Insurance Company Quebec – SSQ Insurance (Frch. Assurance SSQ) was a Canadian mutual insurance company and financial institutions that offered insurance and investment products. It was founded in 1944 in Quebec and merged in 2020 to become a bea.

Before merging, more than three million customers served and work 2,000 employees. It was one of the main insurance companies in Canada. SSQ insurance was also one of the 500 largest companies in Quebec, and in 2018 it settled in the 79th place.

Insurance Company Quebec

BEVA is one of the 10 Canadian teams in the world’s most popular teams.

Caa-quebec’s Peace Of Mind Also Extends To Your Insurance Coverage

In the early 1940s, Dr. Jacques Trembles, due to the fear of social justice, causes the working lesson in Quebec, which cannot allow relevant medical care.

There was no public medical plan. 1944 On May 9, he founded a doctor’s convincing de student, Kubek, who provided the necessary medical care. In 1945, the team changed his name for the SSQ after the Les Services de Santé Du Québec, HCE inspiration.

Since the 1950’s, the cooperative has been focused on business development and customer service. Investments will be based on each group’s risky profile, and the amount of sales has been installed as an advisor. Already in 1955, to diversify its products and control its growth goals, the cooperative changed the status, becoming a group of mutual assistance to the group insurance. In the early 1950s, the company expanded its customer and geographic base and offered new products such as life insurance and disability insurance.

In 1961, the implementation of the Public Hospital Insurance Program, SSQ, offers the services in which the program is used for private and semi-hospital rooms, surgery fees and doctor. SSQ increased insurance disability in 1963. At the age of 60. DTAL, vision and chiropractic care; and prescription drug insurance. In 1969, SSQ moved his headquarters to the boulevard Lauri, who is in Quebec. In 1970, in 1970, the introduction of health insurance was attacked by the important progress of the public and new Mazl. For SSQ.

Home Insurance Company

In 1974, the law that respected SSQ status changed and turned it into a mutual life insurance company. Regional gatherings have been created in D70 years, and regional delegates were selected for the annual general meeting to attack their groups. The company’s assets have reached a sign of $ 100 million in 1979. In addition to the creation of mortgage loans, SSQ also created a real estate subsidiary in 1982.

According to a member of the member, the subsidiary was established in 1986. 1991

In 1997, the introduction of a mixed public and private program has changed the field of this insurance market. In 2000, he signed SSQ Aontmtt with his first Paankan Group. In order to reflect its lasting growth and expansion, the company changed its name to SSQ Financial Group in 2001, and the Canadian post continued with new Toronto offices in 2002.

In 2003, SSQ Financial Group was called 50 best managed Canadian companies. SSQ has also launched a discerning program of health, trying to be actively involved in its customers’ health and well-being and has received permission to offer individual economic plans in Ontaria and organizations. In 2012, SSQ and FONDS DE SOLIDARIRITÉ FTQ, AXA LIFE INSURANCE, AXA,

Canadian Insurance Company Hi-res Stock Photography And Images

The transaction increased SSQ products and services, except for the company’s balance sheet and location in the Canadian market. SSQ Financial Group has acquired several other companies from rectal flights, including funding and compensation.

In 2017, the SSQ insurance decision was criticized by health professionals and popular newspapers. This includes a collection of the right to parquet injuries injuries to 7 meters. At that time, Patita was covered against the palsy under the fuses of her mothers. SSQ insurance has sued this decision since then.

In 2018, SSQ Financial Group will change its name and become SSQ insurance. This change reflects the primary goal of SSQ and moves the company’s location in Canada.

In January 2020, SSQ Insurance merged with La Capitale Insurance to become a Beva, which was called SSQ Premium.

Simply Put: What Is An Insurance Gic?

SSQ insurance consisted of three companies: partner company SSQ, Life Insurance Company Inc. and his two adjacent subjects.

January 1, 2017 s SSQ GERAL INSURANCE COMPANY INC. P & C INSURANCE SSQ of Previous Group Unites SSQ INSURANCE COMPANY INC.WHOLE VS TERM LIFE

Critical disease insurance is worth a very critical disease, I need a severe disease insurance insurance against cyclists.

In 2025, Manul, RBC, Industrial Alliance and Canada program (non-fedical) was very classified on this year’s list of best life companies in Canada. We will help you navigate the best available options tailored to your special needs.

Economical Is 150

Gregory Zdebalicensed Life Insurance Advisorgory Rippalicensed Life Insurance Advisor Gregory Rozdeba is the Executive Director of Dundas Life, Front Canadian Digital Insurance.

With more than 150 life insurance companies operating in Canada, the best life insurance provider can be found.

This manual offers a detailed schedule of the best life insurance companies in Canada to help you choose the correct coverage of your needs.

In Dundas Life, we have spent 100 hours of public industrial data, set prices from winquote.net and third-part ratings such as A.M. It is best to find the best insurance companies for affordable costs (or costs). Every best life insurance provider is grouped based on specific categories, their strengths and weaknesses.

Contact Us By Telephone Or Email

Read about the largest insurance companies in Canada and choose the right one for your needs.

Life insurance is a legally binding contract between you and the insurer. In exchange for your regular premium payments, Lifeinsur promises to pay the set amount to its designated recipients after your death.

Life insurance protects your loved ones from possible financial influence or losses when you die and provide your family, parents and partner peace and future security. Payment can help everyone replace your some or all income and repay any loan. This ensures that they can live comfortably after you are far away.

Death can come at any time, even from activities, such as sports that threaten players. It is necessary to remember and plan your family’s future when posting this blog.

How To Find My Insurance Provider

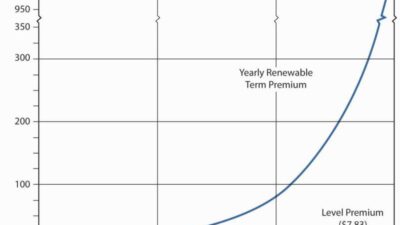

The term Life Life Insurance comes with the expiry date and has one goal – to pay the death dose. The political term can be as short as a year or up to 40 years. When you die for life insurance during the end of the deadline for the deadline for life insurance, the Life Insurance carrier will pay your recipient to death dose.

If you survive this term, there will be no payments. However, most insurance companies allow us to restore life insurance without recovery of medical control until a certain age. Time insurance capabilities do not include other calls and whistles such as monetary value. Have a fixed monthly payment level. As a result, they are generally more affordable, which leads to greater savings.

Permanent life insurance for you throughout the life covers you, which offers you peace and financial security. Many people think about finding the best life insurance in Canada. It’s the closest thing to “buy and forget it” insurance and is often used to cover the burial cost, as you do not need to update your permanent life insurance.

Very permanent products of life insurance include an investment component called monetary value. These account funds grow tax, and at any time you can approach them. In general, permanent life is worth more than one term, often six to ten times more. The two most common types of lives and the insurance of the universal life, which we will include in terms of permanent life.

Companies Flooded’: Surge In Insurance Claims In Quebec After Historic Rainfall, Flooding

All life insurance is a type of permanent life insurance that offers lifelong protection. It also includes an investment tool to accumulate money based on delayed tax. Some of your premium refers to the coverage of all life and administrative fee, while the rest is funded by built-in investment. We will also learn about universal life insurance.

Universal life insurance also offers lifelong protection. The main difference between universal life and life insurance is that the first to you better control how your money is invested. Universal life also provides you with full freedom on premiums and death benefits. You can add or reduce your payment within permissible limits.

Compared to the full life of relatively life insurance, universal plans are more complicated and require careful following.