Insurance Company Comparison – Do you feel in the swamp and confused when you navigate the hard world of homeowners? You are not alone. The array of options can be quite stunning and frankly, a little intimidated. Find the best insurance companies for homeowners that not only match your specific needs but also leave the pocket hole. You need tranquility to know that your basic asset – your home, is well protected.

In Oyer, Macoviak and Associates, we understand all families, all people and all businesses are unique and have unique insurance needs. We appreciate the importance of coverage of the owners of affordable and comprehensive home owners. That is why we are here today to simplify the process and help you make an informed decision.

Insurance Company Comparison

We have discussed and compared the best competitors in the property insurance world: Progressive Insurance, Allstate Insurance, Universal Componity Insurance, Edison Insurance and Florida Family Insurance. We have discussed aspects such as covering options, customer satisfaction rating, and possible discount savings.

Insurance Policy Comparisons

Since 1953 we have been helping thousands of clients to save money on insurance, and we are doing all things. Let’s get your policy with more than rated companies.

Before we meet the best insurance companies for homeowners, let’s explain what homeowners insurance is and why it is crucial.

Insurance of homeowners is a financial protection that includes your home and personal belongings against various forms of harm and theft. In addition, it also provides responsibility for covering it if someone is affected by your property. Most mortgage lenders require homeowners insurance as a loan condition that ensures their investment.

Imagine waking up one morning to find your home as a result of a very damaged natural disaster or fire. You are not only faced with the emotional distress of such an event, but you have to deal with the financial consequences of restoring or repairing your home and changing the lost property. This is where homeowners insurance is valid.

Best Health Insurance 2024

Home owners’ insurance provides financial assistance needed to recover from such incidents, help you restore and move forward without moving forward, without full financial burden. It gives you peace of mind, with the knowledge that you are protected from unforeseen circumstances that can otherwise leave you in financial tribulation.

Now that we cover the basics of homeowners insurance, let’s move on to compare the best homeowners’ insurance companies. We will start with progressive insurance, followed by Allstate Insurance, Universal Property Insurance, Edison Insurance and Florida Family Insurance. Stay to find out their covering options, customer satisfaction rating, and potential discounts.

Progressive insurance is a well -established company in the insurance market that provides a wide range of insurance products, including homeowners insurance. As one of the best homeowners insurance companies, Progressive is known to offer perfect coverage options, competitive prices and convenient online platform for policy management.

Progressive insurance has been a key player in the insurance industry for more than 80 years, providing reliable and accessible options for homeowners across the country. The company is known for its adherence to innovation, offers advanced online tools and resources that simplify the insurance process for its customers.

Compare All Car Insurance Sites

As for homeowners insurance, progressive offers a variety of coverage options to meet different needs. Standard policy involves residential coverage, protection of your home structure and any enclosed structure. It also offers private property coverage, which will ensure the protection of your belongings in the case of theft, fire or other hidden events.

In addition, Progressive homeowners insurance ensures the loss of use of use, which includes temporary housing costs and living costs if you are forced to leave your home due to hidden losses. Other repayment options include covering medical taxes and concealing personal liability, providing financial assistance and legal protection in the event of damage to your building or property damage.

However, homeowner insurance does not include everything. For example, standard policy usually does not include earthquakes, floods or wear and tear damage. In addition, Progressive offers the opportunity to add approval to your standard policy to cover such events.

Progressive insurance has a solid reputation for customer satisfaction. The company is known for its customers’ responsible services and the management process of effective claims. Progressive obligation to customer satisfaction is reflected in its strong ranking by independent insurance rating organizations.

4: Rate On Line Comparison Of Models For A Typical Company

One of the reasons that is discussed among the insurance companies of the best homeowners is the diversity of its discount and savings options. You can save money on your policy by packing your home insurance with your auto insurance. Progressive also offers discounts to have a security system in your home, a new homeowner, and pay for your policy.

In short, progressive insurance offers comprehensive insurance options for homeowners that can be adjusted to meet your specific needs. Are you a homeowner for the first time, or you are looking for a switch of providers, progressive wide coverage options, competitive prices and excellent consumer services make it a solid choice.

Allstate Insurance is another major competitor in homeowners insurance. As one of the largest and most well-established insurance companies in the United States, Allstate is known for its wide coverage options and strong consumer services.

The insurance policy of Allstate’s homeowners includes the foundations that homeowners were expecting, including hiding a home, protection of personal property and liability insurance. But what distinguishes allstate is its extensive elective coverage. You can change your policy with approval such as water backup cover, planned personal property coverage, business property and garden and yard damage. This flexibility allows the homeowners to cover their coverage of specific needs.

How Insurance Companies Determine Premiums

Allstate insurance is highly evaluated for its user satisfaction. According to the claim of the 2023 property, J.D. According to Power’s Satisfaction Studies, the average industry of the Allstate industry above, in terms of their claims. This means that Paul’s owners are satisfied with the service they receive when filing a lawsuit. It is also worth noting that Allstate is financially strong, which receives high ratings from credit rating agencies, which means the possibility of paying claims.

Allstate offers a wide variety of discounts to help home owners insurance premium. This includes numerous political discounts, discounts for automatic payments, and savings for homeowners who have recently updated their homes or installed protective equipment such as smoke detectors or safety systems.

In conclusion, Allstate is a reliable choice among the best homeowner insurance companies, offering a comprehensive and configuration cover that supports customer positive satisfaction rating and strong financial power. This is a great option for those who are looking for personalized coverage and many discounts.

Universal Property Insurance is another major competitor on the list of homeowners’ insurance companies. They have a strong reputation to provide a number of insurance products, focusing on homeowners insurance. Their comprehensive policy is based on a wide range of homeowners, providing a plan for all needs and budget.

Apb Ratio: Analyzing Insurance Premiums On An Annual Basis

Universal Property Insurance offers a variety of coverage options that can be adjusted in accordance with the individual needs of the homeowner. Their standard policy usually includes living and structure, personal property, responsibility and additional life costs. They also offer optional coverage for high value items, water damage and ID theft, by the way.

Like Oyer, Macoviak and Associates, universal property understands that every home and homeowner are unique and therefore requires coverage specifically tailored to their circumstances.

As for customer satisfaction, universal property insurance generally has positive reviews. They are known for their customer response services and the process of swift claims. However, customer experience may vary and it is always important to read reviews and ratings from many sources when discussing the insurance provider.

Universal Property Insurance also offers several discounts to help home owners save a saving premium. This may include discounts for packaged policies, protective devices and new or renovated homes. It should be noted that available discounts may vary in state and individual circumstances, so it is always a good idea to talk to an agent to find out what savings can be used for you.

Better Connecticut Home Insurance

In short, universal property insurance is a solid choice for homeowners who are looking for comprehensive covering options and potential savings. Their obligation towards customer satisfaction and flexible coverage options makes them an important competitor among the best homeowners insurance companies. As always, it is crucial to compare different companies and policies to find the best suitable for your specific needs and circumstances.

Edison insurance is a reputable provider who offers a wide range of hidden options for homeowners. They are known for their obligation to ensure personalized insurance decisions and their devotion to customer satisfaction.

Edison insurance offers a variety of coverage options designed to meet the variety of homeowners. Their policies include a standard coverage such as a residential cover that pays repair or recovery costs if your home is damaged by a hidden event.

They also offer a personal property coverage that protects your belongings in the case of theft, fire or other hidden events. Other noteworthy inserts of their policy are the loss of use, covering medical payments and concealing personal responsibility.

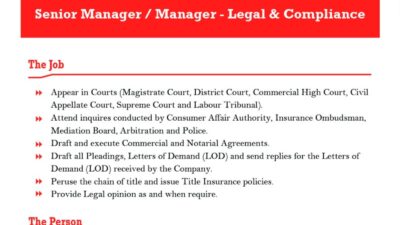

Competitor Comparison Insurance Company Profile Ppt Powerpoint Presentation

ყოვლისმომცველი დაცვისთვის, ისინი გთავაზობთ დამატებით დაფარვას, როგორიცაა გარანტირებული ჩანაცვლებითი ხარჯების დაფარვა თქვენი სახლის სტრუქტურისთვის. ეს ნიშნავს, რომ ისინი გადაიხდიან იმდენი, რამდენიც აუცილებელია თქვენი სახლის აღდგენისთვის, თუ ის განადგურებულია, მაშინაც კი, თუ თანხა აღემატება თქვენს საცხოვრებელ ზღვარს. აღსანიშნავია, რომ ყველა დამზღვევი არ გვთავაზობს დაცვის ამ დონეს,