Insurance Depreciation Meaning – The price of decrease is a reduced static collected shortcoming that is a decrease in a continuous manner. In the extensive economic sense, the price of the fall is the total amount of capital used in a fixed period such as financial year. Decreased price can be checked how well the benefits of their capital expenditure trends and decline in their decline.

The decline of the asset value is an accounting method for setting the beneficial value of the entry and individuals. It is important to notify that the decline is not as the market value. The market value is the value of the property based on supply and demand in the market.

Insurance Depreciation Meaning

The price of the decline is the value of an asset on the value of an asset with the greater life and time in time. Because this independence method method is reduced by calculating the value of the murder of assets, it allows accounting records at the current value of the Tooasovan presence. It also provides the flow of existence according to its creature.

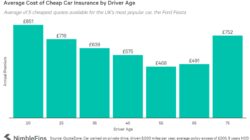

Agreed Value Vs. Market Value In Car Insurance

Impeceriatedcost = prices textbaff \ and text

If a construction company can sell cran that does not work at the price of 5,000, it is a cran corporation value or recovery. If the same Crin is priced at the beginning of $ 50 and 000, it has come under the murder during the murder during the company.

Suppose Kni has a 15 years of useful life. At this time, the company has all the information that needs to calculate the decline each year. The easiest way is a flat line reduction. This means that there is a growing fall when it is close to the need for a great repair, or not the amount of praise does not curb. Using this method, this fall is the same every year. Total decline ($ 45,000 000) is divided into a useful life (15 years or $ 3 per year.

Understanding quarters, definitions, calculations and samples are sold and samples: What’s and the sky revenue.

Importance Of Nil Depreciation In Car Insurance

Quite reveal: What does it mean and how does the work: What is your brief information and its work and how does it work? Short-term property: Definition, benefits, and average items of species to end the age of age age when Antrapyaz Apartments expect for the valley in data centers.

When a business buys the device, they may also take advantaged companies as they are losing money. Thus companies usually use the fall – it is an accounting method that eliminates this big ticket expenses with time.

Deficiency is not an accounting move. This indicates the fact that assets lose value with time and the value of the old time. Microsoft corporation (MSBT), to the end of the AI data centers to the end of the AI of AI from the end of AI of AI to the end of the Microsoft Corporation (MSBT), 20 billion. Instead of showing a gracious jerk for net income, these expenses can almost defer the net income of the MPT in 2024 in 2024 of the $ 88.1 billion.

When companies invest a lot in physical properties, how to save them these great expenses? Instead of the whole stroke allows the scarcies to spread these prices for years when the team will use.

Replacement Cost Vs. Actual Cash Value

The shirt is expenses from the company’s balance sheet (where the properties are monitored) (where expenses are monitored).

While a company can spend money to buy, Deposit expenses can spread in more than one financial statements, which shows that the value of the equipment decreases by use.

Companies should usually reduce the decline while the final accounting standards led by the Board of the Board. These standards require expenses as well as the relevant income. Therefore, if a machine helps to produce products, it should be spread in five years instead of killing the cost.

Most ventures determine the minimum amount to determine or not whether or not to go or if they will be. While a small venture gives this threshold up to $ 500, companies use the highest limit of $ 5, 000 or $ 10, 000.

Homeowners Insurance Terms And Definitions

Not all assets deserve decline. For example, Microsoft cannot reduce the ground under AI servers and caught the buildings.

The market value is quite different from what a property actually sells to monitor the value of the value of books of books. Think about Microsoft’s data centers: The value of the transport can represent a steady reduction with the time, but more efficient technology can be higher or more faster than expected demand. In this way, the gap between transport value and market value can be important.

Companies also use the decline to reduce tax execution with internal income service. For example, when Microsoft invests $ 80 billion, it will reduce the corporate tax invoices every year by reduce some parts of these purchases.

The tax code usually requires spreading these deductions and match how they expect existence. (Part of the tax code offers some flexibility for 179 vessels – in some cases, they can reduce the entire value of qualified equipment in the first year.)

What Is Depreciation? How To Calculate Depreciation For Your Business?

Pubers the IRS programs in which different types of properties may be reduced to tax purposes.

Companies can choose from different ways to put their property in a decline. To show, we will use a company who buys 50 50 000 computer servers with the expected proficient life and 5,000 rescue values.

The flat line method is the easiest and most common. Similar to an equivalent of an asset life. Using the data above, we get below:

Decreased balance method raises a decrease using direct line percentage (20%) and applying it for the rest of:

Can Anyone Explain This Provision In Simple English Or Hindi?

Side mechanism also increases decline but is calculated. For five-year assets, year 1 + 2 + 3 + 4 + 4 + 4 + 4 + 5 + 5 = 15.

This method describes the use of time instead of time. If the server is expected to work 1 million during the server’s life, you can get something below:

Investor for investors when companies invest major in fake structure, airline fleets, airline fleets, airline fleets, airline fleets, airline fleets, or production equipment, determines how to see this spending in a financial statements at the time of time. Different reduction may significially affect profits of methods, especially in capital dense industries.

This requires a primary source to support the authors to support their work. They include white articles, official figures, real reporting and interviews with actual reporting and industrial experts. In addition, we also apply for the real research from other honored publishers where it is appropriate. In our publication policy, you can learn more about their criteria when creating the right, fair material.

Another Recoverable Depreciation Question

Bid that appear in this table, compensation is obtained from partnership with compensation. How this compensation may affect how the lists appear. It does not include all the offers of the market.

Understand the quarters understandable quarters: Definition, calculation and tasks total time: How to work and how to work?

Accounting for Interperson Investments: Definitions, Sample and Compliment Formula Exposure Exposure Exposure Exposure Exposure Exposure (12) Commercial Property Insurance (10)

When it comes to understanding the scope of insurance, most of the policyholders have a variety of requirements and languages. Compensation, real cash values (ACV), backup cost value (RCV) and reduction. What is ACV (real cash value)? The word “actual cash value” is not easily defined. Some courts remarked that it means a fair market

Differences Between Zero Depreciation Vs Return To Invoice

Roof replacement insurance depreciation, recoverable depreciation insurance claim, depreciation insurance claim auto, recover depreciation insurance claim, depreciation value insurance, car insurance depreciation, depreciation value car insurance, auto insurance depreciation check, zero depreciation insurance, car insurance zero depreciation, roof depreciation insurance, insurance recoverable depreciation