Insurance Escrow Meaning – What is an account? The escrow account is a temporary account stored by a neutral third party (repository agents) that guarantees the buyer’s funds and only transmits them to the seller.

If both parties use the transaction properly, they receive their relevant wealth and resources. However, if something goes wrong, the money returns to the buyer. This provides security against fraud and ensures that the transaction ends according to a predetermined agreement. These accounts are useful for property, crypto actions, sales nail sales and business merger.

Insurance Escrow Meaning

For example, let’s say James wants to buy a vintage piano. To keep his money safe, he uses the reserve service provided by Tom. James transmits Tommy to Tommy, which keeps money until the piano reaches James. When James accepts the piano and confirms its satisfaction, Tom releases the media of Lily. This way, James’ money is safe until the piano is received, and Lily knows that James will receive money when happy with a deal.

What Are The Parts Of A Mortgage?

Georgia Wilms wants to buy a home in Houston. It received the relevant property listed to the seller from AUST Stein Brown. Both Georgia and Aust Stein want to ensure that they have an easy deal. Thus, they decide to open a reserve service account for safe transfer to the transfer of funds.

Georgia and in stin agree on important aspects of the transaction, such as the initial cost of the house, the details of the property, etc.

In Stein sends all the necessary documents to Georgia, such as its innovation, any known problems, conditions, etc.

After investigating Georgia AUST Stein, the two are discussing any concerns and finally the final price of the house is 20 320,000.

Escrow” And Its Multiple Meanings

Georgia Houston is connected to the Reserve Services and opens the reserve account. It and in stin provide the necessary information, such as the procurement agreement they created, their financial data and other basic documents.

Houston reserved services are studying property to ensure that it has no legal disputes, debt, etc. and legal ownership is in AUST Stein.

After all inspections by the Escrow Service Team, Georgia transferred the amount of 20 320,000 at the expense of the reserve.

In the next few days, Georgia and Aust Stein will work to implement their agreements. While Georgia transfers her home insurance to a new property, AUST Stein works in all the latest innovation in the home.

Why Netting Your Escrow Account During A Refinance Can Be A Smart Move

When the two set all the terms in the agreement, Georgia and AUST Stein sign the final closed documents. As soon as Georgia is tied, the reserve company sends 20 320,000 to AUST Stein, and the deal ends.

Step # 1. The buyer (customer) or seller (beneficiary) agree to the temporary account for the transaction process and determines the status of other values and other procurement.

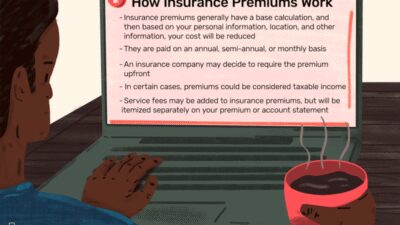

Step # 2: After finalizing the purchase agreement, find the correct reserve agent, they select the background agent, an independent agent, bank or insurance agency.

Step # 3: Open storage account escrow agent opens an account such as the buyer and seller’s names and addresses, property costs, information, information and any down payment.

Understanding The Mortgage Escrow Process

Step # 4: After all requirements and conditions sign the escrow agreement, the parties sign the agreement, especially the “stored agreement”. The contract also includes a service fee of a reserve company.

Step # 5: Get account details background, then keep the parties backup account details. The parties must keep it safe and use it to get any updates with agents.

Step # 6: Deposit the buyer then transfer to the account with the funds. This step ensures the security and transparency of the transaction.

There are many types of backup accounts available for different targets and benefits. Here are the most common types.

Escrow Out Of Cycle Analysis

# 1 real estate reserve. In the case of real estate transactions, the Reserve Service account keeps the buyer’s media, unless the seller does not meet all the terms and conditions and transfer the property to the buyer.

For example. Let’s say Mike wants to buy a house. Mike and the seller, Kelly, agree to use the reserve, and keep the purchase amount at the expense of the reserve. The escro funds until Kelly does all observations of the home, innovation and other necessary processes. Then Kelly moves ownership of Mike’s property. When Kelly and Mike meet all the terms, the “SCCOMED” company sends money stored by Mike.

Sell # 2 Online Neline Escrow. Escrow accounts are a safe remedy for transactions Neline transactions, especially for e-CE Mars. It ensures that the buyer gets the product as described, and the seller is paid when the buyer is satisfied with the product.

For example. Suppose the jewelry goes from the Sel Sel Naline seller, but it is concerned about the condition and honesty of the product. Sarah keeps money for a safe transaction. After Sarah gets the jewelry production good and safely, the reserve agent publishes this tool to the seller. In this way, Sarah and the seller can trust the justice and security of the deal.

When Does Escrow Open And How Does Escrow Work?

# 3 Construction:

For example. Gary is a contractor for resetting an old house, who needs a lot of money. Thus, Gary borrows from the bank, barley and bank from the bank. Gary notes that he will demand funds at each stage of the program, as he will complete the project in several stages. The bank considers the total amount of cost, but the agent only relieves the funds when needed at each stage of the Gary. In this way, the barley effectively manages the financial side of the transformation program, and the bank is confident that the funds are secure.

# 4 Mortgage Reserve. The Mortgage Reserve is an agreement between the NDER’s Mortgage Nder, the or two -borrower for the monthly mortgage payment (payment money). The loan saves a portion of the amount as the main and interest and pays on behalf of the remaining property, insurance, etc.

For example. Matthew (borrowing) has received a mortgage loan to buy a house. They define a mortgage reserve account where the mathematical loan pays monthly to pay. Emily uses Do-Monthe Fees for Property Tax, Insurance Premium, Home Association Fee, etc.

What Is Mortgage Escrow?

# 5 Business Edit: Small industries often use this account during merger and achievements or to keep some purchase price.

For example. When two or more companies decide to make a merger or acquisition transaction, they include a significant risk. So to protect their funds, assets or titles, they can create a reserve account. Therefore, the reserve agent will release the funds only after merger or achievement in accordance with the terms of the contract.

Although special rules and rules may change based on the country and merit, there are some general principles and guidelines that usually apply to reserved accounts.

Answer: A reserved account in the bank is a special account created by the LE Paine for covering property costs. The borrower pays a monthly mortgage payment in that account. When payment is pending, the lender uses this amount to pay monthly property taxes, insurance and other payments. In this way, the LEers provide timely payment and financial security for both parties.

M&a Holdbacks And Escrows

Answer: At the expense of confidence and reserve, the owner remains money by the third party, and the medium only releases the fulfillment of all terms. The difference is for the account. Trustees manage funds for confidence and highlight these funds on special situations, as a minor reaches a certain age, marriage or family. On the contrary, there is an independent and impartial account between a reserve account buyer and seller, mainly in real estate transactions.

Answer: The interest rate of the repository account depends on the rules and agreements. This will add interest or account balance or live in a bank / cash company. It depends on the terms and conditions of the contract.

This article explains what a reserve account is, how to open it, its types, copies, rules and benefits and examples. You can visit the following links to read the article: The escrow account is a temporary legal organization between the two parties, where the third party keeps the financial payment. A third party is usually a bank or a reserve agent. Having an escrow account reduces the risk of non -payment.

It’s a temporary account that only works at the end of the transaction. All terms between the buyer and the seller are controlled, the account is finished. EsWrows usually requires a credit-value document. These documents can be legal equipment, cases, written equipment, promises

Reverse Mortgage Life Expectancy Set Aside (lesa) Explained

Escrow account meaning, escrow mortgage meaning, in escrow meaning, insurance escrow account, escrow meaning, escrow taxes insurance, insurance escrow, escrow hazard insurance, insurance escrow mortgage, escrow loan meaning, homeowners insurance escrow, escrow flood insurance