Insurance Marketplace – Share this page on Facebook (opens on a new tab) Share this page on X (opens on new tab) Share this page on LinkedIn (open on new tab) Share this page via e -mail print this page

NOTE: This calculator was updated on October 27, 2022, with premiums for 2023 plans, and again January 31, 2023, to correct the poverty guidelines used when revenue is recognized as “percent of poverty.”

Insurance Marketplace

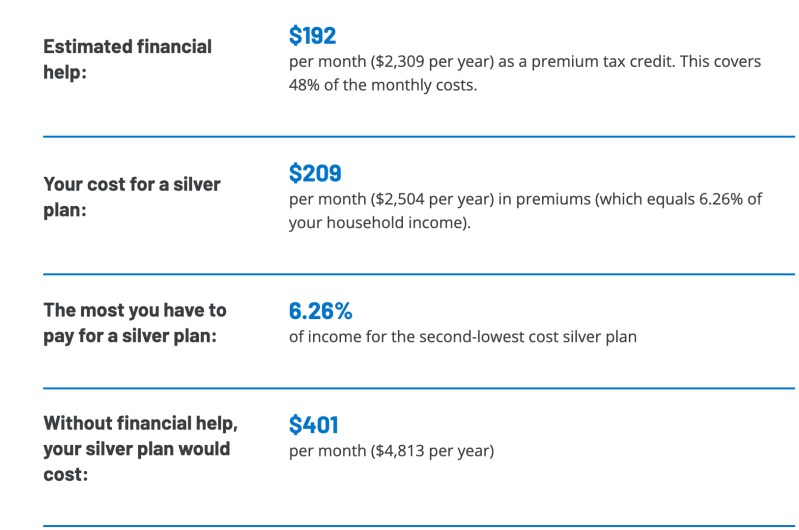

The calculator for the health insurance market prescribes health insurance premiums and subsidies for persons who buy insurance on their own in health insurance (or “market squares”) created in the ACA Act (ACA). With this counter you can specify income, age and family size to assess your qualifications for subsidies and how much you can spend on health insurance. You can also use this tool to evaluate your qualifications for Medicaid. Since the qualification requirements may vary depending on the state, please contact the Medicaid Office of State or Market Square with enrollment issues. We encourage other agencies to have the counter on their websites using the input instructions.

Open Enrollment For The Health Insurance Marketplace Is Available Through Jan. 15 At Healthcare.gov. If You Are Considering Enrolling In A Marketplace Plan, Please Note That Maury Regional Health Only Participates In

The editor’s comment: This calculator was updated on October 27, 2022, with premiums for 2023 plans, and again on January 31, 2023, to correct poverty guidelines used when income is stated as “percent of poverty.”

The calculator for the health insurance market is based on the Cost Environmental Care Act (ACA), which was signed in the Act 2010 and subsequent regulations issued by Health and Human Resources Services (HHS) and head of Internal Revenue (IRS). The calculator includes a subsidy increase for 2023 in the Reduction Act.

Premiums shown in the calculator’s results are based on actual exchange rates with $ 2023. Premier was obtained with data issued by HHS, data received directly from state exchange or insurance departments and data collected from the state -Av -species. Silver Premium is the second lowest cost of silver premium found in the county for the registered postal code and the shown bronze premium is the lowest cost of bronze plan in the county included in the postal code. Not all plans exist in all parts of the county, so actual premiums can vary depending on the program’s range. Premier shown is the selection part used for the necessary health benefits. Actual premiums may be higher if the plans include “not necessary benefits” such as dentists or visual or vision.

The premium is adjusted for the user’s family size and age. The calculator premiums vary depending on age within three to a limit specified in the law, using age components from the proposed regulations issued by HHS (OR, special age elements where states have adopted them). The calculator does not show a tobacco fee. In most states, however, insurance companies can charge tobacco fees up to 50% of the total premium and the tax debate does not apply to stress. Actual tobacco fees vary depending on the schedule and some states do not allow insurance companies to be different from tobacco.

The Coverage Provisions In The Affordable Care Act: An Update

Frequently questions below are intended to help you understand this calculator. Detailed questions and answers to registration for consideration are available for our common questions on the market.

If you have questions about how health reforms will affect you and your insurance potential, go to healthcare.gov, or contact their help center on 1-800-318-2596 if you have questions that cannot be answered on their website. You can also contact the state consumer management program, the exchange or Medicaid office with questions about qualifications and check -in. Click here to find help from sailing and other certified assistants within healthcare.gov.

Cannot give individual tips on your insurance options. However, we provide answers to the number of common questions below, together with more detailed questions and answers to common questions about health improvements.

You may use an older version of Internet Explorer or Firefox. Try updating in a new version of your browser. Aren’t you sure which browser version you are running? Check here for IE or here for Firefox. If you continue to have technical problems with the counter after you have updated your browser please contact us.

Busting Insurance Marketplace Myths For 2024

Remember that we cannot give individual tips or help to understand your performance. If you have any further questions, we suggest that you contact healthcare.gov or the state health insurance market for more information.

No. The calculator is intended to show you a plan for how much you can pay and how much financial support you can be eligible if you buy coverage through the health insurance market. To find out if you are eligible for financial support and register, you must contact healthcare.gov, the health insurance market for your state or Medicaid program.

Although marketplace location for health insurance is based on actual premiums for forecasts sold in your area, there are several reasons why the calculator’s results may not correspond to the actual amount of tax discount. For example, the counter completely relies on information when you specify, but Market Square can calculate the changed adjusted gross income (MAGA) to another amount or can verify your income against the previous year’s information.

Yes, the calculator estimates how much you can pay and the amount of financial support you receive during inflation (IRA), which continued to increase amounts and qualifications for subsidies on the market.

What You Need To Know To Enroll In Health Insurance Through The Marketplace

Grants are US financial support to help you pay for health coverage or care. The help you receive is determined by your income and family size. There are two types of health insurance subsidies available on the market: premium tax credit and cost share.

In the premium tax loan, you help reduce your monthly premium costs. This subsidy is available to people with family income 100% of the poverty limit or higher who buy coverage through the health insurance market. These individuals and families have to pay a maximum of 0% -8. 5 % of their middle -aged revenue (“Criterion Silver Plan”). All above that the government is paid. The amount for your tax rebate is based on the price of the silver plan in your area, but you can use your premium loans to buy all marketing plans, including bronze, gold and platinum plan (these different types of plans are described below). You can choose to have your tax discount directly to the insurance company so that you pay less each month, or you can choose to wait to get the tax credit for a one -time payment when you make taxes next year. Frequently questions provide further information on how the tax discount works.

Contributions for cost share (also called “cost sharing reduction”) help you with the cost when using health care, such as going to a doctor or having a hospital stay. These subsidies are only available to people who buy their own collateral who are eligible for a premium loan and make 100% and 250% of the poverty limit in the range. If you are entitled to a cost share, you must register for a silver plan to use it. Unlike the premium tax credit (which can be used for other “metal levels”), the costs of costs only work with silver plans. With subsidies on the cost share, you still pay the same low monthly percentage of silver planes, but you also pay less when you go to a doctor or stay in a hospital than you would. (Increased cost subsidies are available to Indians on slightly higher revenue according to all marketing plans.)

For more information, read the question of the actuarial values below. If you have more detailed questions about your subsidy, you can contact our joint websites or contact Assist or Navigator via healthcare.gov or State Market Square.

The Aca Marketplace Is Open Again For Insurance Sign-ups. Here’s What You Need To Know.

The sickness insurance market Plagalculator allows you to take household income for $ 2023 or as a percentage of poverty levels in the federal state. Household income includes income for tax, spouse and in some cases children, known as tax returns. When it comes to the calculator, you should specify your best guesses about what your income will be 20 23.

When you go to healthcare.gov or the state health insurance website, it will go through the steps to calculate household income based on wages, interest, profitable, social security and certain other sources of income. The eligibility before the tax discount is based on changed adapted to households’ gross income or stomach. Your most recent tax return will show your adjusted gross income (discipline). For many, the stomach is the same or very closely corrected gross income. Stomach changes your gross income by adding all non -taxable tax benefits you can get, all tax -free interest that you can earn and all foreign income you earned that are excluded from your income for tax purposes. The calculation does not include income from gifts, inheritance, additional security income (SSI) and some other sources of income. For more information, see here.

Federal poverty varies depending on the size of the family. Before coverage of Market Square in 2023, the used poverty level is $ 13, 590 for an adult and $ 27, 750 for one

Free marketplace insurance, travel insurance marketplace, medicare marketplace insurance, marketplace insurance, marketplace aetna insurance, online insurance marketplace, contact marketplace insurance, marketplace insurance hours, the insurance marketplace, apply marketplace insurance, vehicle insurance marketplace, private marketplace insurance