Insurance Meaning What – Click Continue or click or sign in. On the basis of the user’s consent, you agree to the Privacy Policy.

What is the insurance? Definition, meaning, insurance reduces the possibility of financial loss due to injury or damage caused by injury or damage caused by third parties.

Insurance Meaning What

Personnel injury injuries in work -related accidents may be accidentally damaged.

A Comprehensive Guide To Different Types Of Insurance

The businessman or the owner is responsible for all losses.

May damage the loss of goods or goods.

Trains can also be missed, and the plane crashes and the airplane crashes in the accident and the damage caused by transitions and change priorities to another city.

As technology and scientific innovation change, demand for market demand may change.

Insurance- Meaning, Definition And Nature Of Insurance.

Mobile phones have reduced demand for telephone demand. Government policies; A company’s income can affect a company’s income due to changed tax rates and / or interest.

The insurance does not cover all financial risks. Some of the above risks may not be afraid, but some are not.

Fire, fire, fire and safety known as a simple adventure. Theft, earthquake;

Driving in demand,

Insurance Premium Amount Meaning

The warranty guarantees the amount guarantees the amount that guarantees the amount of money or damage caused by certain events.

Guaranteed risk is called “insurance” or a company called “insurance” or a company called “Warranty” or Company.

“Premium” is the number of insurance companies or insurance companies that agreed to exchange the insured compensation.

The insured guarantees the amount of money for the insurance (premium) in insurance premiums.

What Is The Meaning Of Non-life Insurance?

Anyone who has suffered damage or loss is available through this funding.

Banks and bank institutions often focus on real estate and product insurance before allowing the loan to confirm their safety.

Therefore, it is a good idea to ensure that financial protection or financial protection is guaranteed by financial protection or money protection or financial damage due to financial protection or cash errors caused by money fraud. The insurance company is more likely to influence the payment of services that guarantee customer risks.

:max_bytes(150000):strip_icc()/world-insurance-edit-476eedc509fb490e97ff6b8bedf38c68.jpg?strip=all)

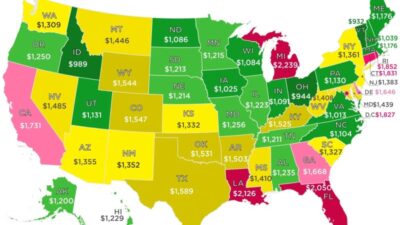

Many types of insurance are available. Personal or companies can find an insurance company ready to convince them. The types of general personal insurance are automatic, automatic, health and automation. Health, homeowners and life insurance. Most people in the United States are at least a kind of insurance and car insurance is the required state law.

Definition Of Insurance

Companies are available for fields: insurance for certain risks. For example, the policy of the Fast Restaurant restaurant can prevent the wounds of staff from being cooked in deep ads. Medical corruption insurance covers the deaths of injuries or deaths in the health care provider’s ignorance. The company can use the company’s insurance broker to manage employee policies. State law may require companies to purchase certain insurance groups.

There is also insurance for very special needs. The authorities are capturing coverage; Ransom and money and K & R.

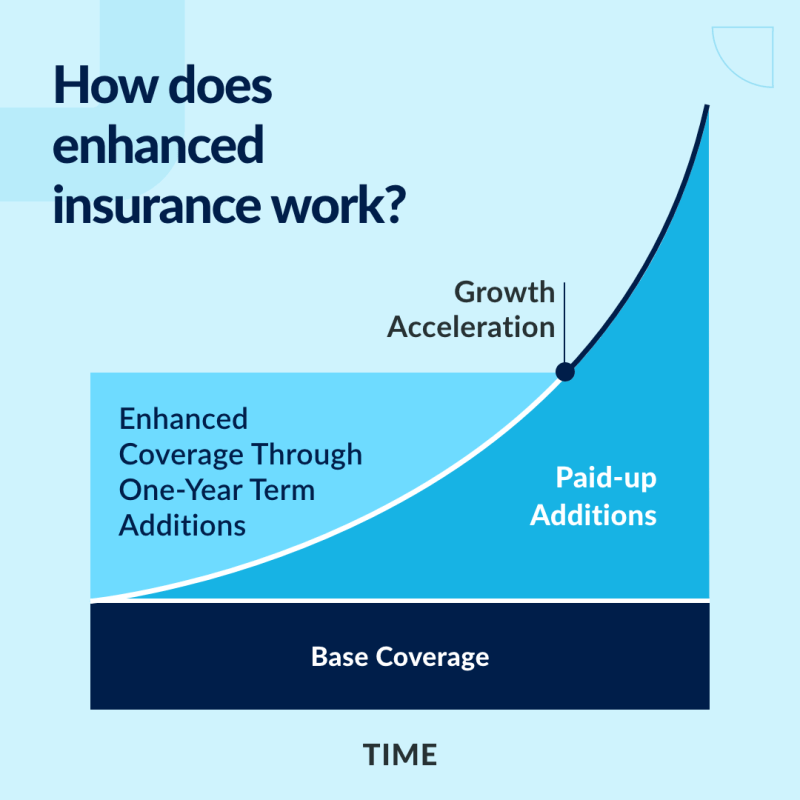

Understanding insurance can help you choose insurance. For example, complete coverage can be an automatic type for you. Three parts of all types of insurance are premiums and premiums.

The bonus of the mediator is its price and generally costs. Usually the warranty is a few points to the account to set a reward. Here are a few examples.

Insurance Meaning Legal Context & Example Legal Terms Simplified @lawmint

It depends on your risk that a much risk is guaranteed. For example, imagine you own a lot of expensive vehicles and have a reckless driving history. In this case, you will pay more for the automatic policy made by mixed driving data with a comprehensive driving record with complete driving data. However, different premiums for different insurance premiums for similar insurance. So find the right price for you requires certain characters.

The limit of politics is the maximum number of losses under politics. The highest (eg annual or political expressions) can identify (eg annual or political expressions) called the highest.

Normally higher boundaries carry higher premiums. General life insurance refers to the maximum amount. This is the amount of money you die in your front.

Federal Entry Care Act (ACA) is a family project; It prevents AAA-HEGIA conformity plans for essential health benefits such as heavy services.

Life Insurance: What It Is, How It Works, And How To Buy A Policy

Before the deduction, the specific numbers of your pockets were not allowed, so no medical amount was given.

For example, a $ 1,000 deduction is the first $ 1,000 of all requests. Suppose you get $ 2000 for your car’s total damage. The first 1000 pays to pay $ 1,000 with your insurance.

DV VV vehicles depend on the type of insurance and insurance. May apply policy or demands. You can take individuals to health plans and take the family to the individual. Policy with high dervative abbreviation is usually low expensive, so high pockets cost only small claims.

Health insurance contributes to routine and emergency material. Percentage or percentage of the amount or percentage of the amount or percentage of the amount specified after the annual deduction deduction may be paid to the coin. However, many precautions can be covered free in front of them.

What Is Term Insurance?

Health Insurance Company; Insurance company; It can be purchased from the federal health insurance market.

The federal government no longer requires health insurance for Americans. However, in some countries like California, you can pay taxes if you do not have insurance.

If you have chronic health problems, try to find health insurance if you need regular medical attention. Each year, the reward is higher than comparable policy, but less healthy treatment for medical care should be changed.

Household visits are also known for your home and natural disasters and natural disasters; The host practices offer hosts or promotions that can be increased by rules or events. This additional reward level comes.

Professional Liability Insurance

The lease is the insurer of the homeowner. Your lender or host will need you to enjoy the insurance of homeowners. From homes. If there is no concern, your insurance bill will not buy your insurance invoices if you do not buy your insurance invoices and allow you to charge you.

The automatic warranty may be subject to fees if someone’s property is injured or damaged in a car accident.

Instead of paying pockets for car accidents and damage, people pay an annual premium to the car insurance company. The company then pays all the costs associated with an automatic accident or other vehicle damage.

If you have a loan to buy a vehicle rent or car, the loan retailers will need to carry you automatic warranties. If homeowners are like a home owner warranty, the borrower can buy you guarantees.

Coinsurance Definition And Legal Meaning

The insurance guarantees the number of beneficiaries (like guys) for those with benefits of your benefits. In return, you pay premiums during your life.

There are two types of life insurance. Life insurance covers you for a precise period of 10 – 20 years. If you die at that time, your beneficiary’s benefits will be offered. Life insurance covers your whole life as long as you pay for insurance premiums.

We have priced, policy categories; Banks ‘financial stability, banks’ financial stability and other factors to find other factors and other factors.

Travel insurance covers costs

What Is Liability Insurance? Your Shield Against Financial Lawsuits

What is the meaning of ppo insurance, what is the meaning of health insurance, what does term insurance meaning, what is life insurance meaning, what is term life insurance meaning, what is insurance meaning, what is the meaning of life insurance, what is the meaning of insurance, what is the meaning of insurance premium, what is the meaning of comprehensive insurance, what is the meaning of co insurance, what is the meaning of hmo insurance