Insurance Company Business Model – Insurance companies scare business samples on behalf of a person or business. Most insurance companies earn two ways: Instead of investing in insurance protection and investment goods. Insurance diversify the risk by collecting risk from customers and redirecting them on a large wallet.

The insurance company’s revenue model can be changed among several types of insurance, including cars, health and goods insurance. However, the insurance industry is usually transferred to the economic risk of customers and -Partely or fully. Insurance write the rules of events that pay customers and write a policy to transmit frameworks if the claim is presented. In return, the insurance company pays customers.

Insurance Company Business Model

The important task for the insurers is to establish the risk of an event and implement the proper premium for the risk of hiring this risk. Consider that the insurance company offers a policy that has conditioned $ 100, 000. The insurance company must determine the risk of activating policies and the payment of the claim occurs. From there, the insurer must determine the level of risk corresponding to customers and primary amount, to properly compensate the risk. This analysis is called underlined.

Process Oriented Thinking For The Insurance Sector In The Digital Age

If the company gives its risk effectively, he will have to earn more income than spending claims in claims. However, if the subscriber group misleads the risk level, the insurance company may be very low and another fee of others may be. If the insurance does not impose premium to risk a particular policy, the company may lose money if the claim is made. On the contrary, if the insurer exceeds the risk, the premium is charged, potential customer loss competition.

In a sense, the actual product of insurers are the rights of insurance. When the customer makes a claim, the company must process, check the accuracy and submit payment. This responsibility helps filter fraudulent claims, reducing the risk of losing the company.

As mentioned earlier, insurance companies invest in a part of their premiums to earn income. Increasing market interest rates can be increased by providing higher advantages or benefits, such as treasury bonds, discharge bonds, high-performance savings accounts and deposit certificates (CDs).

On the contrary, investment tickets are also available as the fees. Low-atmospheres can cause insurers to invest in dangerous assets to go to their profits. In contrast, market interest rates can help prevent insurance to invest in dangerous assets. Insurance companies are often safe: they are safe investments, to earn additional interests while waiting for potential claims.

Insurance Business Model Ppt Powerpoint Presentation Complete Deck With Slides

Like many companies, insurance companies try to effectively sell their products and services and reduce administration and costs.

Some companies work in reinsurance to reduce the risk. Realization means that insurance companies buy excess losses from excess loss. Realization helps the insurer maintain compensation and prevents the default due to many claims payment.

For example, let’s say that the insurance company has been storm policies based on models that show a lower probability of a storm. If the storm is considered to the area, there is a lot of losses for insurance company. Insurance companies stand out without a business in the case of natural disaster, without risking the restoration table.

Regulators require exchanging some size and insurance companies. For example, an insurance company should only be granted by 10% of his share unless strengthened. Therefore, re-design insurance companies may be more aggressive when gaining market share because they can transfer risks. In addition, redesignation facilitates natural incidents of insurance companies, which can be seen in significant deviations in profits and losses.

Top 10 Of The 5th Korea-asean Business Model Competition For Sdgs 2024

For many insurance companies, it is like intervention. They charge a higher consumer insurance rate and get cheap rates, re-designing these policies in massive quantities.

Evaluation of financial performance of insurance companies may have profitability, expected growth, claim and risk analysis. Analysts often analyze financial relational analysis to assess companies using specific insurance ratios.

There are also industrial characteristics for insurance companies. For example, many insurance companies do not invest in fixed assets such as manufacturing equipment. So they are recorded a bit of amortization and capital spending.

Before investment, keep in touch with the financial performance of the financial professional or the financial performance of the insurance company to determine the best investment option for you.

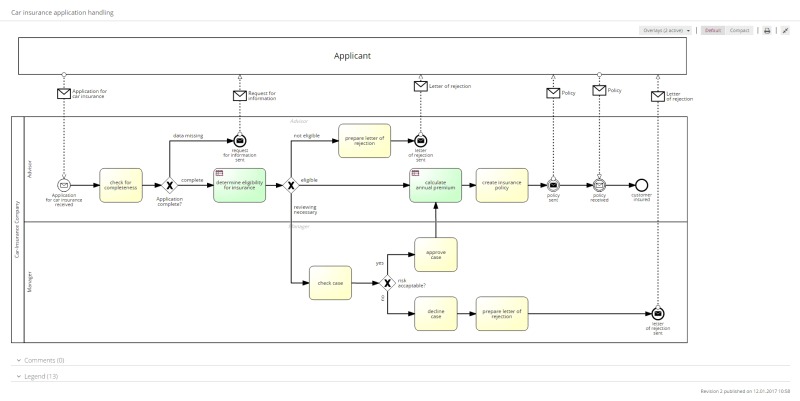

Interaction Overview Diagram Of The Business Process Model

The combined ratio measures the profitability of the insurance company by comparing income, paid rights and expenses. Sometimes the ratio represents this sentence from the vet

Ideally, an insurer wants a composite relationship with less than 100%, means that paid rights and costs are lower than income. In the previous example, the insurer’s costs and rights are 86% of the company’s income. In other words, he obtained a greater income of primaries than the right of rights and costs.

In contrast, the relationship between more than 100% is that the exits of the ATMs of the Rights and Costs exceeds the premiums.

If the insurance company is publicly negotiated, the exchange appears in return, equity prices (P / E) and price book (P / B), especially when compared to some insurance industry.

Insurance Companies: The Role Of Insurance Companies In Supporting Small Business Growth

The P / E ratio measures the company’s stock price compared to profit or profit. Insurance companies show more p / es for the expected growth due to high-claim payments and minor risks. The price means that it is very high against the big P / E profits. In contrast, it means that P / EKO insurance is underestimated.

The value of the price book measures the value of the insurer compared to the value of the book, the value of the book is the net value of the company after selling all assets and after all liabilities are paid. The P / B ratio of less than a year shows a low-value company. Insurance companies have high-risk growth growth, low-risk profile, high-risk payments and high income (ROE).

In comparing financial performance in the insurance sector, analysts will need additional complex factors. Insurance companies make approximate provisions for future rights costs. If an insurance is very conservative or aggressive, to calculate such provisions, financial expectations and ratios are not accurate.

The level of diversity is interfering with the insurance sector. It is common to participate in different or more insurance insurance transactions, such as life, property and accident insurance. Depending on the level of diversity, insurance companies have different risks and income, thus comparing an insurance financial performance to another.

How Does A Health Insurance Company Define Success?

Insurance companies make profits to buy customer printers insurance policies. However, US investors include various products, including treasure and corporate bonds, are insurance income.

Typically, the insurance industry is made up of three sectors, the first is the property and accident insurance that includes car and owners insurance. If the second sector has life and annual insurance, the third includes health insurance.

Several factors can affect the dividend of insurance companies, the number of paid rights, the amount of money received in the premium and the number of underlying policies.

Under UDOS insurance covers the economic risk of an event closing on behalf of a person or company. The insurance company graduates policy by assigning the risks and conditions covered by the Insurance Claim. In return, the insurer receives an annual or monthly premium from a personal or business. In addition to earning money collected premiums, some insurers push in an investment.

Medical Laboratory: Business Model Canvas (examples)

Writers must use primary sources to help their work. These include white paper, government data, basic reports and interviews with business experts. We mention the basic research on other famous editor in the right place. You can learn more about the standards we continue to produce specific content in our editorial policy.

Best Trade Insurance Trade Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance Insurance

Additional insured blanket: What is and how it will work on 10 July 2025. Among the best children’s life insurance companies in children’s care insurance, July 2025, July 2025, July 2025 will be rebuilt as a category of life insurance companies, with the only proposal of your value, critical operations and points.

If you need a business model model ready to be fully edited, feel