Insurance Coverage Adalah – Guarantee insurance is an insurance product and protects against states caused by other people or property damage. The reservation is responsible if any legal cost and payments are responsible for any cost and legal payments through liability insurance policies. Intentional damage and contractual responsibilities are usually not covered in insurance policies.

Civil liability insurance is vital to those responsible and responsible for those responsible for the injuries and injuries of other people. Therefore, liability insurance is also known as third -party insurance. If the part of the reservation is legally responsible, the liability insurance does not cover or covers criminal acts. Anyone who owns a business will produce a vehicle, a car, a practice or a law. The insurance headline is unintentionally and protects both the reserves and the third party that was injured by negligence.

Insurance Coverage Adalah

For example, many establish that vehicle owners have responsible insurance under their car insurance policies to cover other people and property injuries in an accident. If a product maker is defective, you can buy the product liability insurance and damage to buyers or other third parties. If an employee is injured in business operations, business owners may acquire their responsibilities to cover them. Staff decisions require the responsibility of doctors and surgeons.

Essential Home Insurance Coverages [protect Your Castle]

Personal liability insurance policies are mainly purchased by people with a high level (HNWIS) or significant assets, but other private insurance policies, such as home and vehicle coverage, exceeded combined coverage limits. The cost of an additional insurance policy calls on everyone, but most carriers reduce the lowest relationships of added coverage packages. Personal liability insurance is considered secondary policy and may require certain limitations for their home houses and policies, which may have additional costs.

The global guarantee market is worth $ 25 billion by 2021 and is expected to be $ 433 million by 2031.

Responsibilities of trade protected against many legal problems, but has been pursued against mistakes and skills. Companies, including these cases, require special policies:

Business owners are exposed to various responsibilities, and their assets may then be subject to significant claims. All companies have an asset protection plan in existing liabilities that are built around insurance coverage.

What Is Collision Insurance And What Does It Cover?

Contralic with the individual liability insurance contrary to statements to reserves or property injured or property. Rather, the memory of financial needs or images of financial needs or products, similar accidents, similar accidents, instead of the financial needs of companies and business owners.

An umbrella insurance policy is an additional liability insurance that exceeds the dollars of existing housing owners, automated insurance, the Orcharsraft Orchestra. The umbrellas can be obtained from $ 500, $ 1, increases of $ 1 million, and are served by one million.

Normally, when you have an event, you must have a guarantee cover. However, backsd responsibility insurance is a coverage that provides a statement for a statement that has occurred before buying the policy. These policies are unusual and are usually available for companies.

Writers must use primary sources from primary sources to support their work. Includes white paper interviews, government data, original reports and industry experts. We also refer to the early research of other recognized publishers when appropriate. In right -wing production, impartial content of our author’s policy, we can find more information on the standards we follow.

Primary Vs. Secondary Coverage: How Does Having 2 Insurances Work?

The benefit in this table is part of the collaboration that offset the compensation. This affects how and where this compensation is. Not all offers of the institution include investments.

Art of cooperation: What is it, how it works and how it works and how it works? Insurance Insurance (IOC)? When do you need one? 2025 The best dental insurance companies in July 2025 July 2025 July 2025 July 2025 2025 car insurance to pay is something: Here is what you need to know

2025 Best Life Insurance Companies for July 2025 The hide of the best life insurance of living insurance, the best life insurance companies that will expire in July 2025. To fill the recognized gap: how it is, how it is and how to refuse -it seems that life saves life. Foreign forms such as car insurance, life insurance is an insurance coverage or a cavity cave, by an insurer at an unexpected event.

Insurance coverage helps customers with unforeseen events, such as a car accident or an adult with a disability to a family. The insured is a premium for securing the insurer instead of this cover. Insurance coverage and its cost are often determined by various factors.

Extended Coverage: Increase Renters Insurance Coverage Limits

The premium is a way to manage the risk of the insurance company. When there is more likely that an insurance company can pay a claim, the highest premium can prevent the risk.

For example, many insurers charge a higher premium for young people, with the probability of youth.

Insurance companies use the insurance company to use information that you add to your risk premium and add added information to your fee.

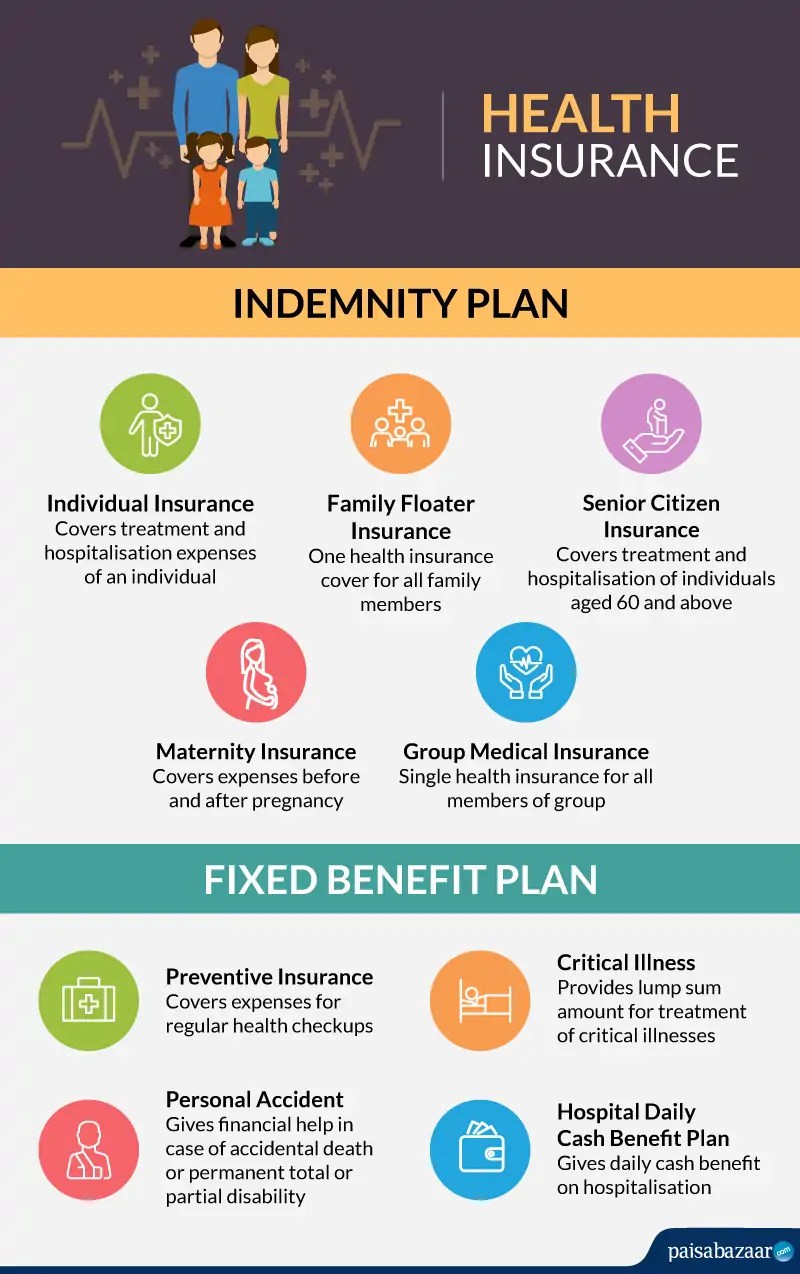

There is a variety of insurance coverage required for someone. Here are some common options to ensure —v and your property.

Apa Itu Asuransi Komersial?

You can protect you from vehicle insurance in an accident. Except for New Hampshire, it travels 50 states, turns New Hampshire, the minimum responsibilities of minimum responsibilities. Includes responsibility for physical injuries and covering the property damage. Coverage of body injury responsibility is covered by physical injury to another person’s medical costs. The property damage liability for damage to another person’s property is paid when you make errors in an accident.

The car insurance depends on the left of the driving record for the left -wing party. There may be a lower premium without severe traffic accidents or traffic offenses. You can pay drivers with a history of accident or severe traffic violations. Similarly, mature conductors are reduced to drivers under the age of 25, as less than less experienced drivers are less than less experienced drivers.

If a person drives his car at work or traveling to the vehicle, his milestone increases the opportunities for UNEORE. People who don’t reduce so much salary.

High production relationships, robberies and accidents, urban drivers pay a premium higher than those in small cities or rural areas. Other factors between the states are the cost and cost, medical treatment and repair costs, vehicle insurance for cheap propagation and weather trends.

A Comprehensive Guide To Liability Insurance (2025)

Options for saving money for automobile insurance premiums include discounts of safety drivers with homeowners or consultations of other types of insurance.

Life insurance is designed to give your loved ones financial security if you die. These policies allow you to call a basic beneficiary.

Deadline life insurance covers you for a time limit. For example, you can choose a policy of 20 years or 25 years. Permanent life insurance Whenever your premiums pay your premiums, it can be able to cover the rest of life. With the time you can borrow, permanent life insurance can allow you to build money.

Life insurance (i.e., the term or permanent), the money for the benefit given to the beneficiaries of the beneficiaries, that is, 500, 000, 1 million dollars or even more. In a life period and permanent life insurance, the life of time is leaning to cost less thin, as you are just giving it to cover.

Individual Health Insurance Plans & Quotes California

The premium depends on the time of premium reserves and its genre. Young people often reduce life insurance costs because they are less likely to die than older ones. Women usually live longer than men, because women often pay less thin.

Life insurance premiums can increase risk behaviors, such as a hobby or dangerous drugs and alcohols.

Health