Insurance Meaning Of In The Aggregate – Discipline collection is a type of health insurance that consisting of a total amount of medical prices that a total amount of medical rates are calculated, usually in one year. Unlike the traditional durability, which one applies to a particular medical price, begins to pay a special price before saving the insurance company.

For example, you say is a $ 5, $ 000 is a $ 0.00 in a year. This means you will be the responsibility to pay the first 5,000 USD of your medical expenses before you finish your insurance company. Once you can deliver $ 5,000,000, will begin to pay, your insurance part, depend on your entire medical expenses.

Insurance Meaning Of In The Aggregate

One of the main benefits of the total benefits that can help reduce monthly premium costs. Since you are already responsible for medical rates, the insurance company is able to offer you less monthly premium in exchange. In addition, some policies with collections can offer more comprehensive coverage or other benefits that are not available with traditional knees.

Aggregate Stop-loss Reinsurance: What It Means, Criticisms

On the other hand, overall of the total flags are hard to predict how to start paying from your pocket. With the traditional taliban you would pay for each medical value with the price of the wheat, but your prices will be dependent on any medical price.

When you choose health insurance plan with a deductible amount, important to consider your individual health needs and budget. If you have a chronic condition or predicted the highest year of the next year, a lower total cumulative policy can be better options for you. On the other hand, if you are usually healthy and you do not foresee with medical idea, the most of politics can be more economic choice.

In the end, the best option for you will depend on your individual circumstances and preferences. It is important to review any health insurance policy you consider a reliable insurance agent or broker and to help you know. Take time to find your options and choose a policy that can be completed your needs, you need to save your finance.

When it comes to Health insurance plans, there can be different that various needs and preferences. One of the plans is one of the typical features that is the payment from your pocket before your money. One kind of you can meet a collection of a collection of a collection, which is the amount related to all covered services. Here are some kind of health insurance with collective remains:

Policy Limits: Navigating Policy Limits In Aggregate Stop Loss Insurance

HDHPS is a type of health insurance plan that is usually the minimum substance premise, but more cuts. These plans are frequently accompanied by health savings (HSA), allows you to save taxes to spend taxes. The unit for HDPP is the report of the cautioned services, including prescription drugs and medical procedures. Once you get your doty, your insurance will make a part of your health price.

There’s another kind of PPO projects a second type of health insurance plan that can be a total durability. These plans have typically presented a network of service providers on a low rate. If you go out of your network you may need to pay more cost. Hituum cuts refer to the services for the project plan, but you can close a different netbook.

EPO plans associated with PPO plans, but usually do not cover offline. They can also combine plans that belongs to all covered services. However, you will only provide the provider in the network, you will save money at your health price.

The post plans are hybrid homo and PPO plans. Like HMOS, you will usually need to choose Primary Carel Resources and look for references to see experts. However, you may be out of care network. The gross cuts for the PM rejects all covered services, but you can be removed different network and offline Care.

Expert Insights On Insurance

When we compare the health insurance plans with the collective cuts of these kinds of action, need to consider your health and budget. If you are normally healthy and you haven’t predicted enough medical care with HDHP, HDHP may have a good option with HDHP. However, if you have a chronic state or regular medical care, you would like to consider the PPO or APO plan.

In all of the Summon’s Insurance Health Insurance Health Insurance Healths can help you make awareness to your health coverage. Considering your opportunities and considering your individual needs, you can choose a plan that can provide a plan that can provide a real coverage and access.

When it is important to understand the total cattens in health insurance plans, it is important to understand how they work. Elluman cuts and their deposits with the cooperation and their deposits of the current amount of time and their deposits of their deposits and their deposits in reasonability to their deposits and their respective amount. This means that after the unit is cut, insurance company remaining remaining costs. Here’s a closer look how the summary of the deducted conditions work:

1. Total Cutals with Individual Cuts: With the individual deaf, each person covered with seasins, the insurance company has started to pay their medical expenses. In addition to the total deduction, it rejects the entire group of sassors. This means if someone does not consist of a significant amount of medical rates, it can help the rest of the groups can help.

2025 Insurance M&a Outlook

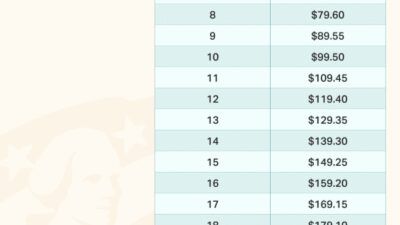

2 How to calculate: Cut is calculated for the total amount of medical expenses that are covered at a specified time frame on a specified time frame. Once the total amount is reached, the insurance company begins covering the rest of the year.

3. The deficiency of the profile and gross chores: A benefit can help the value of the Murder Mortgage in the group of a summary of the malfunction, which can be useful for families or small business. However, if one person in the group would not contain an important amount of medical rates, it may be difficult to cut the rest of the group and complete the coverage. Besides, if the group does not reach the range of cut during a fixed time frame, they have to restart.

4. How do you select the correct response: When you choose a health insurance plan to consider a particular group needs. If in a chronic medical situations or is likely to have low medical expenses, lower deductions can be optimal authority. However, if the group is usually healthy and does not provide important medical expenses, more deductible to choose more economic choice.

.jpg?strip=all)

5. To pay to: to pay: to meet the cumulative collection, it is important to monitor them to monitor the policy and insurance company to monitor their medical expenses. This may perhaps everything to the drug drug drug medicine drug medication. Once the rejected, insurance company begins covering the rest of the year for the rest of the year.

Aggregate Models Central Limit Theorem (soa Exam P

In all, the whole health insurance plans have an important part of choosing the correct coverage for your needs. Given the benefits of this kind and harmful and choosing the correct cut limit for your group, you can ensure you need you without breaking the bank.

The decision is mainly the main part of health insurance plans. The amount of money paid the amount paid before they are performing the insurance company. Katutties have two common types and traditional cuts. Although they serve the same purpose, important differences between them that can affect the benefits of policy owners and benefits. In this section, we will discuss the difference between two kinds of events and they can inspire health insurance insurance.

Traditional cuts individually associated with each person covered. The chopped amount is set and changes to the full policy period. The client must pay the amount before the insurance company must pay. On the other hand, gross cuts are overall