Insurance For Veterans – All Corporate Rescue Insurance (SSGLI), Family Life and Veterans Insurance Groups) will have a highly effective discount in July 2025.

Parliament has adopted a special dividend for veterans they have or no life insurance company has spread for over 30 years. These rumors are false and sometimes used to deceive veterans. Read more about “Special Divid”

Insurance For Veterans

Wan wants to prepare its members of the veterans service and their families for lifelong financial security and promote their financial well -being. Life insurance is an integral part of that security.

Veterans Auto Insurance: What’s Most Important To You?

Valefe life insurance became January 1, 2023 and offers full life coverage up to $ 40 to a veteran with a communication problem. Know more about the amount of money that has never increased $ 10,000. Under this plan is effective in enrollment in two years.

Life insurance of Cortimembers is a low -cost life insurance program for servers. The coverage can be extended up to two years if the service is completely disabled to break down. Discover the difference between guarantees, life and whole. SGLICOVICES automatically for the training, ready and members of the most active National Council, the Life Insurance Group of Madclenmen. Veterans Insurance Group allows veterans to change their SMLI to the civil coverage of recurrence life after dealing with the service. Know more about the difference between life insurance and the set. VGLISERVEMMERS with full -time insurance with the right to convert the SMLI into VGLI after breaking the service. More information about veterans’ life insurance. Family life insurance (FSGLI), a Sgicememers, a couple and sons of SGLI insurance. The spouse’s coverage may be nothing more than the magician’s coverage. Dependent children are automatically covered for free. FSGLITERM life insurance is automatically offered to the Insurance Spouse Spouse and the dependent child of the insurance guard under the life of family life insurance. The prevention of injuries of the service injury is the automatic characteristic of the services, which have suffered a blind loss by Seril.

Veterans insurance (VMLI) offers a defense of the lives of people with disabilities who are approved for Va House.

Service Service Service Insurance, Automatic Automatics, with Automothers cars, with full -time registration systems should use SGLI instructions. To access Soes, visit www.milconnect.dmdc.oll/Milconnect/. Members with part -time insurance or not to get the seeds should be used 8286 to make a shli change.

Life Insurance Benefits For Veterans

Family life insurance (FSGLI) The Services Recipient should be used, so you should use silk to reduce or restore FSGLI coverage. To access Soes, visit www.milconnect.dmdc.oll/Milconnect/. Members who cannot afford to obtain the seeds should be used 8286A to make a change in FSGLI coverage.

The prevention of injuries of the person’s terrorist trauma injury. To file a complaint for TSGLI benefits, complete and submit this veterans document, we want to recommend to some veterans who can buy life insurance.

We have chosen five companies that are highly recommended for the veterans of the United States, which provide different policies to meet different needs:

Recognized as the best option is the life of violent veterans, violent veterans stand out for their appropriate policies for military members and veterans. They have a strong reputation for customer service.

Specialist Travel Insurance For Veterans

Right to the right: Vegi is available for veterans with maintainer insurance policies while in the army. After leaving the military military, two years ago of windows and 120 days to request VVV without answering health questions. However, if the new endinger applies after the first 240 days of the next service, they must answer health questions.

Safe: VGLI offers lifelong coverage as long as the premium is paid. Veterans can choose the amount of coverage up to an increase of $ 10,000 up to $ 400,000. The amount of coverage may be equal to or less than your amount when they are.

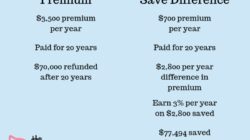

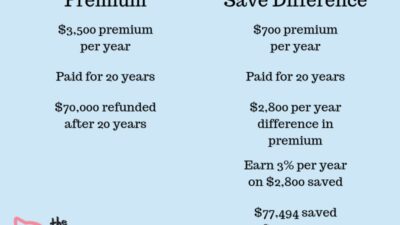

Premium: The cost of the price of the pre-preremium depending on the age of the veterans and the number of coverage they choose. Primal rates increase as insurance veterans are higher. The normal premium is higher than the SGLI, which reflects the transition of active service members to the state of veterans and increased age.

Changes in business policy: Veterans with VGLI have options convert their policies into private life insurance policies with companies involved at any time. This option can be valuable if you have a veteran to find a policy of different conditions or benefits.

Overview Of 100th Anniversary Of Va Life Insurance

There is no health question for the first candidate: If veterans practice for 240 days of military, they do not need health problems to achieve health problems to get health problems to get health problems.

Online Monitoring: Veterans can manage their VGLI policies on the Internet, including paying special payments, updates the recipient’s information, and controls their coverage.

The benefits of death: In the event of the death of the VGLI, the owner of VGLI policy owners does not offer tax -free benefits for beneficiaries. The amount of profits is equal to the number selected by the veteran.

Viji is a valuable choice for many veterans, especially for good health that can be difficult to get life insurance elsewhere. Provides direct SLLI changes with the additional benefit of Dominion coverage. Veterans believe that VGLI should evaluate individual insurance requirements, especially when they are in terms of age, age and financial goals. Learn more here.

Best Veterans And Military Car Insurance In 2025

The company is recommended for the best life insurance offered by a policy that offers a lifelong insurance policy and can create cash value over time.

New York’s life is one of the oldest and most famous US insurance companies in the United States, offering many products, including a particular benefit from veterans. This looks more closest than they offer:

Veterans believe that New York’s life should evaluate their long -term financial needs and insurance needs. All the life insurance of New York’s life is not just the death of death. It is a financial instrument that can play an important role in the general strategy of the financial plan of veterans. Learn more about New York’s life for veterans here.

AAFMAA highlighted to offer best -term life insurance, which is usually affordable and limited.

Best Military Car Insurance: Companies And Discounts [2025]

AAFMAA is not a non -profit maritime association, a non -profit member, financial services and victims of the Community Association of the United States Armed Forces. This is a detailed aspect of what AAFMAA special provides life insurance:

For families, veterans and military families who consider AAFMAA life insurance offers a solution that qualifies in the deep understanding of the military lifestyle. Their range of products along with financial assistance survivors and financial services become a complete option for those involved in the armed forces. Learn more about Avada Here

Known as a long history of serving military members since 1963, the United States has been elagrated by a better financial qualification and advanced services. These are the most important options among members of the service member for life insurance.

The US National Association (United States) is a highly considered financial group of financial services that is particularly obtained for military members of veterans and their families. This is a deep look at the United States offer, especially in the life insurance sector:

What Insurance Is Available For Veterans With Mesothelioma?

US sacrifice to meet the needs of the military community, along with other financial services, and other financial services make it a popular choice among members of their veterans and family members. The understanding of their specialty of the challenges and lifestyle of the military personnel, adding their own layers of customization and relevant to their offer. Learn more about the United States for veterans here

Valife is a problem that is guaranteed to offer the amount of the amount from $ 10 to 40 to $ 40,000.

Veterans insurance is a program that is specially designed to meet the life insurance requirement of US military veterans. This is the main look of Great:

Valife is a valuable choice for veterans, especially for those who can have difficulty insurance through traditional channels due to their health conditions related to their services. It offers a way for veterans to ensure financial protection for their families, recognizing and facilitating the only devotion and obstacles that those who served in the Army. For more information, visit here

Dental Insurance For Veterans

Those are our tops