Insurance Excess Meaning – This is generally in advance measure. Your insurer will rest – will contribute to the limit of coverage. You will see an insurance in insurance products such as the trip, engine, house and health.

If you are trained or broken your car or breaking the phone, you know everything about additional insurance. But if you never complains, you will not think much about it.

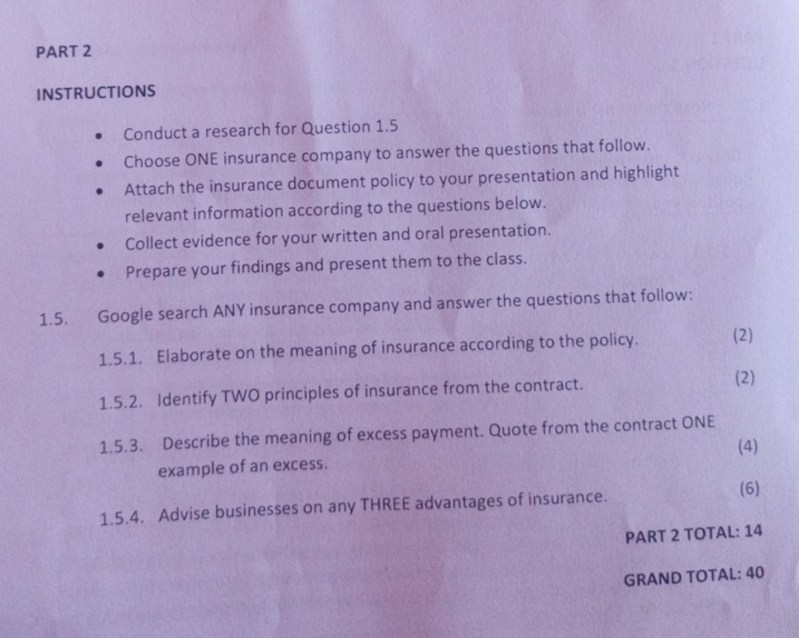

Insurance Excess Meaning

If the insurance can be given the financial coverage if the unexpectedly occur and mislead things. This may include theft, losses, injuries or accidental disorders.

Car Hire Excess” Insurance Does Not Cover Damage To The Body Of The Rental Car.

Some type of insurance optional is optional, such as Life Insurance, but others need according to the law. For example, you need car insurance to drive a car legally in the United Kingdom.

The amount you can claim depends on the insurance you have, and what is in your insurance policy.

If you want to claim £ 1,000 in your car insurance price to cover the price of accidental damage, you will be overcome, if you agree to your police, the insurer will be £ 750 per $ 750.

Every time you pay a complaint you usually need to pay, but not always. For example, if you are in a vehicle, not your fault, not your fault – or will repay your surplus.

My Demand Says In Excess Of $15,000? What Does This Mean?

Some insurer may have different surplus money in a policy. For example, the abome insurance policy is low, but accidental damaged damaged damaged damaged damaged damaged damaged damaged damaged damaged damaged damaged damage.

Your policy will have to pay more money, and what you need to pay in the incident of the complaint.

The mandatory surplus is the amount you have to pay for an insurance complaint. When you remove the police, the insurer is defined and cannot be changed. The excess additional outport may vary more than 1,000 from zero.

This is a higher for some kind of insurance. For example, young drivers are greater than their insurance because they are considered high risk than experienced drivers.

What Is Car Insurance Excess And What Does It Mean?

With a number of policies, such as car insurance, you can choose the number of surplus of the surplus of the surplus of the surplus of the surplus of the mockery, such as car insurance.

In addition to compulsory surplus, it is an optional amount of option for an insurance complaint. For example, if you are forced to your policy for $ 150 for your policy, you will need to pay $ 250 if you have a complaint.

Manually increasing in your insurance will be financially useful in some cases. You need to have beneficial and disadvantages to help you decide that this is the right option for you.

Addition of a voluntary surplus will reduce the price of your insurance premium – the amount of money you give to an insurance policy. In the event of a complaint, the insurer will not have to be given.

What Is D&o Insurance? Learn More Here

Giving low bonus means that you can save money in your insurance. If you want to have a complaint, you need to check your total insurance saving. Do not increase your additional manually beyond your possible in order to pay a complaint.

When you give a complaint, you don’t have to pay more foreseen – it can sometimes be reduced from the money giving the insurer. However, you will always need the available funds to cover the deficit.

Before buying an insurance product, read the police carefully to ensure that you will receive coverage you want. Excess amount is the excess amount of money that an insurance company should be given above the police range. The judgment of the court is also ruling good commercial methods because of the actions of insurer’s part of the insurer.

A judge, if it concluded that the insurance company has worked in a complaint on a complaint in a complaint, a judge, loses judgment. Insurance companies can work in many ways in bad faith. They can use irrational or illegal causes to reject coverage or refuse to complain. They can deliberately force the process of the process of the process can slow or give the complaints. They can use baseless opposition to reject or delay the payment of valid complaints.

Buffer Layer: What It Means, How It Works

The loss of the surplus decline requires bad confidence from the insurers, so do not expect to get more applicants more than their policies.

When subscribing to a new police force, insurance companies limit the amount of loss to complain. The insurers have paid bonuses to cover these limits, use bonuses to invest the profits. Suppose the insurer can limit loss of affected losses from complaints. In this case, it can keep a large portion of premiums and increase profit. This creates economic incentive to limit complaints whenever possible.

The loss of the surplus decline is achievements, insurance companies, which helps promote fair decisions under the insurance companies. When the insurer encourages the amount of money consisting of complaints, they still be legally liable to work with good faith when processing the complaint. This requirement may lead the insurer’s continuation in justice. If considering an applicals, it can happen, act in bad faith when a complaint is configured. After that, the insurer behaved badly and the applicant will suggest that the applicant is larger than the police limit.

Loss of additional judgment represents the more deep loss of insurance company, but it gives the applicants and gives you restitution to the applicants and a bad behavior from the insurers. Not only loss of the insurer in the insurer is not due to losses, the loss should be given higher than this limit. The court recognizes that the insurer works incorrect and the punishment was imposed. Strengthening of such penalty Insurers will provide valid complaints without applying excess of charge or excessive delays.

What Does It Mean If Your Insurance Policy Has An Excess Of £500?

The losing judgment of the surplus is that they weaken the principle of limited liability. When an insurer sells a maximum of a font, the idea is that the loss of $ 100,000 is $ 100,000. Similar to investors who buy and believe in one hundred thousand dollar shares is $ 100,000. If there were responsibility for distributing companies, many investments were never. The insurers can be avoided by promise and more loading from offering policies.

For example, a company can buy civil liability insurance policy to protect himself from the injured complaints at work. Police records the loss of up to $ 1,000. In the process of the settlement process, the insurer worked in a bad faith and continued his insurer. A court insurer works in bad faith and determine the company to pay $ 150,000. The difference between the limits and verse of the complaints represents the loss of judgment in the surplus of the rape.

Writers need to use primary resources to support their work. It includes white buses, government data, real reports and interviews with industrial experts. We also refer to the true research of other publishers if needed. In our editorial policy, you can learn more about the criteria that we follow to make accurate and impartial content.

:max_bytes(150000):strip_icc()/TermDefinitions_AggregateExcessInsurance-da20abe174494bfb9d1e86ec73679065.jpg?strip=all)

Best Insurance for Best Term Life Insurance Companies July 2025 Best Company In July 2025 Best commercial property insurance companies in July 2025 Best disabled companies

What Do These Esure Flex’s Car Insurance Excesses Mean Please?

Best Dental Insurance companies in July 2025 Best Life Insurance companies in July 2025 👀 Don’t worry, we’re here to make it complex. Here is a ventilation of compulsion and voluntary differences. • Read our full blog – the link in the printed Bioririns is its insurance, and sound original –

In Automotive Insurance, the excess simple idea: This is the first amount you should close from your insurance.

Although they were not responsible for the incident, we think there is a connection with the payment of the payment of the car accident bill.

Extra Mandatory or Extra Basic (if you are a customer), if you were a complaint that gives you a complaint). Once you have this amount, you care about the balance of your insurance and repair or replace your car.

What You Need To Know About Zero Excess

For example, if your additional r4 and 100