Insurance Market – The size of the global healthcare insurance market calculated in 2025 of $ 2.50 billion and is expected to affect $ 4.83 billion by 2034, which represents a CAGR of $ 7.60% from 2025 to 2034. Market change and forecasts are based on income (a million USD/billion), with 2024 being like a basic year.

Last update: 6. May 2025 | Message code: 1369 | Category: Health Care Format: PDF / PPT / Excel

Insurance Market

The size of the global healthcare insurance market was recorded for $ 2.32 billion in 2024 and is expected to increase from $ 2.50 billion in 2025 to approximately $ 4.83 billion to 2034, expanding to CAG 7.60% from 2025 to 2034.

The Insurance Clock

Integration of artificial intelligence has the potential to transform health insurance by improving customer experience, increasing efficiency and reducing costs. AI can analyze historical data to accurately evaluate the risk and adaptation of premiums for individuals or groups. AI integration helps to improve risk assessment and subscription. Machine learning models evaluate health records, lifestyle habits and genetic data to predict potential health problems.

AI can identify the formulas of fraudulent claims using algorithms of anomaly detection algorithms. AI -controlled AI systems can process claims faster by verifying documents and determining eligibility without manual intervention. AI minimizes human errors in the processing of receivables, improving the accuracy and satisfaction of customers.

The size of the US healthcare market was rated in US $ 680 million in 2024 and it is believed to reach around $ 1,450 million by 2034, with 7.87%growing to CAGR from 2025 to 2034.

North America dominated the health insurance market, supported by a combination of factors, including health coverage provided by the employer, the presence of high -quality medicines, the National Medicare Program and greater emphasis on medical innovation. This dynamics contributes to the increased demand of the region after financial guarantees, especially within the worst health care results due to conditions such as cardiovascular disease, diabetes, kidney disease in the final stage and HIV infection.

Embedded Insurance Market Growth Analysis, Market Dynamics, Key Players And Innovations, Outlook And Forecast 2024-2030

American patients show a wide range of preferences, from those looking for available financial protection due to high costs and insurance gaps to those who want exclusive private health insurance. In addition, Canada is home to many health insurance initiatives that strengthen a strong presence in the market for affordable and easy access to insurance for patients.

Asia Pacific is experiencing a significant increase in the health insurance market, which is attributed to its remarkable abilities of health care expenditure, a large base of patients and the emerging middle class. Countries like China and India are crucial for the management of the region in this sector. These countries serve as the main health care centers and create a wide range of health coverage, including government policies that support health insurance, digital tools and online platforms.

When individuals in Asia and Pacific become richer and more aware of health care, their desire for top and financially healthy insurance products is increasing. Constant advances in the field of insurance techniques and processing, supported by favorable government policies, further strengthen the growing position of the market in the region.

North America represented 40% of income share in 2024 and is estimated to maintain its dominance during the forecast period. North America is characterized by increased awareness of the benefits of health insurance, increased disposable income, increased prevalence of diseases, increasing geriatric population, increased demand for the latest operations and drugs and increased healthcare spending. All these factors have expanded market growth in the region.

Property And Casualty Insurance Market Size, Report, 2024-2032

Asia Pacific is expected to grow at the fastest rate on the health insurance market during the forecast period. The Asia and Pacific region is home to the world’s largest population. Rapid urbanization and increasing penetration of insurance companies promotes market growth. Changing lifestyle of consumers, unhealthy eating habits and increasing obesity are the main factors of the growing prevalence of chronic diseases in the region. Increasing disposable income, improving Internet access, increasing literacy rates, increasing investment in the development of advanced healthcare infrastructure and increasing health insurance awareness of the population are the most important factors that are expected to increase market growth in Asia and Pacific market growth. Increasing government initiatives in the Asia -Pacific region for people over the age of 70 brought the market in the forecast period.

Health insurance plans sponsored by the employer are increasing with the increasing level of employment. Dopted health insurance plans make the coverage of low -income groups available. Subsidies reduce the financial burden of health insurance, which is available to individuals with low and medium income. This increases the registration in health insurance plans and extends the customer base for insurers. Dopted health insurance programs often include incentives such as tax benefits or premium discounts, encouraging more people to apply. Governments may finance programs for specific groups, such as children, older people or low income families, directly increase the coverage rate. Subsidies allow cooperation between governments and private insurers, where private companies manage subsidized plans, thereby growing their market share. Subsidies can provide affordable plans for advanced insurance companies, which increases the demand for politicians with wider coverage and value -added services.

The public segment represented 56% share of income in 2024 and is estimated that it maintains its dominance during the forecast period. This is attributed to increased confidence in the public and trust, because the government itself acts as the main insurer and provider of healthcare services. For example, LIC Corporation in India and Medicare Federal Government in the US. In addition, insurance companies for public health offer safety and operate at a low price.

The private segment is estimated to be the most oportian segment during the forecast period. Private players come up with improved medical services and premium capabilities for customers. In addition, some inefficiency associated with healthcare insurance in the public sector is overcome by private market participants and therefore gain more attention on the market. In addition, they offer higher benefits over the public segment.

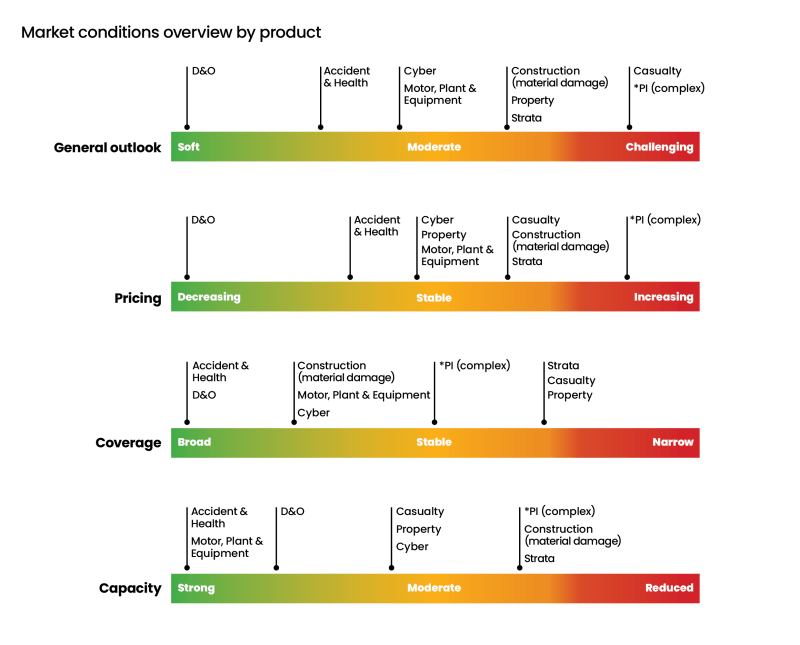

How To Deal With A Hardening Insurance Market

The life coverage segment was more than 52% of the market share. People choose life insurance as an investment option that also has huge benefits of tax -saving taxes. In addition, the availability of wider life insurance variations offered by different players on the market serves a wider range of customers with different needs.

Theterm insurance segment is expected to show the highest CAGR during the forecast period. This is attributed to the availability of huge benefits for low costs to customers. It includes healthcare insurance plans, which mainly cover the cost of treatment in health units. Therefore, the main driving force of this segment is the growing prevalence of various chronic diseases. This also provides security and helps customers protect their medical expenses.

In 2024, the silver segment of the dominant presence in the health insurance market in 2024. In the federal market and state stock exchanges, silver plans are the most popular, with 70.0% of stock buyers being selected. Those who have one or two lesser health problems who need a medicine are usually those who use them.

The Gold plans segment is expected to grow at the fastest rate on the market during the predicted period of 2025 to 2034. This could be explained by the growing occurrence of chronic diseases that require frequent medical visits and prescription drugs that are not adequate from the pocket.

Selling Insurance Online: Dtc, Aggregators, Embedded

Adult segment has seen its dominance in the global health insurance market in 2024. The adult population has a significant prevalence of lifestyle diseases that can increase future health risks. Heart diseases and other conditions that require hospitalization are more common in the population.

The segment of older citizens is expected to grow at the fastest rate on the market during the predicted period of 2025 to 2034. People over 65 are included because they are more prone to chronic diseases that increase hospitalization rate. Health insurance plans for seniors are more essential, especially when it comes to retirement. In addition, it offers a number of benefits, including lifelong renewal, covering the outpatient department and no medical screening before buying plans. It also offers the advantage of annual tests free of charge.

The size of the global healthcare insurance market in 2024 was achieved $ 2.32 billion and is expected to be more than $ 4.83 billion by 2034.

The global health insurance market in the forecasting period of 2025 to 2034 grows to CAGR by 7.60%.

Hong Kong Insurance Market Size, Share

Increasing prevalence of chronic diseases, high health care costs, increased disposable income, constantly new products to the market of many players, increasing awareness of health insurance companies and improved services related to the settlement of claims.

The main market players are Aetna Inc., AIA Group Limited, Allianz, Assicrazioni Generali, Aviva, Axa, Gypsy, Ping and Group), Unitedhealth Group, Zurich.

Deepa Pandey, one of our weighted authors, plays a decisive role in shaping high -quality content that defines our research reports. Deepa is a holder of a pharmacy master with a specialization in pharmaceutical quality assurance and is equipped with deep understanding of the regulation, quality and quality of the health industry and the health industry