Insurance Ka Meaning Kya Hota Hai – Introduction to insurance. The importance of insurance Insurance is a compensation agreement, on the basis of which the insurance company or the insurer agrees to pay a little.

Presentation on: “Introduction to insurance. The importance of insurance Insurance is a compensation agreement, on the basis of which the insurance company or the insurer agrees to pay certain.” – Transcription of the presentation:

Insurance Ka Meaning Kya Hota Hai

:max_bytes(150000):strip_icc()/insurance_claim.asp-final-ad2bc2c60d5c46e999bf064a90ff2dc6.png?strip=all)

2 The importance of insurance Insurance is a compensation agreement, on the basis of which the insurance company or the insurer agrees to pay a certain amount of money to compensate for the loss caused by the occurrence of an uncertain event in consideration of specific periodic payments, that is to say contributions.

कर्मचारी राज्य बीमा (state Insurance) से सम्बंधित क्या,कैसे और नियम व कटौतियों सम्बंधित सभी जानकारी यहाँ पर।।here, All Information Related To What, How And Rules And Deductions

3 Insurance definition Insurance can be defined in two ways: Functional definition. Legal definition.

4 Functional definition “Insurance is a cooperative device to spread the loss caused by a specific risk in relation to many people exposed to it, which agree to guarantee this risk”. _PROF. R.S. Shame

5 Legal definition “Insurance is a contract in which the sum of the money is paid, ensuring that the insurer has the risk of paying an amount high to a certain emergency.” _CIF Justice Tindal

6 Insurance functions Offer and acceptance. justified objects. Contract. consideration. Cooperative device. Protection against financial risk. Good faith. compensation agreement. Tax of certainty and bankruptcy. Insurance is not a gambling. Inwarding. Insured interest. Insurance is not appointed as charity.

Crop Insurance Problem

7 Insurance functions The insurance functions can be divided into three categories: Basic insurance. Secondary insurance. Other functions.

9 secondary functions Provides capital. Increase performance. It helps to evaluate the profitability of the main projects. Insurance helps to reduce losses.

10 other functions Economic development. extension of foreign trade. provides investment funds. Encourage savings. Check the inflation. car -fiducia and good will. Social insurance. credit devices.

12 Life Insurance In 1536, Richard Mortin issued the first policy on the life of Williams Gybbon. In 1696- Mercer was founded. In 1698, “Hand in Hand Society” In 1721- Parliament adopted the law. In 1818- The first foreign company, or the approximate company was in India. In 1829 “Madras Equitable Company”. In 1956- mainly the Indian companies ended a joint venture with foreign companies to conduct life insurance together. Some of them are: HDFC Standard Life Insurance Co. Ltd. Max-New York Life Insurance Co. Ltd. SBI Life Insurance Co. Ltd

Insurance Terms Meaning Difference Between Sum Assured And Sum Insured In Hindi

14 General insurance companies such as New India Insurance Companies Ltd. Oriental Fire and General Insurance Company Ltd. National Insurance Company Ltd. Riliance General Insurance Company.

15 The details of the general insurance are the following real estate insurance (fire insurance and maritime insurance) Civil liability insurance (theft, loyalty, motorcycle and machine insurance)

16 The importance of insurance The importance of insurance can be studied under four heads: important for the individual Importance for companies Importance for trade and industry Importance for society.

17 Importance for the individual Insurance guarantees security. provides tranquility. Delete dependence. It serves as a source of savings. Life insurance as a reasonable investment. protects the mortgage. Other (family needs, old -age needs and so on)

Insurance: अगर आपका भी इंश्योरेंस क्लेम हो गया है रिजेक्ट! तो अब क्या करें?

18 Importance for companies Financial assistance. reduces the uncertainty of corporate losses. improves performance. compensation. Recognition of credit devices. Continuous business. Safety of employees.

19 Meaning for trade and industry Economic development. gain the exchange of currencies. source of capital creation. source of income

20 Meaning for the company Protection against the wealth of society. Economic growth. standard of life. Social insurance benefits. Just loss of loss. Removal of social evil. accelerating the production cycle. reduced inflation. huge funds.

21 Insurance as a social insurance tool Security and safety. Peace of mind. Encourage savings. Provides investments. meets different needs. It helps to reduce losses. Increase performance. Increase the loan. control of the inflation rate. Trust work.

Insurance Meaning In Hindi

22 Economic Insurance and Development Report between insurance and economic development. Impact of the impact on E.D. Investments necessary. huge funds. accelerating the production cycle. risk protection. promotes foreign trade. promotes financial stability.

Download PPT “Introduction to insurance. The importance of insurance Insurance is a compensation agreement, on the basis of which the insurance company or the insurer agrees to pay a little.”

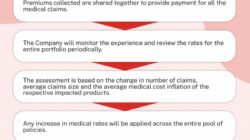

In order for this page to work, we register the user’s data and provide it with processors. To use this site, it is necessary to accept our privacy policy, including a cookie policy. The insurance is defined as the process of transferring risk by the owner (activity) to the insurance company in exchange for the insurance premium. Insurance is a financial agreement between the insurance company and the insured party, in which the insurance company provides financial protection or reimbursement to the insured in the event of losses suffered by the insured due to damage to the activities insured in certain circumstances. In exchange for financial protection, the Insured pays an insurance company a certain amount known as the insurance premium. Insurance is a form of risk transfer. In the insurance, the person or organizations transfer the risk of an insurance company in exchange for an insurance premium. The insurance company, in turn, combines the insurance premiums of many insurers to cover the losses of few who suffer losses

The insurance works on the collective concept of the customer. Insurance companies collect insurance premiums (insurers) and the companies in turn promise to return the insured in case of losses they have undergone due to specific dangers. Insurance is therefore an agreement in the distribution of losses caused by a specific risk in relation to the pool of people exposed to this special risk. Insurance companies act as an intermediary to collect a group of people on display at a common risk.

बदल गए नियम, बीमा पॉलिसी सरेंडर करने पर अब मिलेंगे ज्यादा पैसे, रिटर्न और एजेंट कमीशन पर भी होगा असर

Consider the example of a factory owner who is exposed to the risk of fire damage to his factory. A fire accident in a factory would mean losses of rock crown due to damage to plants and machinery, wrestling, buildings, etc. In this way, the owner of the factory would take preventive measures to guarantee his factory against fire -fighting accidents. In addition, the owner of the factory will also ensure when acquiring an fire insurance policy. The insurance policy will refund the insured for any activities insured by damage due to related fires and threats.

When purchasing an insurance policy, the owner of the factory protects itself from the risk of damage to the factory due to a fire accident

General insurance, also known as non -life insurance, is a contract between a general insurance company and the insured, in which the insurance company grants insurance compensation for damage to insured assets due to threats. All insurance policies except for life are classified as general insurance policies. General insurance applies to non -human activities, such as factories, car, load, etc. General insurance is also known as property insurance and victims in some countries.

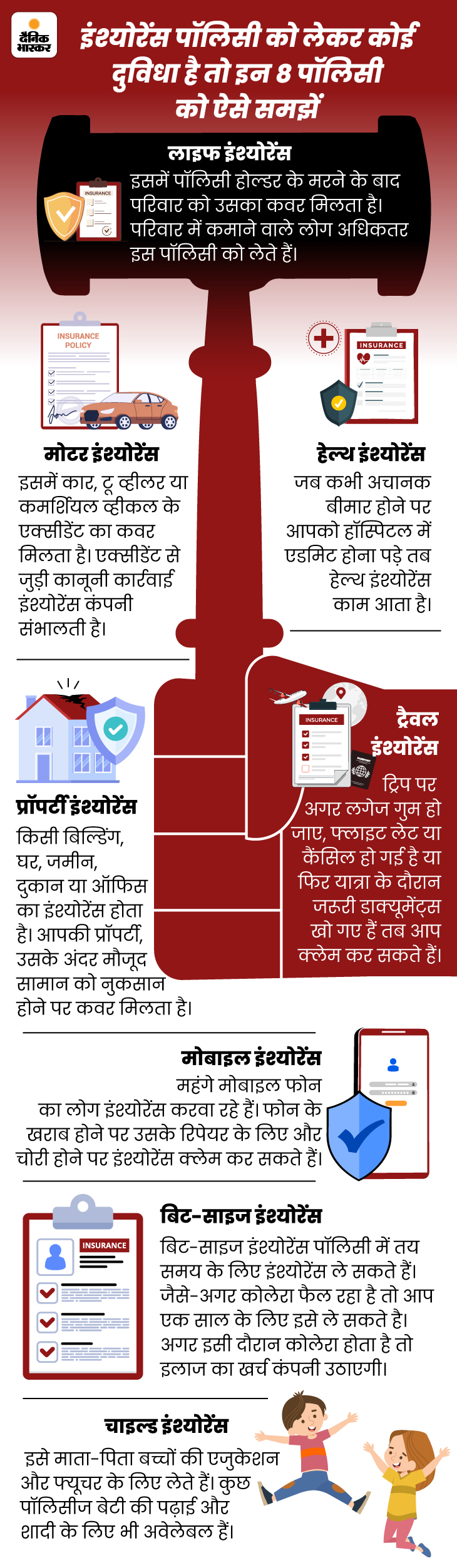

Various types of general insurance policies are available, which include several risk exhibitions, which are the people and companies listed below:

98% Of Women Believe, Health Cover Should Be Woman Centric, Know How Much Power In Women’s Special Health Insurance

The health insurance policy provides a protection of hospitalization costs of the insured person supported due to diseases or injuries. Politics also provides insurance for expenses before hospitalization, pre -excussion procedures, Ajush treatments, etc.

The engine insurance policy provides protection for accidental damage to the insured vehicle, as well as legal obligations suffered due to injuries or damage to the properties caused by third parties

The travel insurance policy is a protection of medical expenses that may arise due to diseases or injuries of the insured during the trip, as well as various unexpected accidents that can occur during the trip.

The fire insurance policy provides protection for the loss or damage of insured activities due to allied fires and dangers. Politics includes the costs of repairing or exchange of damaged activities and properties.

कंपनी से मिले Health Insurance के भरोसे रहना कितना सही? 5 Points में जानिए खुद की पॉलिसी होना क्यों है जरूरी

The computer security policy protects the insured company from financial losses and the obligations of third parties supported after the IT attack or the accident in violation of the data

The general commercial insurance policy for civil liability, also called the CGL insurance policy, provides insurance costs and compensation incurred by the insured due to the damage to the body or damage to property, which third parties have supported due to accidents deriving from the commercial operations of the insured company or due to the consumption of products of the insurance company.

The insurance policy from liability for the product protects the company from the legal liability deriving from complaints relating to body injuries or damage to properties to third parties due to the consumption of the products of the insured company.

The insurance policy of public liability provides a defense and compensation protection, which the insured company is legally subject to payment due to injuries or damage to properties, which third parties have undergone due to accidents in the insured business room.

Esi क्या है? कोनसे कोनसे Employee को Insurance मिल सकता है?

Responsibility for directors and officials

Ssn ka matlab kya hota hai, email address kya hota hai, postal code kya hota hai, domain name kya hota hai, stalking ka matlab kya hota hai, kya hota hai, pyar kya hota hai, commerce ka subject kya kya hota hai, nri account kya hota hai, zip code kya hota hai, broker ka kya kam hota hai, freelancer ka matlab kya hota hai