Insurance Company Margins – Welcome to the latest edition of our health insurance company financial update, Pulse. Our goal is to inform you of the key trends and dynamics affecting the financial results and profitability of health insurance companies. Earlier this year, we issued a Q4 2023 finance analysis. This update contains a quarter of 2024 net income trends for guaranteed companies, revenue focus, trade partnership and Medicaid (including re-determination), highlighting the focus on market capitalization.

Generally, the average profit rate (pure / premium income) with four in advance is 3.2% by 1.9% lower than the non-asphalt average Q4 2023 and 2.3% lower than the non-heat average Q1 2023 3.6%, leading the loss of Unitedhealthcare due to the solution.

Insurance Company Margins

Unitedhealthcare recorded a net loss in the first quarter of 2024, with a profit rate decreased by 5.8% in the fourth quarter of the fourth quarter, in the first quarter of 2024, which took a loss of $ 7.1 billion recognized in the sales of their subsidiary in Brazil. In addition to an extraordinary object, Unitedhealthcare’s margin will be in the first quarter of 2024 as Q4 2023.

2025 Global Insurance Outlook

Cigna also fell in the quarter of 2024, 11.7% in a quarter of 2023 to 8.0% in P1 2024, but the Q4 2023 was swollen due to the recognition of deferred tax benefits.

The profit rate of the elevice increased by 3.4% from the quarter 2023 to Q1 2024, which is mainly at a lower cost ratio.

CVS health (AETNA) was their relatively unchanged profit rate by Q4 2023 at 0.9%, except that it increased by 0.2% in 1 2024. Their profit rate was also 3.1% lower than P1 2023 reported over 4.0%.

On average, the relationship between medical losses (medical expenses / premium) for the four large public companies that have revised is 1.2% less than a quarter of 2023 by Q1 2024.

Financial Business Objectives: Examples And Types

In the first quarter of 2024, loss proportions were reported 85.6% for higher, 90.4% for CVS health (AETNI), 84.3% for Unitedhealthcare and 79.9% for Cign.

The loss ratio is affected by seasonal trends and is not uncommon for a lower loss ratio of Q1 than the previous 4. Generally, the average loss ratio was 1.5% at Q1 2024 at 85.0% compared to Q1 2023 at 83.5%. This increase was operated by Unitedhealthcare (82.2% to 84.3%) and CVS health (AETNA) (84.6% to 90.4%).

The operating expenditure ratio (operating expenditure / premium) decreased by 0.8%from Q4 2023 to Q1 2024. CIGIN (-0.4%), CVS strength (-1.9%), and height (-1.2%) was reported while decreased by 0.3%.

Many carriers commented on the trends of use appeared in the first quarter of 2024, and found that total use was generally at expectations.

Insurance Industry Is Quietly Making Record Profits

Centen. The health benefits relationship for a quarter was 87.1%, which was on the trip with full annual instructions. He broke the center with a business company and found that they had a 90.9% relationship between health benefits in Medicaid, which is slightly worse than expected. Medicare’s HBR was 90.8% in the quarter, which was in line with expectations and commercial HBR 73.3%, which is slightly better than expected.

Cigna. The relationship between medical care was better than expected at 79.9% in the quarter, driven by focus on initiatives for accessibility and efficient prices. The MCR of the year is expected to be 81.7% to 82.5% in the range, improving 20 basic points from the last high range. In addition, Cigna expects their relationship to be in the second quarter in all annual instructions.

CVS Health (Aetna). In the quarter of the year, the 90.4% ratio was between 90.4%, which was 580 basic points higher than the previous quarter, indicating a higher use of Medicara’s benefits, the best impact of lower star estimates for 2024 payment and unfavorable development from the previous year. CVS Health (AETNA) (expect their relationship between medical benefit by 2024 around 89.8%, which is 210 basic points from previous advice.

Humana. Reported the 88.9% quarter share of 88.9%, which was at expectations. For January and February, man noted a little more use in the hospital, but this compensates the affection at the end of February and during March.

History Of Insurance In India

Molina. For a quarter that is in line with expectations, the business price ratio was 88.5%. Medicaid’s business continued to show healthy margins and experienced a cost ratio of 89.7%. Medicare Advantage observed an 88.7% cost ratio in the quarter. Molina found that increased use they experienced in the second half of 2023 due to higher long-term services and supported costs and the use of the pharmacy continued in 2024, but it seems that operational improvements and additional adjustments to the benefits made in their abandoned company, successfully in leveling costs. The coefficient of Molina Molina Health Costic was 73.3% in the quarter, also according to expectations. Molina assumes that their consolidated MCR of the year will be 88.2%.

Unitedhealthcare. It reported that the proportion of medical supply is 84.3%. This reflects about 40 basic points associated with the temporary establishment of some care management activities. Unitedhealthcare has not reflected any favorable quarterly gains affecting the development of medical reserves. Due to the potential for cyber attacks affecting receipt time, they reflected an additional $ 800 million in claims reserves. Outpatient care activity among the elderly remained at elevated levels, which first appeared in the first half of 2023, which were planned for 2024 bids by Medicare Advantage. The general activity of the hospital for treatment also falls into expectations.

In the first quarter of 2024, the joint partnership in Medicaid of public carriers decreased by 4.9% compared to Q4 2023, driven by further determination of the eligibility of Medicaido. However, the joint inscription in Medicaid is still about 25% higher than at the beginning of the pandemic. Total trade partnership increased by around 3.0% compared to Q4 2023, as some individuals who lost medicalide coverage could deviate to commercial coverage.

During their earnings calls, many carriers provided knowledge of their membership year. In addition, some carriers have also commented on the current process of countries that determine the eligibility of Medicaid. Public health ended officially on May 11, 2023, and several countries began to re-determine 1. April 2023.

Customer Experience Transformation In Insurance, Free Vizolution White Paper

Centen. The quarter ended with around 13.3 million members, exceeding 13.2 million members expected. This was mainly based on the time of the re-determination process. Centenes estimates that by the end of the quarter they were 90% of the route through this process. In particular, commercial operations at the end of the first quarter are growing by 3.9 million market members by the end of the year to 4.3 million.

Cigna. The first quarter ended with about 19.2 million doctors, reducing 0.6 million members by the end of 2023. This was primarily driven by a reduction in their revenue in each exchange after moving their book into certain geographies to improve overall profitability.

CVS Health (Aetna). The three months ended with around 26.8 million doctors, which is 1.1 million members compared to 2023. This reflects the growth in Medicare products, individual exchanges and trade groups, which partially offset the impact of medical resolution.

Element. The three months were completed with a medical member of around 46.2 million members. This reflects the suffering in Medicaid, which is partially offset by constant impetus in their business business. In the quarter, the element was added by nearly 400,000 000 000 free-based commercial members, which were operated by a strong restraint and a successful seasonal sales season. They also added more than 200,000 individual ACA members based on attractive positioning of products and coverage transitions away from Medicaido. Eleeevis believes that nearly 90% of Medicaid membership has already re-determined eligibility.

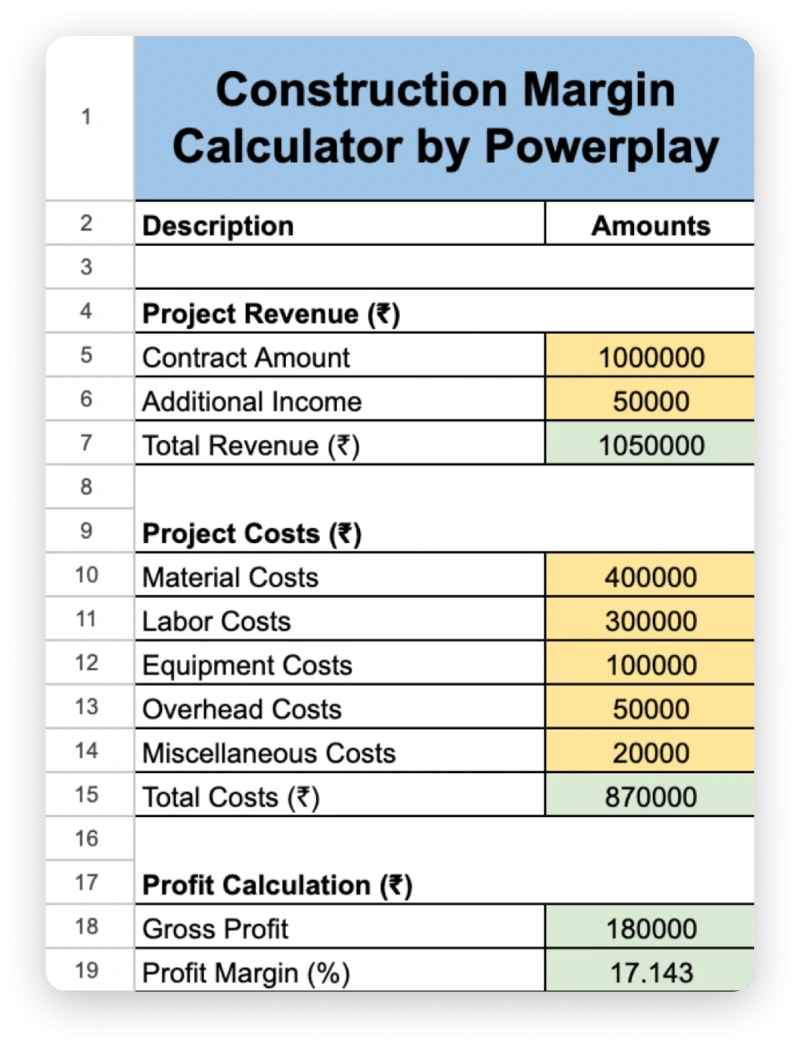

How Do You Calculate Gross Margin? Use This Free Online Calculator

Humana. The three months ended with around 16.2 million members, around 800,000 from the end of 2023. This was operated by around 600,000 members in independent PDP products. Based on these results in the first quarter, Humana increased her year’s expectations on Medicare Advantage partnership by 50,000 to 150,000.

Molina. In the Molina quarter, the inscription in Molina decreased by 50,000 members due to the net impact of the re-determination of the medicalide. For the time being, Medicaid’s registration decreased by 550 000 due to the re-determining effect. Generally, they could transfer about 30% of Medicaido’s lost revenue to their market products.

Unitedhealthcare. Unitedhealthcare added 2.1 million new consumers in the first quarter. Medicaid Business finished the first quarter with 7.7 million members, slightly less than at the end of 2023 reflecting the suffering to restore medicalide.

The table below shows changes in the reported entry for 16 quarters most recent for commercial and Medicaid for a set of public companies where the award was consistently available. In the quarter of the total trade partnership it increased by around 2.8 million, while Medicaid’s partnership decreased by about 2.0 million in the quarter of a quarter of reinforcement.

Insurer Participation On The Aca Marketplaces, 2014-2021

The capitalization of the health plan increased last year, but in the quarter of 2024 she denied and followed the growth of the S&P 500 index

From the quarter of 2021 to the quarter of 2024, the total market capitalization of seven public health companies, which we oversee, experienced modest growth. Between March 31, 2021 and 29. March 2024, the combined market capitalization of these seven public health plans increased by 22.1%. In the same period