Insurance Company Owned By Policyholders – An insurance company is an insurance supplier of policies holders who offer coverage of or almost costs, while distributing the profits of members as dividends or reduced premiums.

Mutualinsurance Companyis an insurance company owned by policies owners. The sole purpose of the mutual insurance company is to provide insurance coverage for its members and holders of policies, and its members are granted the right to choose management. Mutual insurance companies make investments in portfolios as a regular mutual fund, with profits returning to members as dividends or reducing premiums. Federal law, not state legislation, determines whether the insurer can be classified as a mutual insurance company.

Insurance Company Owned By Policyholders

The purpose of a mutual insurance company is to provide its members with insurance coverage to or near the costs. When a mutual insurance company has a profit, these profits are distributed to the members by paying a dividend or a decrease in premiums.

Who Elects The Governing Body Of A Mutual Insurance Company

Mutual insurance companies are not traded on stock exchanges, therefore their investment strategy avoids the pressure of the need to achieve short-term profit goals and can work as the most suitable for their members for long-term benefits. As a result, they invest in safer low-yield assets. However, since they are not publicly traded, it may be more difficult for the policy holders to determine how financial the solvent is a mutual insurance company or how it calculates dividends it sends back to its members.

Large companies can form a mutually insurance company as a form of self -insurance, or by combining divisions with separate budgets, or by uniting other similar companies. For example, a group of doctors may decide that they can get better insurance coverage and reduce the bonuses by combining funds to cover such types of risk.

When a mutual insurance company switches from the property of members to the stock market trading, it is called “demutalization” and the mutual insurance company becomes an insurance company. This change can cause policies holders receive shares in the newly carried out company. Most often, this is done as a form of capital raising. Insurance companies can raise capital by allocating shares, while mutual insurance companies can only raise capital by borrowing or raising the rates.

Mutual insurance as a concept began in England in the late 17th century to cover losses due to fire. It began in the United States in 1752, when Benjamin Franklin created Philadelphia’s contribution to the insurance of houses from fire loss. Mutual insurance companies now exist almost everywhere in the world.

Accounting Of Life Insurance Companies

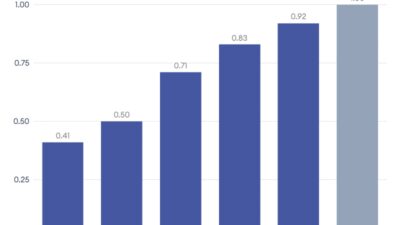

Over the last 20 years, the insurance industry has gone through major changes, especially since the legislation of the era from the 1990s, has removed some of the barriers between insurance companies and banks. As such, the percentage of demotization increased as many mutual companies wanted to diversify their operations outside the insurance and gain access to more capital.

Some companies have been completely transformed into shares, while others have formed mutual holding companies owned by the holders of a transformed mutual insurance company.

It requires writers to use primary sources to support their work. These include white documents, government data, original reporting and interviews with industry experts. We also mention original research from other reputable publishers when appropriate. You can learn more about the standards we follow in creating accurate, impartial content in our editorial policy.

The offers that appear in this table are from partnerships from which they receive compensation. This benefit can affect how and where lists appear. Does not include all offers available on the market.

Solved An Insurance Company Owned By Its Policyholders, Who

Valued Marine Policy: What It is and How IT WORKS CARRIGE AND INSURANCE PAID TO (CIP): Definition and Example Policyholder Surplus: What IT IS AND HOW IT WORKS BROKEGE Amount at Risk: What It is and How IT WORKS BUSINESS Automobile Policy (BAP): What It is and How Works Premium to Surplus Rati: What IT IS, HOW IT WORKS, Importance Means, How It Works

American Land Title Association (Alta): What It is and How IT WORKS Ultimate Mortality Table: What It is and How IT WORKS UNDERWRITING FEES INSURANCE: Meaning and Example Comples Open Cover: Meaning, Overview, and Requirements Both-to-Blame Collision Clause: Meaning, Overview, and Example Best Small Business Insurance for August 2025 National Association (Naifa) What Pei Mutual Insurance Apart from the Other Insurance Suppliers? The answer is in our name – we are a mutual company and we are 100% local. But what exactly does this mean and why makes us the best choice for islanders who seek peace of mind with comprehensive insurance?

We are here to help put the record directly to all “mutual”, so you can make the best informed decision when shopping for home, business, fishing or farm insurance. Continue to read to learn about the unique structure of ownership of mutual companies and how it is beneficial to policy holders. We will also look at the critical role that mutual insurance has played in Canada for more than 175 years. We will deal with some of these annoying myths and misconceptions about mutual insurance. At the end of this article, we think you will sing the praise of all things mutual! And if you are already the holder of the Pei Mutual Policy, we hope this article will give you peace of mind that you have made the right choice of insurance!

The biggest difference between a mutual insurance company and the insurance company is their property structure. Share insurance companies, such as corporations, are the property of external shareholders. This means that the main purpose of the company is to maximize the return on shareholders, with profits being paid to the shareholders.

Capital Stock Insurance Company: Meaning, Pros And Cons

In contrast, the mutual insurance company is entirely owned by its owners of policies, also known as “members”. Its main purpose is to serve its members and the community. Profits are reinvented to strengthen operations and/or return directly to members. Here, at Pei Mutual, we love to return profits to our policies/members with reduced prices for their annual premiums, and after a few years we even send a check on discounts in the mail!

The management structure is also very different. In the insurance company, investors hold control and usually give priority to how they can quickly make the most return of their money, even if it is to the detriment of the company’s policies. For comparison, of a mutual insurance company, the members vote on the Board of Directors who set the by -laws. All members are welcome to attend the annual general meetings in order to vote for the by -laws and to receive an overview of the financial results of the previous year.

Here is a quick “cheat sheet” that emphasizes the key differences between a mutual insurance company and an insurance company.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png?strip=all)

This is the heart of the “mutual difference” – mutual insurance companies are guided by people, not by profits.

ᐈ Insurance Companies Suing Policyholders When Exercising Their Option To Repair ⇒ Legal Blog

Despite their many years of success, mutual companies are sometimes misunderstood. Here are some myths we would like to clean:

Myth: Mutual persons do not offer competitive prices. Fact: mutuals often provide very competitive prices as they do not need to generate profits for shareholders and work with indicative thinking. In PEI Mutual, we are proud of understanding the unique needs of customers on the island and the provision of homeowners, companies, farmers and fishermen with insurance in accordance with their specific needs and budget.

Myth: Mutual people cannot cope with big claims or big events. Fact: Mutual companies usually rely on their own resources to pay claims. In the rare case of a large -scale event, they will work together through national networks such as the Ontario Mutual Provision Association (OMI), the Canadian Association of Mutual Insurance Companies (CAMIC), Regional Networks such as the Maritime Association of Mutual Insurance Companies (MAMIC) and the mutual reinsurance of the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for the Ferma for Ferma for Ferma for Ferma for Ferma for Ferma for Ferma for Ferma for the Ferma for Ferma

At Pei Mutual, we have been able to successfully navigate several major events, including the hurricane Fiona because of our solid financial planning and partnerships in the industry.

Participating Life Insurance Products With Alternative Guarantees: Reconciling Policyholders’ And Insurers’ Interests

Myth: The mutuals are old -fashioned or behind the times. Fact: Mutual companies have always been committed to remaining on the leading edge of change in order to best serve their members. Today, this means investing in modern technology and online tools, to be up to the development of policies and maintaining high customer service standards. Here at the Pei Mutual we are currently moving to the most modern customization system that will serve us for many years to come.

At that time, agricultural communities were rooted throughout the country. Agriculture formed the economy and society of the nation, which would become Canada. Despite the important role that farmers played in the construction of the country, they struggled to have access to insurance for their equipment, crops and livestock. The established insurance companies were not interested in taking the risks associated with the protection of farmers from natural and human -created disasters.

Farmers had a choice – continue to deal with farming and risk losing everything or invent your own settings. Since they are an intelligent bunch, farmers have chosen the latter option and have started organizing mutual protection associations to combine resources and share the risks inherent in agriculture.

In 1836, Gorna Canada established laws that recognize agricultural mutual insurance companies and guide their work. Over the next few decades, Lower Canada and West Canada followed the suit, allowing mutual to practice. Not wanting to stay behind, Atlantic Canada joined the mutual movement in 1885. With – you