Insurance Company Underwriter – Insurance subscribers are professionals who make and analyze the risks that the Insurest people and the absents. Insurance subscribers set prices for high risks. The term subscription means being rewarded for the will to give a risk. Subscribers use special software and actuarial data to determine risk of risk.

The subscribers of an investment bank often guarantee a corporation for a corporation, which guarantees a corporation as a source of capital. The bank is acting only in the “facilitator”, regardless of the sale or failure of the company’s shares.

Insurance Company Underwriter

Insurance subscribers take the risk involved in the agreement with a person or entity. For example, a subscribed can assume the cost of a home in exchange for a premium or monthly charge. The risk of an insurer assesses a risk before the policy period and time of refresh.

Empowering Underwriters: The Convergence Of Human Experience And Technology

For example, employees should be considered several variables when classifying employee insurance subscriptions. Property, random insurance agents work as on-site subscribers, starting ties or houses or rental for starters. Agents report accidents to the home subscribed. The subscribed is considered to be the dangers of allowing liability.

The dangers include the presence of unwanted swimming pools, broken sidewalks and trees that are in property. These and other incidents represent the risks of an insurance company, and demands for liability in drowning or accidental slip need to be granted.

Introducing many factors involving an applicant’s credit rating, which often involves an applicant’s credit rating, an algoric rating method is used for prices. Creating the appropriate premium system based on the interpretation of the platform, the field reported by the fields subscribed observations. The underdore underdatter are the answers submitted by the applicant when they reach the premium.

Insurance companies balance the subscription approach: if so is very aggressive, more demands can be compromised by the expected regions; If they are very conservative, they distribute opponents and lose market share.

Insurance Underwriter Resume: Sample & Guide [entry Level + Senior Jobs]

Commercial bank subscribers have evaluated the credit to decide whether the loan or funding or funding or funding. If the borrower is charged with a shot that hides the risk of an enigma to cover the lender’s risk.

Subscribers assess the risk of medical cessation through medical cessation from the individual health conditions of self-insured employers’ groups. Stop loss employees protect their own health insurance claims.

Self-secured entities close medical and prescription claims, reserves of reserves from reserves reserves reserves. Self-assured entities subscribers should be assessed to assess the employee of individual medical profiles of employees. The subscribers assess the group’s risk and are estimated at the appropriate premium level and the total claims are estimated and the employer can cause the employer.

:max_bytes(150000):strip_icc()/UnderwritingIncome3-2-99c6961c6f5145d680cb8b20a21f53da.jpg?strip=all)

Fast fact: insurance subscription is a large and profitable industry; According to business insurance, Warren Buffett Insurance and Ransurance premiums are used to invest in Haddow.

Types Of Underwriters

Writers need to use primary resources to support their work. This includes a white paper, government data, real reporting and interviews with industrial experts. We also assume true research from other appropriate publishers. You can learn more about the criteria we follow in the production of precise and unprejudiced in our editorial policy. Mortgage, insurance, loan or investment, usually commission, premium, stress or interest.

Subscribers are trying to determine the possibility of the borrower, and if you have a അഡ് phalt, it is a large amount of available. In the event of insurance, subscribers try to evaluate the strength of policy holders and other components and increase the risk of people as much as possible.

The subscribed play a critical role in many industries in the Finencial world industry, in the insurance industry, the insurance industry, the equity markets, and some common types of detractions. A person is called a book runner for the position of a major subscription.

The subscribers of the modern period perform a variety of roles, depending on the industry. In general, subscribers claim by determining the risk from a transaction or other type decision. The possibility of a result or investment in the expected effect is a risky risk.

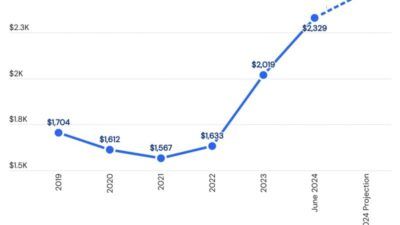

Statistical Guide 2024

They rely on Underrititsbecus that investors determine whether they determine whether investors are being obtained. Subscribers contribute to the activities of the torels. For example, in the public offering of Anpal (IPO) and the subscribed may have bought the IPO issuer, which can be sold to investors. The IPO is a process of selling shares in the public bag in front of the former private company.

The term “subscribed” came out in the first days of sea insurance. Boat owners were trying to protect yourself if ship owners lose insurance for a ship. Shipowners will be prepared from a document described by the ships and their content and destination.

Rate and terms agreed are set on paper. The conditions they wanted to take to issue as some responsibility or risk are introduced to be signed on their behalf. These businesses were popularly known as subscribers.

The most common subscribed is a mortgage loan subscribed. Mortgage loans were approved on the basis of revenue, credit history, debts, paper and general savings of the applicant.

Insurance Underwriter Career Video

Mortgage loan subscribers ensure that a loan applicant meets these requirements. Completers estimate that the consequences are assessed by an assessment of property and lending to the room.

Mortgage loan subscribers have the final approval for all mortgage loans. Non-readable loans can go through the process of the process, but the decision is needed to start.

According to the birth statistics of the US office, the employment of insurance subscribers expects to reduce the employment of insurance subscribers to reduce from 2021 to 2031.

Insurance subscribers, mortgage subscribers, review applicants for coverage, accept or refuse an applicant based on risk analysis. Insurance brokers and other entities submit insurance applications for customers and decide whether to review the insurance subscription app and offer insurance coverage.

A Guide To Understanding Life Insurance Underwriting

Insurance subscribers advise on risk management issues, determine the coverage available to specific individuals, and reviewed existing clients for existing coverage analysis.

Public distribution and distribution of public distribution from a corporation or other exit body from equity markets. Perhaps the most stated by equity is the proprocesss.

IPO underwriters to determine the security price of offering the previous securities price, buy securities from the issuer, buy securities from the issuer and sell investor providers.

IPO subscribers have IPO specialists about staff. This investment banks work with a company to ensure that all control requirements are met.

Insurance Underwriting: Graduate Area Of Work

IPO specialists contact IPO specialists with a large network of investment organizations, such as mutual funds and insurance companies, such as mutual funds and insurance companies. The interest of the interest of this large institutional investors helps an subscribed to set the company’s stock price.

The subscribed will sell shares in the initial price and will buy any surplus.

Daily securities such as the body, corporate bonds, municipated bonds or their liking stock (usually a government company or agency). These profits are widened by subscription.

BBT Securitor (then sell them to other buyers). When the loan is issued, the subscribed literation group, also known as the subscribed and the Syndecet subscribed.

🎙️ Don’t Miss Obby Hampande, Our Individual Life Claims Underwriter, Live On Lusaka Radio 97.7 Fm At 10:40hrs! #insuranceweek2024 #mlife ##protectingyoualltheway

Investors need subscribers to determine if the business risk is investing. In addition, underwriting also causes the success of sales stages.

A mortgage loan is one of the subscribers subscribers. The loan applicant shall ensure that the applicant is meeting all needs before or discarding the loan. Another common type of insurance subscribers is reviewed and inspects or denies an applicant based on their discoveries. Subscribers working in the equity market should be given in the form of a common or preferred stock.

A book runner is the primary subscribed or lead coordinator for the new equity, debt or securities tools. This type of subscribers can coordinate with others, for example, those representing large companies, jump