Insurance Company Valuation Multiples – Insurance Agency and Mediator Industry include companies that sell insurance policies Lisa and Anuitent. In recent years, the industry has experienced healthy growth, earned more than 210 billion dollars. In addition, the demand for insurance agencies remains stable. As the economy improves and premium increases, the insurance agency and indirect industry continue to grow. However, there are more than 400,000 insurance agencies in the United States. As such, this industry is extremely competitive. If you want to buy, grow or sell insurance agency, it is crucial to understand the multiplication of the assessment for the insurance agency.

When evaluating the insurance agency, there are several factors to consider. As such, it is useful to get business assessment. During business assessment, evaluation analyzes the main value for the specialist insurance agency. In addition, they will consider the financial statements of the insurance agency. Then a specialist compares these matrices to the same insurance agencies that have recently sold. Using different valuation methods, the job recognizes the appropriate market value for the insurance agency.

Insurance Company Valuation Multiples

If you are selling an insurance agency, obtaining business assessment can help you determine the appropriate price list. The assessment of the insurance agency can also help maximize the value before the sale. However, if you are buying an insurance agency, business assessment is crucial for appropriate pricing negotiations.

Enterprise Multiple (ev/ebitda): Definition, Formula, Examples

As a business evaluator, an insurance agency for business assessment chooses to work with persons or sales persons. We are pleased to answer questions about the values of the agency insurance. Schedule consultations today. See also how to appreciate insurance agency, insurance agency, and also appreciate insurance validity programs.

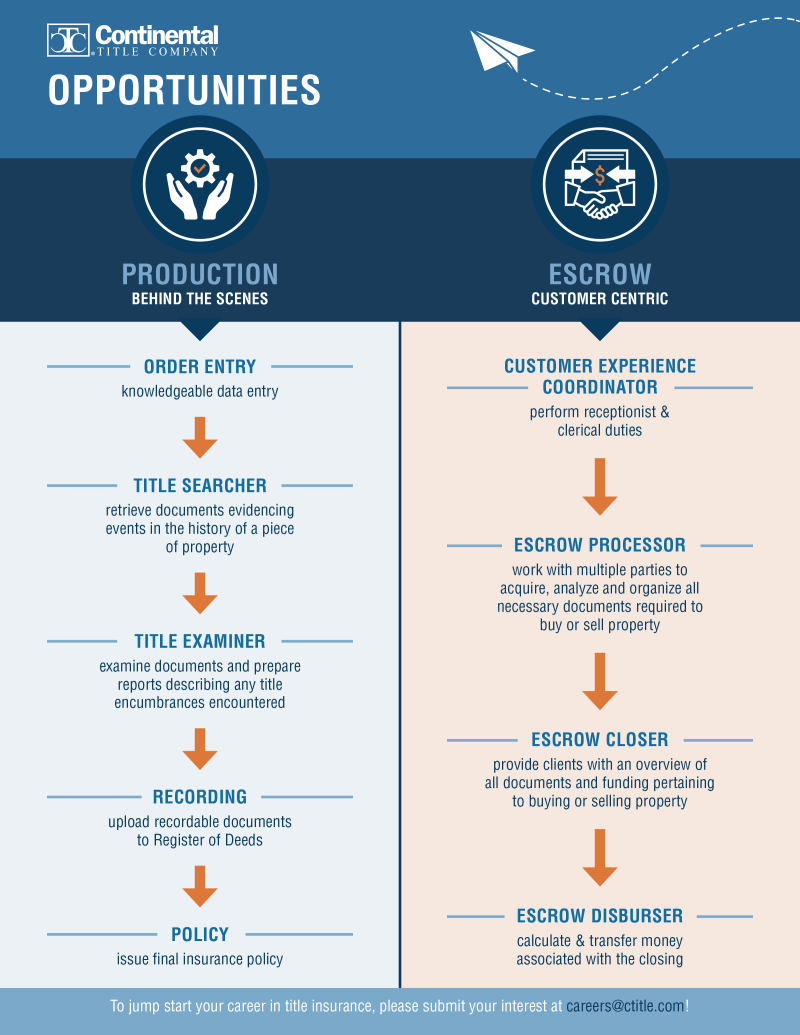

The following figure shows the average market multiplication for the insurance agency. When giving the value of the insurance agency, the assessment of business evaluation often uses market access. This approach depends on the multiplication of the assessment. However, this is just a guide. To know multiplication for your insurance agency, receive business assessment. The valuable value of peak business is happy to provide business assessment to your insurance agency. Schedule consultations with peak business assessment to learn more!

Declaration of responsibility: This multiplication is only in academic purposes. As such, the information provided are not created by the assessment advice. This multiplication is not an estimated opinion of evaluation of peak business or its assessment professionals. Instead, see the instructions and advice of a professional assessment of professional qualified on anything in this article.

The multitude of evaluations is a relationship that compares the value of the insurance agency in the financial metric. This may include cash flow, earnings or sales. For example, the popular ratio is still multiple. This compares the discreet salary of the seller with more insurance agencies with the default company value. In order to determine the rights market value, an assessment expert analyzes a multitude of comparative insurance agencies that have recently sold in the open market. After that, a specialist determines multiplication applicable to your insurance agency and offers a number of appropriate market values.

Lights, Camera, Insurance: How To Get Started With Video In Your Insurance Agency

For example, assume that insurance agency has 5 215, 000 in SDE and received 3,75K SDE multiple. In this case, the Agency will have the default costs of 6 806, 250 (5 215, 000 times 3.75K). In contrast, multiple more than 3.91, indicates that the value of the company is 40 840, 650. (5 215,000 times 3.91K).

Peak Business Assessment, Business Evaluators, work with people who want to buy, grow or sell insurance agency. In the next paragraph, we discuss multiplying the assessment of the insurance agency. These numbers indicate a range of values that are often dealing with insurance agencies. It is important to remember that the values range can change because each insurance agency is unique. Below, we emphasize SDE, EBITDA and Rave multiplication for insurance agency. For more information on multiplication of the assessment of the insurance agency, schedule costs of consulting with a peak business assessment!

According to peaked data, insurance agencies are engaged in average seda multiple at 3.29K – 4.12K. To calculate the default value of the insurance agency, apply more than a recent period of 12 months revenue. The number is as follows:

Suppose the Insurance Agency generates 20 320, 000 in discretion and seller transactions at 3.79K multiple. In this case, the business value is about 1, 212, 800 USD.

Get A Free Business Valuation

SDE multiplication is usually used by a professional assessment when evaluating the insurance agency. To calculate SDE, business evaluators receive a profit of insurance agencies and withdraw all costs that do not work a new owner. They may include personal transactions, return owners and incapable or non-related business costs. By doing so, it helps the professional to determine the potential cash flow of the insurance agency. This is important when determining the value of the insurance agency.

On average, insurance agencies deal between EBITDA multiple range 4.38K – 4.89K. Apply this more in EBITDA to determine the default business value. See the following equation:

For example, the insurance agency has EBITDA from 8,268, 000 and transactions on more than 4,82K EBITDA more. Using the upper matrix, the insurance agency costs approximately 5 805, 000.

EBITDA helps to determine the return on investing multiple companies (ROI). Business evaluators can choose to use EBITDA multiple because it helps them normalize differences. This allows comparison between the same insurance agencies. The normalized ratio offers an accurate presentation of future wages that can expect from the customer insurance agency.

What Is The Value Of Lloyd’s And How Does It Change Daily?

According to the data of the valuation of the type of business, the insurance agencies sales on average of Revenues from 1.87K – 2.33K. The Vest Assessment Specialist can more determine the default business value by multiplying the amount of income from the insurance agency. See the following equation:

For example, the insurance agency earns revenue of $ 600,000. Then it deals with more than 1,96k multiple. In this case, the job is about 1, 176,000 dollars.

Professional business assessment in evaluating peak business will determine which multiplication for the insurance agency is valid for your business. Often the Rave depends on the multiple. In addition, the assessor uses different methods to determine different values for insurance agency.

When you use ventilation on assessing insurance agency, there are several factors that the assessment expert considers. The evaluation process can be complex. As such, it is best to get business assessment. Valuation of peak business, business evaluator Utah, is happy to help! During business evaluation, we discuss how the value of the insurance agency and applicable multiplication. In addition, business assessment can help you understand the value of the insurance agency and how to increase it.

Global Insurance Survey 2023

Superior evaluation, business assessors, emphasizes many insurance agencies across the country. At the top we focus on providing valuables to help you buy, expand or sell insurance agency. The peak is happy to answer the questions you answer to a professional assessment and the questions you answer to the insurance agency. Start now by scheduling the cost of consulting with the bottom route! The multiple approach is a method of assessment or principle indicating that the same property is sold at the same price.

The multiplication approach is the theory of evaluation based on the idea that sells the same fortune at the same price. It assumes that the type of ratio was used compared to companies such as margins to pair over operational pairing or cash flow in the same companies.

Investors also refer to access to multiplication as an analysis of multiplication or multiplication of the assessment. While doing this, they can relate to financial intercourse, such as price-body ratio (P / E), earnings as multiple.

Generally, “Multiple” is a common term for a class of different indicators that can be used during value. Only only a relationship is calculated that is calculated by dividing the estimated market value or property with a special item on financial statements. The multiplication approach is a comparative method of analyzing that tries to appreciate the same companies use the same financial matrix.

Machine Failure And Predictive Maintenance Through Analytics In Insurance

Analyst that uses access to evaluation assumes that a certain relationship is applicable and applied to different companies operating in the same business line or industry. In other words, the idea behind the multiplication analysis is that companies are comparable, the multiplication approach can be used to determine the value of a company’s firm based on the value of another.

The multiple approach is trying to capture a number of operational payments and financial characteristics (eg expected growth), to achieve the value of a company or equality.

Managing the value of the company and the duplication of equality are two categories of multiplication of assessments. The multitude of companies involves the relationship between the company and sales (EV / Sales), EV / EBIT and EV / EBITDA.

The duplication of equality includes the price of company shares and the basic elements of the company’s performance, such as earnings, sales, accounting value or something. General multiplication in equity includes ratio price to cancer (P / E), price / for profit ratio (PEG), a price of book (P / B) and the price ratio.

Intrinsic Compounding On X: “embedded Value Cagr Of Life Insurance Companies From Fy18 To Fy24 (6 Year Cagr) And Their Current Price To Embedded Value Ratio Generally, It Has Been Observed That

Even when there is no change in the value of the company (EV), multiplication of capital can be artificially affected by changes in capital format. The multitude of companies allows a direct comparison to different companies, regardless of the capital structure, they