expenditure + claim) / premium. The higher this ratio, the less profitable the company is when insurance policies (and vice versa) are reduced. No investment income (or expenditure) is not included in this calculation, so even a joint ratio of 100% or more is not necessary that the insurer is losing money.

Underwriting ratio: The underwriting ratio is only a minus which is a combined ratio. If the combined ratio is 95%, the underwriting ratio is 5%(1 – 95%). In other words, after all the overwriting expenses, claims and commissions, the insurer has 5% of the premium earned.

Understand Financial Statements: Definition, Types, And Templates

Thanks for reading the guide of CFI on the financial statements of the insurance company. To pursue your career and skills, the following CFI resources will be useful:

Excel shortcuts for PC and Mac specializes for Excel Shortcuts Excel Shortcuts Excel shortcuts – it may feel slow at first if you are used for the mouse, but it is worth investing time to take time and …

Financial modeling guidelines CFI’s free financial modeling guidelines are a completely and full resource in which model design, model building blocks and general tips, tricks, …

What are SQL data type SQL data types? The structured query language (SQL) includes many different data types that allow it to store different types of information …

Projected Balance Sheet Business Commercial Insurance Services Business Plan

What is the Structured Querry Language (SQL) structured query language (SQL)? The structured query language (known as SQL) is a programming language used to interact with the database….

Upgrade to a payment subscription gives you access to our broad collection of plug-and-play template designed to strengthen your performance, as well as CFI’s full course catalog and recognized certification program.

Get unlimited access to over 250 productivity templates, full course catalogs and recognized certification programs, hundreds of resources, expert reviews and support, real -world finance and research equipment, and more unlimited access for more.