Insurance License Meaning – An independent expert is considered independent because it cannot be employed directly by the company, the company or the organization, but from a third party specializing in owners or other types of insurance complaints. An independent expert adjusts complaints on behalf of the insurer, but not directly as an insurer employee. When he is in line with a third party, the insurer essentially entrusts the complaint and process of adjusting a complaint management company, which then gives it to one of their experts.

The owners’ insurance will cover you in a series of damage they have suffered, such as a storm or interruption damage. If you have to file a complaint on the insurance policy, a complaint will adjust the damage and legality of the complaint to the insurance company.

Insurance License Meaning

Two types of experts will generally make an inspection, either public or independent expert. An independent expert seems to be the most beneficial for the owner, but the distinction between the two experts is often misunderstood.

How Road Rage Can Affect Car Insurance Rates

Experts according to experts in accordance with the state’s license requirements in which they perform their work. They can work as 1,099 independent businessmen or W-2 employees. They are generally recruited for one of the two main reasons – a large volume of complaints and / or legal reasons. During natural disasters, the number of owners’ requirements is significantly increased.

For example, in 2012, Hurricane Sandy destroyed significant sections of the Côte du New Jersey and New York, severely destroyed more than 340,000 homes. Consequently, the owners’ insurance companies have seen a top in complaints.

Insurance companies often do not have human resources for type authorization and will therefore hire independent experts to facilitate their workload. An insurance company can order a third insurance company to negotiate and evaluate the cases on its behalf. The nature of this type of work also emphasizes the use of independent experts in remote or highly specialized areas. Examples of this could be a cottage in the mountains or damage caused by a rare animal that is not often observed in most insurance complaints.

In many cases, the rules of a particular state or the provision of a specific insurance contract will also impose the use of an independent expert. This is something to take into account when you buy owners’ insurance and the comparison of different insurance companies.

Participating And Non Participating Life Insurance

However, independent insurance experts are not your only choice. If you want your own procedure management expert for you, there are public experts. Public experts only work on behalf of the owner and do not represent an insurance company in negotiations.

If you have a home, it is useful to understand when an independent insurance expert may be necessary. For example, let’s assume that a severe storm causes a tree that is owned by your neighbor in your backyard, destroying the fence and part of the roof of your home in the process. Submit a complaint with your insurance company and your insurer contributes to independent expert insurance.

The insurance expert will visit your property to evaluate the extent of the damage and take photos. They can also talk to you and your neighbor to discern what happened. Once they have left your property, the insurance expert can consult professionals in repairing the fence or roof to determine the repairs will cost.

Once they gather all the necessary information, they will draw it on a report and present it to your insurance company. The insurance company may then consider the report and determine the quantity to be paid for your complaint, depending on the evaluation of independent insurance insurance.

Auto Insurance Guide

An independent expert does not represent the owner. If a owner needs his or her own representation, a pubic specialist can be the best choice.

Public experts will carry out their own home compensation ratings and the insured person may submit the report to their insurance company. While, theoretically, the expert from the public exposure has the best intentions of the owner of politics in mind, always know if you hire one. The inexperience of a owner and the specialty of an adaptation create the opportunity to handle. The same is true for independent experts and the world insurance company.

One advantage for owners who use public experts is that, similar to insurance lawyers, public experts receive a recovery committee. In other words, they are paid only if you do, which encourages them to work in your interest. Their payment comes from any money you receive from payment of insurance. Public experts are also hired to evaluate the work carried out by the independent expert to guarantee that the corners have not been cut and that the owner receives as much as they can.

If you always believe that your insurance company must be more than it is ready to pay, you may need to hire a lawyer to continue a civil complaint.

September Is Life Insurance Awareness Month!

Understanding the definition of an independent expert is vital to your termination process. An independent expert represents the owner in some way. The independent regulator probably represents the insurance company. If you prefer to have your own representation, using a public expert can be a good idea.

It requires the authors to use primary sources to support their work. These include white buses, government data, original reports and interviews with industry experts. We are also referring to the original research of other publishers considered, if necessary. You can find out more about the standards we follow about producing precise and impartial content in our editorial policy.

The bids displayed in this table come from corporate relationships from which they receive remuneration. This fee may have an impact on the way the announcements appear. Does not include all offers available on the market.

Intercession Agent: Role and Responsibility for Insurance Subscription: Importance and Examples Cluse Incharee: What does this mean, how Ceding Company works: importance, advantages and excessive types of police holder: What is and how it works in the American Land Title clause:

What Is An Agent? Definition, Types Of Agents, And Examples

Clean amount at risk: What is and how is the premium to excessive proportion: what is, how it works and significant worksaninsurance brokeris a professional acting as an intermediate between a consumer and an insurance company, helping the first to find a policy that best meets their needs. Consumers of Insurance Brokers, Notinsurancesuppanies. Therefore, they cannot connect the coverage to the insurer’s name. This is the role of insurance agents, who represent insurance companies and can make insurance sales.

An insurance broker earns money for insurance supplies for individuals or businesses. Most committees account for 2% to 8% of premiums, in accordance with state regulations. Brokers sell all types of insurance, including health insurance, home insurance, accident insurance, life insurance and income.

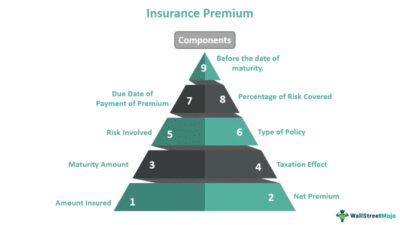

The main way in which an insurance broker earns money comes from the committees and the fees have won the sold fonts. These committees generally represent a percentage of the total annual policy premium. Insander the amount of money a person or business pays for an insurance policy.

As soon as it won, the premium is the insurance company. It also represents a passive, because the insurer must ensure that the police complaints are covered. Insurers use bonuses to cover the responsibilities associated with the policies they register. They can also invest in bonuses to create higher returns and offset some of the costs of insurance coverage, which can help an insurer maintain competitive prices.

The Difference Between A Contractor’s Bond, License, And Insurance

Insurers invest bonus in assets with variable liquidity and return levels, but are required to maintain a certain level of liquidity. State regulators determine the number of assets necessary to secure complaints of the insurer.

A broker or insurance agent will often have a flat percentage compared to the first year of the insurance of a police force that then sells an annual payment of a lesser income less but undergoing the life of the Police.

Brokers also earn money by providing consulting and consulting services to customers for fees. In some cases, the cost of the transactions may be priced. For example, brokers can charge costs to start changes and help complaints.

States are governing how and when brokers can charge costs. When authorized, the fees must meet certain criteria, such as reasonable and agreed by the customer and the broker.

Federal Register :: Short-term, Limited-duration Insurance And Independent, Noncoordinated Excepted Benefits Coverage

Doubtful, some insurers encourage brokers who allow to pay bonuses or increased supplies. The remuneration is often based on previous performance and is used as an incentive to pursue some income that generates income.

However, because – in the interests of their customers – brokers do not represent a particular company, this method of response committees is often rejected.

The broker is used to represent the best interest of their customers. Part of the broker’s duty consists of understanding the situation, needs and desires of customers to find the best insurance policy in their budget. Choosing the right insurance plan may be complicated and studies show that many people choose one less than optimal plan when counting only