Insurance Company Careers – Here’s a chance to make a career with the United ISurance Company Careers. Many jobs are provided by the combined Dubai Careers insurance company with lots of benefits, so prepare and be prepared for such opportunities created by Fidelity United ISurance Company.

The Joint Insurance Company was registered in 1976 and is referred to by the Abu Dabi Stock Exchange. The company was registered on 22.12.1984 as part of the register of the insurance company (reg.no.8), as required in accordance with Federal Law No. 9 1984.

Insurance Company Careers

The company has paid capital, which is 100 million. Over the years, the combined insurance company has grown from “modest, starting from the oldest created insurance companies in the UAE, offering flexible and individual insurance covers that meet the requirements of our predominantly personal, small and medium -sized businesses. We are always looking for new and better ways to give people insurance confidence.

Belize Bank Insurance Is #hiring In Several Locations. 📌 Insurance Company Staff (20+ Positions). Deadline: March 24, 2025 ⏰ 🎯 Email: Careers@bbinsurance.bz (subject: “position_title Application For Your_name Referred By Job Vacancy Belize”)

If you really want to apply for a job in the Fidelity United ISSurance Company and United Dubai Career Career Career, then click the Submit the Internet Summons below, send you a resume and resume directly to the combined UAE career insurance company. Go quickly apply. All the best wishes to all of you.

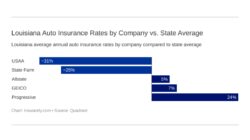

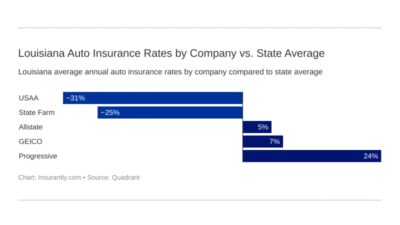

We are not a recruiter, we just share all the jobs, and all jobs are free, so if anyone asks for money, you don’t pay anyone. In any case, if you want a Dubai assignment, apply for daily basses and wait for the right call. And be passion. As you can see in the above graph, some of the highest paid insurance jobs are an insurance actuar, and then personal financing advisers, insurance underreiters, risk consultants and insurance agents.

With the growth of online scratching and interstate policy, many experts in this sector can work at home or elsewhere. Insurance agents have access to different ways they can contact and contact customers. For example, they can, for example, use an email or phone calls and sometimes arrange personal meetings that work best for both parties!

The insurance industry is one of the most stable and well-paid industries in America. Regardless of the economy, insurance will always be in demand because people want to protect themselves from financial losses, medical expenses and more!

Assistant Job Vacancy At The Oriental Insurance Company Limited

According to the US Statistics Bureau, the employment of insurance agents is expected to increase 7% from 2020 to 2030, approximately in accordance with the national average. Similarly, an average of 50, 400 options for insurance agents is expected over the next ten years.

What is the average salary for an insurance agent? The sky is a limit to what the insurance agent can earn. Many factors determine how much they do, as well as their level of experience and where their company works – but no matter what you choose, there will always be many opportunities to earn!

The more customers you have, the higher your profits. This is because the commissions are based on the interest from all their prize. What’s more, the insurance industry rewards agents who can create a loyal client base, which means that agents make more money when their customers restore policy and enter new with the company!

The insurance industry is always looking for entry -level employees. Becoming an insurance agent is not so difficult or a long time -inflicted process. The process usually entails the passage for the ability to sell a further degree or certification in business-related businesses will help enter this profession.

Search For Insurance Jobs And Apply

Independent agents can continue their career choices that will allow them to get more independence by having their business. If you are looking for Freedom to work in your time, it may be an option to think. One of the wonderful things concerning an independent agent is what you are more managed.

Just like independent agents, brokers can work with companies of different industries to acquire the skills needed when working on their terms, without given hours, as other people do.

When carrying out cold calls or sending letters, expect the word “no” to come out. Keep in mind that different insurance packages are already protecting most people, so you will need an exceptional offer of products/services if your company follows them specifically.

You may find that customers’ conviction is to enroll in a new type of insurance is a difficult feat. They may have doubts about whether they should take this step and you will need time before earning a considerable amount of money from the endeavor.

Career Resources Archives

Many websites offer insurance without demanding to interact with the agent, but it will still be fierce competition until affiliate partnerships are playing for independent agents. Artificial intelligence, such as AI, can help accelerate customers with insurance policies.

There are many reasons why life insurance can be considered hard work. Work as a life insurance agent can be psychologically and emotionally drain. It is necessary to be able to fight stress and work for long hours. Agents looking more may have to work on weekends. In addition, the compensation may not be as significant as you imagine when you first run.

Working in the insurance industry means work with a diverse group of people from different sections of society. Adaptation of the style of communication based on the type of people you meet is one of the most important skills you can have and develop.

Similarly, negotiations are an important skill for all contracts, but it is especially important when working with insurance. The key to a successful agreement is to find the right balance what every party wants.

Oman Insurance Careers Jobs In Uae

The insurance industry is competitive and you will need to come up with problems every day, or you can risk losing your customer. It is expected that you must immediately evaluate the problem and determine the best course of action so that the timing can still be fulfilled.

To have a successful career in insurance, you need to understand the policies that your customers want and how best to provide them with what is needed. You will also need good customer service skills to convince people that they can trust their needs, will be satisfied together, working together- from the start of talks to the closure of the bills at the end of the year!

Mathematics is the most important skill for anyone, but it is important when you are in the insurance industry. You will deal with numbers daily, so you also need to have some mathematical skills. It is important to have an awareness of how specific prices affect the insurance coverage and how to make the balance between available premium and quality coating.

When transferring the insurance agent requirements, you should always count on rates and avoid any mathematical mistakes or inaccuracies, because even a minor mistake can cost the client a lot of money.

Axa Careers Jobs Opportunities Available Now In Dubai –

The work line in the insurance can be tedious, but accuracy is always necessary. It is important to stay organized so that your time does not spend on mistakes and confusion because these few minutes could be used elsewhere.

Insurance brokers are engaged in a lot of customers, which requires maintenance and maintenance of many records. Maintaining in order your workstation will allow you to store details about each customer so that you can work more efficiently or quickly for them.

The insurance sector is constantly evolving to meet customer requirements. Firms in the insurance sector are looking for workers who can use social media skills, digital marketing and cyber communications. This is necessary because the change of customer needs to meet new technologies that facilitate instant access to information on your behalf.

Most insurance companies offer extensive employment opportunities for people with different skills sets, and therefore insurance is a great field of career finding. Insurance agents are often regarded as the most famous work in the field, but other important work roles are also required to make sure that the insurance company has everything you need for success.

📣 #newjobsopening Of #leader As A #seniormanager In The #servicerecovery For India’s Leading #insurance Company At #mumbai 🏦 Position: Senior Manager Department: Service Recovery Location: #mumbaicity Experience Required: 8+ Years Of Experience

Although insurance has many different careers, they all have some common requirements. The following are general requirements for entry into the insurance industry:

Some jobs only require high school end, such as requirements or insurance agent. For example, some jobs in insurance may not require degrees if you have great communication, sales and interpersonal skills.

A bachelor’s degree is required for insurance work that focuses on analytical and business components. A degree of business, finance and marketing can help you prepare for a career in the insurance industry.

Some jobs in insurance are complex and require a lot of experience to master. For example, the actuaries need not only the database management skills, but also the SQL coding knowledge so that they have a successful career in insurance.

The Big Meet Sydney Careers Fair

Previous insurance experience is mandatory for those who seek to become an employee or senior employee of any company. Internships is a great way to get hands -on insurance experience. Achieving certification in the right profession can also give you an advantage while hunting for work in the insurance industry. If there is no