Insurance Meaning Policy – Life insurance. The definition of how it works, types, basic situations, companies, rider, requirements, bonuses, benefits

Life insurance is a league between the insurer and insurance company, by which insurance company promised to stay beneficiary’s death or maturity.

Insurance Meaning Policy

“Life insurance” is an agreement between the insurer’s insurance company, by which insurance company promised to stay beneficiary of death or beneficiaries beneficiary. Death boxes for the beneficiary is replaced by the income from the insurer with the death of the insurer person. As far as possible to pay the debts of our own, economic children’s education costs and meet others long-term purposes.

Business Risk Management(marine Insurance)

Life insurance policy names nominated or beneficiary to the good of death. Goddess benefits to provide financial security to insurance family. Life insurance policy is explained below.

The Indian life insurance industry is about 24 life insurance companies, 23 of which are private insurers, and 1 – life insurance (life insurance).

In the Indian life insurance industry is highest direct premium of RS7.83 Lakh crore in FY23, compared to the total gross premiere fy22 rs6.93 lakh, 12.98% increase in the foundation y-o-y. Life Insurers Private Sector Informer 16.34%, with the State Registered Y-O-Y-Y-60%. Premiums restoration premiums continue to the majority of the total premium received a life insurance companies FY23 – 52.56% and 47.44% of the balance is introduced to a new business premium.

In the life of insurance industry paid in the sum of RS4.97 Lakh crores FY23 in front of FY22 in front of RS5.02 Lakh crores. Rs1.58 Rs.58 Rs.58 Rs.58 Rs.58 Rs.58 Rs.58 Rs.58 Rs.58 in front increased in FY23. Industry paid to RS41, 458,34 crores in front of FY22 RS60, 821.86 crores.

What Is Term Insurance?

For fy23 to life insurance industry, as a profit stood at RS42 RS42, 788 crore, as RS7, 751 crores in Fy22. By FY23, life insurance companies issued new policy of 284,70 lakhs during the individual businesses, from which public sector’s insurance company issued by a policy of aetches and 8.76%. The Indian life insurance industry is registered 2.21% as well as a new number of advice in the previous year.

There are many kinds of life insurance, which are available to the wide range of needs and preferences.

The term insurance is the kind of insurance that provides a single-time payment to the benefit of death in case of insurer death. Political ensures long-range quantity coverage is a policy term. The term of the job plan is a major insurance plan that ensures benefit of death in case of insurance. Politics do not accumulate any cash value. Liment insurance is a simple-low value option for life insurance coverage. Politics provides a great benefits to high bonuses. As political only benefits death, which is also known as a clean program program. Termmissions contract is a big choice to ensure the financial security to the family, and the payment received from political can be used to be remote, as persons or children’s education costs.

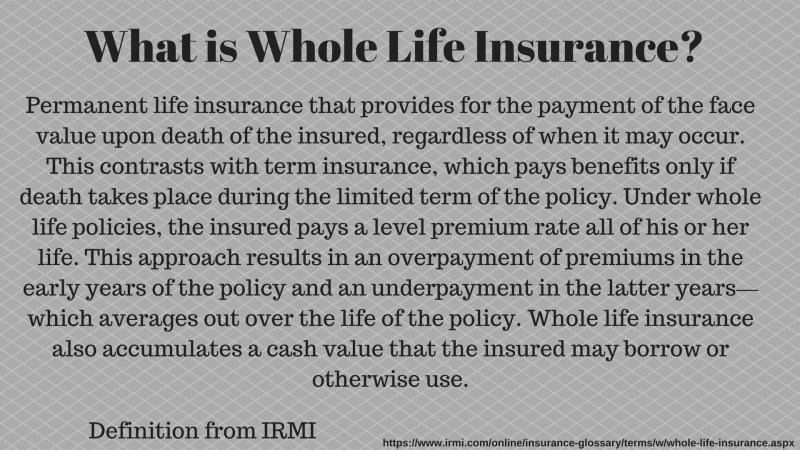

An entire life insurance counsel provides life from insurance, that is, in it, before insurance is 99 years. A whole life insurance policy is the most insurance terms and provide coverage up to 99 years.

I’m A Cfp & A Mom

A group of life insurance policy provides one-time payment to benefit from the employee’s family member, if the employee’s death. Employers generally buy a group limit insurance policy for employees.

The unit is linked to insurance advice, which is also known as ULIP, is the kind of insurance policy that combines long-term purposes and insurance coverage to financial security if the accident. The insurance premium paid for ulip program is divided into 2 parts. Some of the premium goes to the cover of life, with a second part can contribute to their head or debt fund to meet the future goals. In the insurer receives the benefit of maturity at the end of the end of the plan limit, when the cause of death is paid death to life is imposed

The child insurance program are the kind of life insurance, which is the first and principally used to ensure the needs of the child’s future higher education. The child’s insurance policy combines a savings and insurance where parents pay premium for child. This premiums accumulated to the maturity of the benefit to the end of the plan, which can be in the finance education. In the event of the parent decline, political paid amount of life coverage of the life coverage.

Pension Plan that also known to the pension plan, is the kind of insurance policy that allows you to save money in years, as you can enjoy stable and specified income flow in retirement years. The insurer receives the payment of payment to the death under one single life. According to the joint of life version, the pension plan also pay for the annuity of pension price. Pension plans to give guaranteed return after retirement to help you meet your obligations. I offer flexible investments and payment options that allows you to accumulate the pension facilities to the convenience and take payments to your choice of your financial purposes.

Articles Junction: Types Of Fire Insurance Polices

Joisting Plan, it also called the Savings Plan, combines health plan and allows you to build a financial criteria that will help you to meet your short-term and long-term financial goals, as well provides life insurance coverage. These programs are designed to save insurers and create a significant body. In the Savings Plan provides to pay the time at the end of the plan limit.

Offers protection, both investment gives investors in Asset classes and reading of their capital, debt, debt and balanced

The cyclist is the additional provision of the main plan of life insurance, which confirms the plan coverage. Insurance companies often provide insurers according to their needs to adapt their insurance policy. Passengers present primary method by an insurers can change their life insurance plans. Usually, insurers pay extra insurance for each cyclist, although some policies can include special riders within their basic premium.

The life is an uncertain, and therefore it must be prepared. Life insurance provides advantages of defense and savings. As a result of the insurance policy is part of each individual financial program. Some important benefits of insurance policy are presented below.

Understanding Homeowner’s Insurance In Missouri: What’s Covered?

Life insurance serves as an important financial guarantee if you have a dependent man, children or other family members who trust in return. In case of your transition, death benefits from life insurance policy can be used to an economy such educational costs or investment in pension plans. Further, life insurance policy includes a monetary value element that gradually increasing the time, providing an added financial asset. Here are some people who buy a life insurance plan.

In January 2001, Adity Birla Sun Life Insurance Insurance is a joint venture between Aditya Birla Group and Sun Life Financial Inc, which is a leading organization in the international financial services in Canada. The company has a spacious network of 340 branches and a team more than 64, 000 agents and insurance brokers. The company offers a wide range of products as a term insurance policy, pension plans, children’s insurance plans, the savings of plans, strong and group insurance program. Aditya Birla Sole Life Insurance Insurance Company Memories in Gross Income Rs15070 RS15070 Crores in FY23, Y-O-Y 24% growth. Premium (monkey) the company’s personal new business has increased by 37% of the RS3, 22 CF’s FY 2023 increased by 14% in FY23. The premium of FY23’s new business is stood 30% in FY23 RS4189 crore in y-o-y basis. In FY23, Aditya Birla Sun Life Insurance Company Reports RS194 Crores Tax Pat RS124 Crors in Fy22. Aditya Sun Life Insurance Insurance Company requirement requirement requirement