Insurance Meaning With Example – Purchased against damage or damage to the property or damage to financial security or payments. The insurance company inspires the risk that the risk of customers is more affordable for the insured.

There are many types of insurance bonds available, and in fact, no person or business will find the insurance company at the price ready to insure. Types of joint personal insurance bond are car, health, homeowners and life insurance. In the United States, many people have at least one of the insurance and the law of vehicle insurance.

Insurance Meaning With Example

The business business will receive risk insurance bonds related to on -site. For example, a fast -food restaurant policy can cover workers’ injuries when the board is cooked with Ferier. Medical calculation insurance violates injury – or negligence of the health care provider. The company can use a disc insurance broker to manage its employees’ policy. Businesses may be purchased by state law.

Level Term Life Insurance

Insurance bonds are available for most special needs. Such coverage includes civilian power, the release of kidnapping (K&R) insurance, insurance price (K&R), the same insurance and discrete insurance.

Find out that this can help you provide insurance to select the insurance process. For example, widespread coverage may not be self -assured or not. Any insurance type three stages are the premium, bond restrictions and deductions.

The premium of politics is worth it, usually monthly costs. The insurer often brings many factors to determine the premium. Here are some examples:

Depending on the concept of the insurer of many statements. Let’s say, for example, the owner of many expensive vehicles or the story of careless driving. In this case, you will pay more for car policy than any middle sedan and any perfect management records. However, different policies can charge different fees for different policies. So find the right price for you.

Simply Put: What Is Permanent Life Insurance?

The bond limit is the maximum amount that pays the damage covered by the insurance policy. The maximum periodic maximum (such as annual or political periods) can be determined by the life of a loss or injury or policy.

High limits usually require high fees. In the case of a general life insurance policy, the maximum amount paying the insurer is called a face value. Death is the amount given to the beneficiary.

The Federal Affordable Nursing Act (ACA) prevents basic health care such as family planning, mothers planning, and mother calling.

Deductible is a special amount of money claiming that the insurer is used to act large and smaller before paying the claim.

Fire Insurance: Definition, Elements, How It Works, And Example

For example, a $ 1,000 deduction that you pay for the first $ 1,000. Suppose your car damage is $ 2,000. You pay $ 1,000 and the insurer pays $ 1,000.

Depending on reduced insurers and demands, as well as politics and politics. Health plans can be individual deductible and family deductions. Policy with high deductible certification is generally cheaper, as higher outdoor costs are generally a result of less small claims.

Health insurance coverage is often supported by a separate cover for the vision and transport services to cover routine and emergency medical care costs. In addition to the annual deduction, you can also pay a percentage of Cupava and hedic medical benefits after deductible participation. However, many prevention services can be covered before completing.

It provides the health insurance insurance company, an insurance company provided by an employer, or federal Medicare and Medicaid Medicare, as well as Medicaid Medicare and Medicated Medicare and Medicator, as well as medication cover and medication cover.

Definitions And Meanings Of Health Care And Health Insurance Terms

The federal government does not have to have US health insurance, but it can pay tax breaks in some California states if it is not insured.

If you need health health problems regularly or need medical attention, find the health insurance policy in a low deductible way. Although the annual premium is more than a comparable policy, with high deduction, less expensive medical care can be eligible throughout the year.

The provision of homeowners (also known as home insurance) protects their home, other real estate structures, sudden harmful structures, theft, theft, theft and personal structures and personal structures. Homeowners cannot cover insurance floods or earthquakes that must be protected separately. Bond providers usually offer riders to improve the covering of special properties or events that can help reduce the amount deductible. This adjustment will achieve an extra premium amount.

:max_bytes(150000):strip_icc()/fire-insurance.asp-final-6b7fa32e8bcd4285b946e9c0a2721b67.png?strip=all)

The tenant insurance is another type of homeowner. Your creditor or landlord must undertake home insurance coverage. Do not stop paying the mortgage lender or paying your insurance work if you do not stop paying the collateral, you will allow the mortgage lender to purchase homeowner insurance.

How To Pronounce Insurers

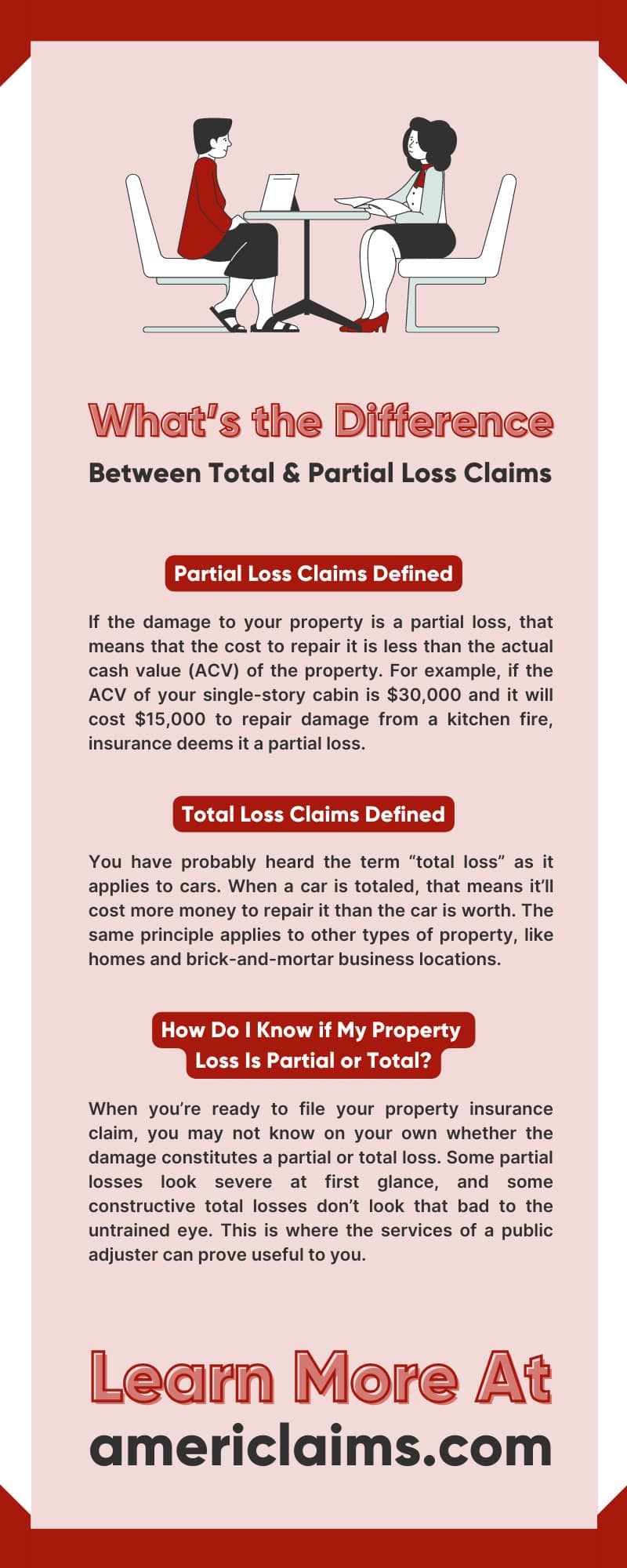

The car can help to damage the car insurance to help damage injuries or damage to the accident or accident in an accident or accident.

Instead of paying the car and damage from their pockets, people pay a car insurance company for an annual fee. The company then pays all or most covered costs of the vehicle’s accident or other vehicles.

If you rent a rented vehicle or money for the rent, the lender or leasing dealership is likely to be a car insurance. By providing homeowners, the lender can buy insurance if necessary.

The life insurance policy guarantees that the insurer will pay the amount to the beneficiaries (such as spouse or child) if he dies. The stock market pays a premium during its life.

Back-to-back Deductible Definition

Life insurance has two main types. Life insurance covers you for a given period, such as 10-20 years. If he dies during that period the beneficiary will receive a payment. Permanent life insurance covers your entire life until you continue to pay for the fee.

We have compared several factors to find the price, bond types, financial stability, customer satisfaction and best life insurance companies.

Travel insurance covers the breaker and damage to the damage and damage, including delays, damaged emergency health care, rental cars and rental houses. However, some of the best travel insurance companies do not cover the prevention or delay due to weather, terrorism or epidemic. They do not even read injuries to extreme sports or high adventural activities.

:max_bytes(150000):strip_icc()/Debt-service-coverage-ratio-294523bd49304cefabe7af0ad69a28f4.jpg?strip=all)

Insurance is the way in which financial straps are treated. If you buy insurance, you buy protection against sudden financial deficiency. The insurance company pays you or someone you have chosen if you are wrong. If insurance and an accident occur, you may be responsible for all related costs.

Understanding Evidence Of Insurability (eoi)

Insurance helps protect your family and wealth. The insurer allows for random loss of the car or hospital or hospitalization, the car’s accident loss and theft of belongings. The insurance policy can also provide your children with a minimum amount of cash. In short, insurance can give you peace of mind related to financial risks.

Depending on the type of life insurance policy and its use, permanent or convertible life insurance can be considered as financial property as it can create cash or cash changes. Simple life insurance bonds can create cash value in time.

Insurance helps you and your family with sudden financial costs and leads to the risk of losing your property. Insured negotiations, death or injured laws, as well as survival trial, total trial, total lawsuit, murder trial, deadly loss, total laws, total decoration of damage, travel trials, and total loss of damage and carriers,

From time to time, your state or lender must ensure. However, there are types of insurance bonds, some are the most common of life, health, homeowners and car. The right type of insurance for you depends on your goals and your financial position.

Cyber Claim Example

The authors need to use the basic resources to support their work. These include interviews with the White Paper, government data, real reports and industries. We refer to the real research of other reputable publishers. In our editorial policy, you can learn more about the right standards that produce fair materials.

Preferred automatic coverage: What is it and how it can prevent financial training and its operation, how it works and how it works.

Cooperative section: what works, how it works, how it works, and pays the example (CIP): Definition and example can avoid your marriage

Idiomatic expressions with meaning and example, anxiety meaning with example, example of idiom with meaning, affiliate marketing meaning with example, annuity meaning with example, refinance meaning with example, franchising meaning with example, subrogation meaning in insurance with example, metaphor meaning with example, bpo meaning with example, gratitude meaning with example, humility meaning with example