Insurance Company Gst – At the 54th meeting of the GST Council, the GGST Council recommended the creation of a group of ministers (GOM) to fully deal with issues of GST on life insurance and health insurance and submitted a report by the end of October 2024.

The following 55. The GST Council meeting is expected to relieve the GST rate on the health insurance rate over a wide range.

Insurance Company Gst

Service tax was applied to all types.

Are You Aware That Input Tax Incurred On Certain Expenses Is Not Claimable

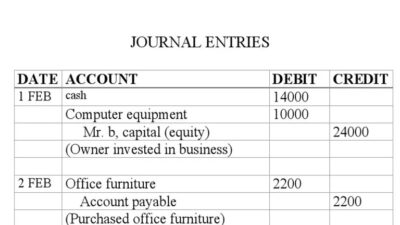

All these rates were replaced by 18 %, resulting in an increase in the premium. The cost of providing services in relation to life insurance is:

(A) the total premium assigned to minus investment or savings of policy owners if such money is informed by the policy owner.

(C) all other cases- 25 % per 1 year and 12.5 % for the second year on the bonus charged.

Before -gst and new policy owners faced a premium amount of phenomena due to increasing rates. As far as insurance is concerned, the consumers were granted an increase in taxes. Given the increasing number of GST returns, the insurance companies faced the high cost of compliance with regulations and administrative costs and also influenced the taxation of Inter -Branch services.

Do You Know How Gst Is Applied To Your Health And Life Insurance Policies?

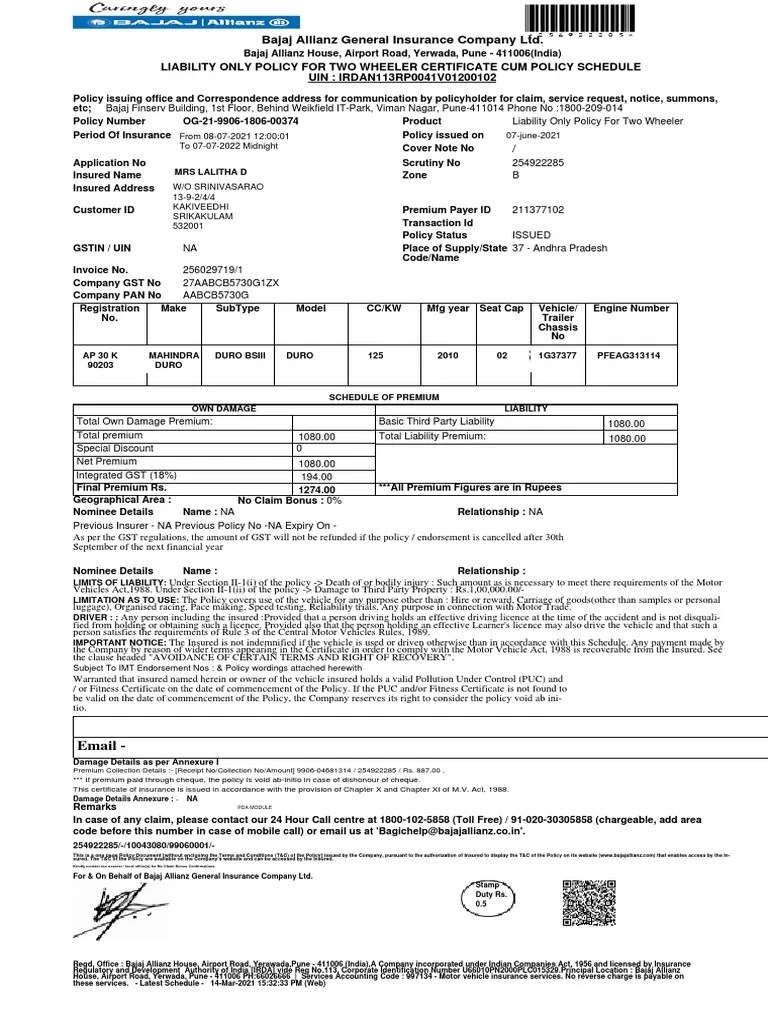

General insurance includes fire insurance, sea insurance, vehicle insurance, theft insurance, etc. The GST rate on normal insurance is 18 %.

As regards policy holders, general premiums increased when the tax rate increased from 15 to 18 %. The owners of the corporate policy who took over general insurance are looking forward to the tax credit at the GST entry paid for their policies (also available under the service tax). People who are insured for life and health will not have a input tax credit because it is not available for life and health insurance (because it is taken for personal purposes). Even the owners of corporate policy with group life and health insurance for their employees have no tax credit.

Upon arrival at the decision of the GST CBIC Council, the GST Council explained the application of GST to “any bonus of the claim” through Circular no. 186/18/2022-GST.

Insurance companies usually offer their customers ‘no bonuses with claims’ in matters where insurance claims were not made during the insurance period. Money is offered as a remuneration or discount form of the renewal of the insurance contract and deducted from the paid premium.

Withdrawal Of Gst, Merger Of Public Sector Insurance Companies Sought

According to the circular, the customer or the insured person receives an insurance contract for the compensation of the insurance contract according to the political conditions of the policy and is not responsible for any agreement for not required insurance during the insurance period. The insurance company does not provide the insurance company with any offer of the insurance company.

According to Section 15 para. 3 (a) A) of the CGST Act will not exist discount on the supply price if the same is recorded on the invoice. Therefore, the “without claim” bonus can be considered a consideration for any offer provided and is considered a discount and deduction and no GST will apply to it.

Banking services received a 15 % service tax, which later increased to 18 % within GST. Like insurance, banking services have become more expensive for consumers to increase taxes. Most banks make transaction fees in the case of a refund from various banking ATMs, a refund from the branch (the first 5 free for both). Everyone attracts 18 % GST.

Bank companies transfer tax liability to their customers. However, their administrative work and compliance are significantly increasing. The branches serve each other who are taxable by GST (they may later claim a tax loan). This increases paperwork and increases operating costs accordingly. Entrepreneurs can breathe as they can claim a tax loan for banking services paid in their business accounts.

Gst Authority Issues Rs 922 Cr Show Cause Notices To Reliance General Insurance

As a result of the increase in GST rates, all policy members pay more premiums for their insurance. In an average family, health and car family, insurance costs increased by 3 %. Assuming they spend tomorrow. With the exception of tax on 30,000 insurance, their costs increase by 3 %, ie 900.

As a capable authorized accountant with extensive accounting skills, finance, taxes and audit, I specialize in facilitating complex regulations for a wider audience. India and GCC are well aware of tax laws, I am very interested in the evolutionary financial ecosystem. Passion for learning, I like to deal with conversation, looking for new cultures traveling and standing with music .. Read more

ICICI production technology fund Grototota Digital India Fund directly Grothexus Balupe Fund Grothelacy

SBI Mutual Fund India mutate fund HDFC mutual financing mutual funding of the Mahindra Mutual Fundcii Fundcici Prepatal Fund Dottlement Berla Funds Funds Matuchel Fund Funds

Circular No. 217/11/2024-gst-entitlement Of Itc By The Insurance Companies On The Expenses Incurred For Repair Of Motor Vehicles In Case Of Reimbursement Mode Of Insurance Claim Settlement.

Stock Market Lyews Bank Actions Percy Percy Percy Price IRctc Price ITC ITC Price Action Price Price Motors Action Price Action Action Action Action Price Price Price Price Price Price Price DFC Bank.

Obviously, India, businesses, organizations and authorized accountants in India provide taxation and financial solutions. Clean 1.5+ million satisfied customers, 20000+ time and tax experts and 10000+ businesses across India.

The income tax statement (ITR) was simplified by a clear platform. Just upload the form 16, ask for your deductions and get your admission online. You can return your income from salaries, property, capital, business and business and other resources according to your income. In addition, you can also file a return on TDS, create a form 16, use our tax calculator software, claim the game, check the return status and generate income from rent for income tax.

CAS, experts and businesses can develop GST with Clear GST software and certification course. Our GST software helps to easily manage your return and invoice tax experts and businesses. Tax courses of our goods and services include teaching videos, leaders and experts to help you specialize in taxation of goods and services. Taxes for goods and services will also help you register your business for law.

Gst Fraud Worth ₹824 Crore By Insurance Companies

Substantial Tax Savings Funds (ELSS) invest in clear taxes by investing in online. Our experts recommend the best funds and you can get a high profit by direct investment or through SIP. BLACK Download through your mobile phone and give a return. The Indian insurance sector has increased the tax authorities that have larger catches of the main requirements of Star Health, LIC, New India Insurance, Rgic, Icici Group Companies, Babic, HDFC Life, Go Nigas and GST. Experts are stopped where some people believe that the matter is outside tax evasion, causing financial fraud.

The General Director of GST Intelligence (DGGI) and the Income Tax Department have started the investigation at the same time after the investigation of last year that insurance companies limit the rules and regulations of commissions that allowed agents and bachelor to pay more. There was such a payment against the invoice that officials said they were fake.

The Income Tax Department allegedly reviewed the loss of income tax due to alleged expenditure. Initial investigations cover 30 insurance companies, 68 tax agents and benefits. Later, the investigation was extended to many banks that worked as insurance as nationwide at national level.

In the case of banks that worked as a courageous investigation, the investigation revealed that insurance companies paid the cost of banks supplies that never appeared in banks books. It is equivalent to the inviolability, which is a serious violation of I-T laws.

Cbic Circular No. 217/11/2024-gst: Itc Entitlement For Insurance Companies On Motor Vehicle Repairs

On the other hand, DGGI considered examples of insurance claims claiming a tax loan without the basic supply of goods and services using fake income provided by mediators.

According to the internal assessment of the tax authorities, the alleged amount of tax evasion was around 30,000 CRORA in income tax from 1 July 2017, when GST was introduced by a reduction in its income and offering incorrect expenses.

The lack of receipt of fees, tax officials began to issue demand notifications to these institutions. According to the Economic Times, in the meantime, with the implementation of interest and fines, overall obligations may increase.

The company said on Monday that Star Health and Allied. DGGI received a notification for paying a tax of 38.99 crore. A few days ago, Reliance General Insurance Company (RGIC) won more than one GST show, CR 22922.58.

Gst: Icici Lombard, Six Other Insurance Companies Receive Scn For Non-payment Of Gst On Reinsurance Premiums Since 2017

The General Insurance Company in the New India Insurance Public Sector has received the largest demand for GST among all insurance companies worth 2, 379 Crores.

Previously, Bajaj ALIANZ General Insurance received a notice of Crore RS 1, RS 010 for a tour. HDFC Life also faced Dani from the CRS RS 942, followed by ICICI Pradual Life with RS.

Before April 2023, a due commission was available to insurance agents of the product line ceiling.

Check company gst registration, company gst number, gst company, insurance gst exempt, gst registered company search, gst register company, company registration and gst, gst registered company, travel insurance gst, insurance gst, gst insurance claim, insurance gst claimable