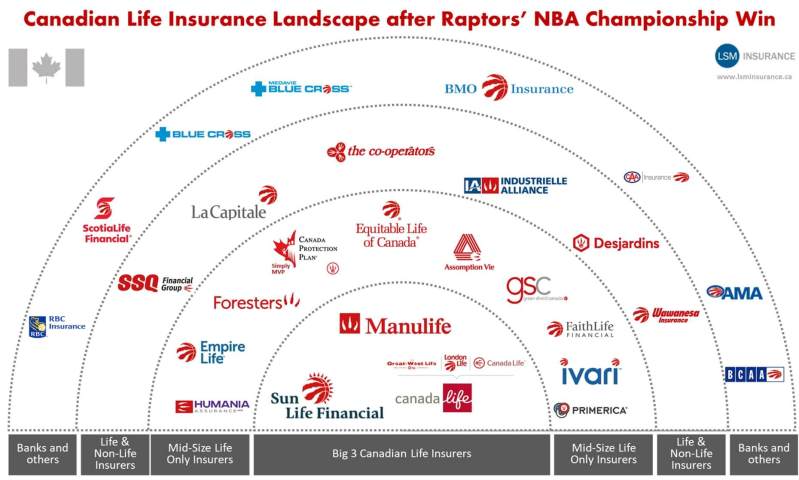

Insurance Company Canada – All against life insurance.

This is a critical disease insurance that costs more critical pain or I need

Insurance Company Canada

Manulife, RBC, Industrial Alliance and Pran Canada Arechance (for non -Medical) are highly included in the list of the best life companies in Canada in 2025. We will help you to navigate through the best options available, considering your specific needs.

Lsm Insurance Canada

Gregory Rozdebalicensed Sersroty Serrons AdvisorGregory Rozdebalicensed Sersrourorance Advisor Gregory Rozdeba is the CEO of Dundas Life leading Canada Digital Insurance.

With more than 150 life insurance companies operating in Canada, finding the best Canadian life insurance provider can feel great.

This guide offers a detailed disassembly of the best life insurance companies in Canada to help you choose the right scope for your needs.

In Dundas life we spent 100 hours, considering public data, prices for Winquote.net, and the third rating of companies such as A.M. It is best to find the best insurers for available costs (or costs). Each lead life insurance provider is combined with several categories depending on its strengths and weaknesses.

Scc Finds Insurer Not Estopped From Denying Coverage

Read about studying about the largest life insurance company in Canada and choose the right for your needs.

Life insurance is a legal mandatory contract between you and the insurer. In exchange for standard premium payments, Lifeinsur promises to pay a given amount to your appointed beneficiary after your death.

Life insurance protects your loved ones from a potential impact or harm when you leave your life and give your family, parents and partner a peaceful soul and future safety. Payment will help everyone replace some or all of your income as well as pay off any loans. This ensures that they can live comfortably after you leave.

Death can come from anywhere, even from lessons like player sport. Be sure to remember this throughout the message on this blog and plan us for your family’s future.

Great-west Life, Canada Life, London Life

Life insurance policies have expiry date and have a goal – to pay for death. The term of policy can be short as one year or up to 40 years. In the event that you leave life during life insurance, the life insurance carrier will pay for the death of your beneficiaries.

If you experience this term, there are no payments. However, most insurers allow you to restore life insurance without medical updates, up to a certain age. Insurance insurance parameters do not include additional bells, such as financial value. They have a monthly payment with a fixed level. This makes it usually easier to access, leading to greater savings.

The permanent life insurance policy gives you the illumination throughout life, offers you peace and financial security -what many think about finding better life insurance in Canada. This is closest to “Buy it and forget” and is often used to cover funeral costs because you do not need to restore your permanent life insurance policy.

Many permanent life insurance products also include an investment component called cash price. This account funds increase taxation and you can access them anytime. In general, a permanent life costs more than an urgent life, often six hundred times more. The two most common types of permanent cover of life are life insurance and versatile life insurance we will discuss.

2019 Winners And Excellence Awardees

Life insurance coverage is a form of permanent life insurance that offers living protection. It also includes an investment tool for accumulating tax money. Part of your prize covers the entire life account and the administrative fee, and the remaining finances in the built -in investment account. Next, let’s learn about Universal Life Insurance.

Universal Life Insurance also offers living protection. The main difference between universal life and life insurance is the first to offer you the best control over how your money is invested. Universal life also gives you some degree of freedom about your premium premiums and death assistance. You can increase or decrease payment with acceptable restrictions.

Compared to all life insurance, universal plans are more complex and require careful monitoring, especially when changing market conditions.

Non -medical life insurance does not require a medical examination to prove freeness. It makes it easy to qualify when you have health status and keep track of the application process quickly. The process can be as fast as 5 minutes.

Best Life Insurance In Canada (june 2025)

Although no medical life insurance examination offers comfort and speed, it is important to note that premiums may be slightly higher than traditional plans. This is because insurers pay the lack of medical information by repairing prices. However, for those who prefer the application method, there are no options for medical tests can be an important solution.

When used. A life insurance company will determine your suitability and set your premium -based answer. These politicians usually include the waiting period – usually two years. If you leave life during hope, the insurer will not pay death. Instead, it will return the insurance premiums you have already paid.

As long as you are at a certain age. However, the amount of death help is relatively small. Approximately $ 25,000 to $ 50,000. Most people take a guaranteed entry insurance policy to cover the end of life’s end or leave a little inheritance with their children or grandchildren.

You can buy life insurance online by a broker (e.g. dundas life) or by an agent. No matter how you buy, make sure you go shopping to make sure you get the best value for money.

Canada Life Insurance Review [2025]

These days you can do so much on the Internet: order food, order a holiday, check out previous employees, check the previous employer -and even buy life insurance. Buying life insurance directly from the supplier is simple, simple and fast. If you know what you need and

Such independent brokers, life insurance agents act as mediators between life and people insurance. Some agents represent only an insurance company and are called

Since the independent agent works with many carriers, they can offer you more options for obtaining an insurance range. More options can mean lower awards. However, all insurance agents provide insurance suppliers, not consumers. So they don’t always offer goal tips for you.

Life insurance brokers act as a mediator between Canadian insurance companies and consumers. Good rule: Brokers represent consumers, not insurance suppliers. This means they can offer you goal tips depending on your needs.

Best Car Insurance In Canada: Caa Overview

Choosing the best life insurance company is a major solution. Here’s what to consider to ensure that you get the best scope and support:

Not sure what kind of life insurance product is the best choice for life insurance in Canada? Try to talk to an independent broker such as Dundas Life, which will help you determine the right solution.

Kawater’s headquarters in Winnipeg, Manitoba, WawaSa Insurance have offered many different types of insurance, including home, car, farm, commercial business and life insurance. They were established in 1896 and had strong financial health, according to the AM rating. Compared to their competitors, they offer one of the cheapest life insurance plans.

We have a living insurance and many years. They send regular updates and let us know. “

Direct Billing For Mental Health Services

The Assumption of Life was founded in 1903 and is now located in Monquone, New Bransvik. Since then, they have continued to grow with over $ 2 billion. They are most famous for their non -medical life insurance, but they offer a number of insurance solutions for all the people. They offer many available coatings.

“Life seaption products are a great choice if you are looking for an affordable time of life protection, especially for a longer time, such as if you have children or you need to cover a long-term mortgage.”

Desjardins is one of the largest financial institutions in Canada, founded in the province of Quebec, with more than 20 subsidiaries. They offer a wide range of insurance and service products such as life and general insurance, venture capital, brokerage securities and managing management.

Desjardins financial security is a branch that enters life insurance, and they have over 6,000 counselors (only 1200 in Quebec) that will help you find a policy. Spouses, business partners or owners of many businesses can divide a joint policy into two individual permanent life insurance plans when their future changes. Available for three terms of life insurance – a period of 10, a term of 20 and a period of 30.

Bcm Insurance Company

Manulife is the largest and one of Canada’s oldest insurance companies. They are most famous in their terms of life insurance plans and offer a variety of consisions of the unique needs of the people. Manulife insurance rates are usually best for people looking for less than $ 500, young and good health. The integrated manulife coating policy is a highly valued pair plan.

“When my wife passed, I told them. They