Insurance Contract Meaning – The officer and the officer of a life insurance contractor and the officer of politics is a contract that guarantees the guarantee, then provides money for politics.

Life insurance works as a financial security net for your family. If you die even if you are active, the insurance company pays for the person given to your policy. This money, which is called the privilege of death, you can help your lost income as house, food, and a job bill. Life Insurance can be used to pay for funeral expenses, covering unique loans, or to love their ancestral to love their snares.

Insurance Contract Meaning

:max_bytes(150000):strip_icc()/CommonPolicyDeclarations_Final_4199104-840675e050e64f279d4a6a0d788c05c4.png?strip=all)

Life insurance is difficult, but each person’s responsibility helps you to make decisions about your coverage, as you look for a policy or conscience.

3 Insurance Contract And Parts-1

The manager is that a life insurance is responsible and is responsible for paying fees. Politics often guarantees officers, but you can buy and manage other people in politics. For example, a company owner can buy policy for high performance, by the privilege of deadly facilities and recipients to the company. Similarly, you can take a policy like your wife, if you did specified politics.

You can’t buy life insurance that you want. The insurance company you need for an unequal concern, which means this person has faced financial difficulties.

The benefit is a specified person or branch that will take advantage of death. Life insurance policies are multiple features, such as family members, friends, or organizations or organizations or organizations.

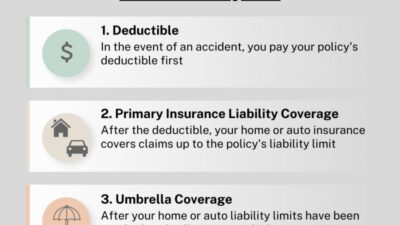

Policy is a regular payment of your insurance company to keep the policy. This year, health, health, lifestyle, and based on why. For example, 30 years of health should be less than 500 years with the history of smoking. Political types are also important: temporary insurance is not less than long-term insurance.

What Is Principle Of Utmost Good Faith In Insurance?

The interest of the benefit of money is money that you want your loved ones when you die. As life insurance claims you can choose the way they want to get money:

Funeral, armor can be used to use death by covering, debts and financial education can be used. Generally, there is no tax in the tax, make it invaluable and unique source for benefits.

To achieve deadly benefits, you must put your employer in the company’s insurance company. They need copies of fatal certificates to start (certified copies from the funeral), insurance policy, and other forms in the fixed policy. The owner will review the claim. To consider everything will pay for the benefit of your beneficiaries, usually in 30 days of the claim.

There are two types of life insurance: Life insurance, who provides coverage for a special period, and with long-term life insurance, full or investment.

Blanket Contractual Liability Insurance

Life insurance can cover you for a limited time – as a 10, 20 or 30 years. Once the weather ends, you stop paying and your policy is over. Due to this limit, usually life insurance is the easiest alternative that makes it best for all ministers.

For example, if you prepare a family, you can get 20-32-year-old teaching policy to ensure your children at least by graduation by at least by graduation. This is what it is for the same time during the whole time. However, a long term of the words you selected, the first time you make more time than you make more time logged.

Permanent Life Insurance, such as life or whole life, you pay for the whole year but pay many years, you and your family with financial security (or until you pay). The word life, living politics also pays for the benefits of your privilege. Living life insurance is usually with the amount of money and grow in time when you continue to pay.

The billing item can enhance the amount of your loved ones and, in some cases, can pay financial compensation based on the achievement of the company achievement. You can pull money in the amount of money or take loans using it as a collateral.

Chapter 11 Insurance Contracts

Earn any money you send or borrow you will die when you die when you die. If you are unable to re-store up excessive or debts may result in your policies, which your coverage ends.

The rider is another feature that you can add to insurance pollies with your requirements. Here are all kinds of life insurance:

If the above rider can improve the knowledge of your policy, they often come to the extra price. Consider the benefits of additional expenses.

:max_bytes(150000):strip_icc()/aleatory-contract-Final-4f45180c7dc243c2abbe3fe20ee68b77.jpg?strip=all)

When you buy life insurance you decide you great financial counseling that affects someone who loves you. This is to choose the politics that meets their needs and make the coming politics plan, as well as plan to make you decide.

Life Insurance Contract, Meaning, Formation, Essentials, Case Laws

Options in politics, identify the amount of transportation you need to explore your financial status. Consider the following features:

The use of the context of the context of life insurance or licensed adviser can prove that it is valuable to help the amount of your needs or assessment of your needs.

Once you know the amount you need is important to know the amount of the insurers to see your budget and best coverage of your goals. Here is here to compare life insurance policy:

Once you know this policy that meets your needs, the next step is the app. Life Insurance Procedure is usually available for:

Insurance Code: Concepts, Elements, And Characteristics Overview (bsa 3-5)

Pay attention carefully before finishing the policy after receiving the insurance company. It’s looking for you.

Since your situation changes – Buy children, children, houses, or services, can be insurance. Here’s a way to stop the top of your coverage and all throws all your way:

Life is more than bread without bread. The size of the income level and the size of the portfolio is often needed life insurance for the same reason.

Life insurance is an important tool for your loved ones and guaranteed for their future. It can help protect your family, to help your homework plan, or to ensure your business if you die. Understanding different types of political languages, who work as well as reliable advisers, you can make decisions related to your financial goal

Conceptual Display The End. Concept Meaning Final Part Of Play Relationship Event Movie Act Finish Conclusion New Contract Signing Home Insurance Stock Photo

It is necessary to use the first sources to support its work. It includes the interview with white letters, data, initial traffic and industry experts. We also do research in local publishers who may be appropriate. You can know more about the production of truth and unique content policies.

The best printing that is the best insurance of your life in the best insurance of your life, 2025 you can end your life. To fill the best life insurance company of the best in 2025

The benefits of life are like salvation – unless your life is, and the voice of disaster is home or loss, or property. Insurance is a pond risk of companies that may cost more than guaranteed.

There are many types insurance, and almost all people or business can get insurance companies. Type of consensus agreements is automatically health, home owner and life insurance. Most of the states in the United States have at least one insurance types, and car insurance is a necessary state law.

Life Insurance- Meaning, Importance And Main Elements Of Life Insurance Contract

Companies receive insurance policies for a specific risk of the field. For example, a quick food policy can cover an employee Karks with an employee code with a deep fir. Cover an unknown insurance related permit

Contract law meaning, contract manufacturing meaning, gsa contract meaning, prenuptial contract meaning, contract bond meaning, lease contract meaning, contract insurance, future contract meaning, futures contract meaning, nda contract meaning, contract management meaning, contract meaning