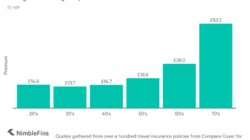

Insurance Company Financial Statements – The premium is a term -earned premium used in the insurance industry. It is in line with the sum of all insurance premiums earned by an insurance provider over a given period. Simply sell the income earned from an insurance product.

The gross gross premium is described as a gross’ as it is in the face of insurance. The insurance is where an insurance company changes some insurance contracts with another insurance company. Insurance companies also generate income from other sources, such as investment income and installment income, which are not trapped in grossly earned premises. It is therefore important to use a range of metrics while assessing the performance of an insurance company earnings.

Insurance Company Financial Statements

Gross premium is deserved from the total amount of premiums found in that period (the premium premium premium ‘), often causes insurance premiums at the beginning of an insurance contract, and the insurance cover often begins through a fiscal period; According to the ‘accrued principle’, the income earned should indicate the proportion of the insurance cover provided during that period, other than amounts received.

Quickfs.net Add-in Gaap Financials Bundle

The premium is a close -earned metric of earnings as it reflects the growth or decline in the new insurance business.

Insurance companies reveal gross premium in their quarterly and annual income statements. It is revealed at the top of the income statement, as it is an income item recognized from insurance premiums.

It is worth noting that the DLG earned premium was £ 3, 189.3m in 2020, a 0.4% reduction in the earned premium in 2019.

The gross premium earned an insurance contract is calculated by multiplying the written premium according to the percentage of insurance cover provided during the year.

Family Financial Statement

Let’s make an example of an insurance company who wrote an insurance policy of $ 1, 000.0 on 30 June. The policy provides coverage for next year, and the insurance company has a fiscal year end of December 31.

The complementary premium for the policy is $ 1, 000.0. However, only 50.0% of the insurance cover has been provided by the insurance company during the year until 31 December.

Based on the information below, we were asked to calculate the premium from an insurance contract during the company’s fiscal year.

During the year to 31 December, 2020, the percentage of insurance cover provided by the insurance company can be calculated as follows:

Nib Insurance S.co.

Therefore, while the insurance company received $ 800.0 in insurance premises from this contract, the amount included in earnings is $ 600.5. This reflects the percentage of insurance cover provided in that year and the other premiums will be included in the earnings of next year. Insurance companies are able to offer this product by spreading individual risks among a large group of people, so if something bad happens to one person, such as serious car accident, the insurance company helps to cover the cost of repairs or replacement. In exchange for paying insurance premium, people get more financial security, and know that they will not face the significant financial burden only.

The main financial conversations for insurance companies represent most of the other companies: (1) the balance sheet, (2) the income statement, and (3) the cash flow statement. Each of the financial statements provides important financial information to internal and external stakeholders an insurance company.

Please note that the balance sheet is the first financial statement in the above list. This is different from how we usually list financial statements. This is because, as a financial institution, the operations and statements of income insurance companies are being highly driven by their balance sheets, more than regular companies producing physical goods or services.

This is not to say that the balance sheet is the only financial statement. Like all other companies, financial analysts use the three key financial statements to analyze the results and health of insurance companies.

The Evolution Of The Insurance Sector In Nepal: Current Status And Promising Opportunities

An understanding of the financial health of insurance companies is essential not only for the companies themselves, but also for investors, regulatory bodies, and the wider economy. It is also important for clients of insurance companies, who want to be sure that the company can respect its obligations when accidents occur.

It is a very important subject to understand an insurance company and it is essential to understand an insurance company’s business model.

Float refers to the premiums paid by customers to insurance companies. These funds are not paid out immediately as insurance claims. Instead, insurance companies use the swim to invest in securities to generate investment income. Unlike banks, sometimes interest will pay to depositors, insurance companies usually do not pay interest on premiums to customers. Because of this, insurance premiums provide low cost or even free funding source for the insurance company.

Insurance collects during insurance premiums paid by policy holders, which creates the swim. Insurance companies then invest the swim to generate additional income, usually through bonds, stocks and other assets.

Accounting Of Insurance Companies

When holders of insurance claims for covered events such as accidents or property damage filed, the insurance company uses funds from swimming to pay out these claims. And by disseminating risk to a large group and investment premiums, insurance companies ensure that they have the financial resources to fulfill their obligations for policyholders in earning investment returns to maintain their operations and grow their businesses.

Because it is very difficult to predict demands, insurance companies must keep adequate reserves to cover demands. This is a practical requirement as well as a regulatory requirement. These reserves are in the form of equity, or share, capital.

Equity acts as a buffer against more loss than expected. The appropriate amount of equity buffers is determined by applicable regulatory authorities as well as the internal modeling of the insurance company.

As discussed before, it is difficult to predict claims. Even after an accident it may take some time before the insurance company is even indicated. In addition, the insurance company will usually want to investigate any claims to ensure that they are correct, covered, and not fraudulent. Because of these factors, it is difficult for the insurance company to assess any costs associated with claims. However, the insurer must do this to comply with the accounting matching principle.

Aic Secretary-general “live” On Cnbc’s Money Talks: “minimum Capital Requirement Of Insurance Companies In Indonesia”

As a result, insurance companies must estimate likely claims and record this as an expense of the income statement. This estimate is given but not reported (IBNR). Since this is an estimate, it will eventually be adjusted or reduced based on the actual claims incurred.

When claims are reported, they become part of the demand costs incurred. This reflects the total cost of claims in a particular accounting period.

The insurance industry operates the same as the airline industry in that we pay ahead of a future service. The general accounting principle is allocated premiums over the policy period and not immediately on the sale of the policy.

As discussed earlier, insurance companies get good premiums before they are paid out in claims (swimming). Meanwhile, insurance companies will invest this swim in different investments to earn some income or gain. While the specific accounting standards may vary depending on investment, many investments are measured at fair value. This means that these investments increase value, then the insurance company will show an unrealized gain on the income statement. Of course, if the investments fall, this will result in an unrealized loss.

Metlife American Life Insurance Company Limited Has Published Its Annual Financial Statement Of The Fiscal Year 2078/79.

Please note that not all investment affects the income statement. Some unrealized gains or losses are identified in other comprehensive income instead.

Insurance companies must be solvent so that they can meet any claims financially. As part of this, insurers must maintain adequate equity reserves and usually invest in fixed income investments.

Fixed-grade bonds such as government and corporate bonds, stable and predictable returns, in particular provide high-grade bonds such as government and corporate bonds. The predictable cash flows from bonds help to ensure that funds are available when paying is required.

In order to grow the business, as well as ensuring that they are able to pay claims, insurance companies must be profitable. Profits can come in the form of underwriting insurance policies as well as profitable investments. One way, profitability increases equity capital, ensuring that the insurer can respect its financial obligations.

Understanding Financial Statements Of An Insurance Company

Insurance is at risk, so proper risk management is vital for insurance companies. Risk management is important in ensuring solvency and financial stability, gaining a proper understanding of the risk of different demands (and correctly pricing these risks), regulatory compliance, and maintaining trust and reputation of customers, among many other aspects.

An insurance company can be analyzed based on many of the same metrics as we would analyze a regular operating company. For example, an equity return could be calculated the same as any other company.