Insurance Navy – Ellyno, November 12, will be open to work on Monday and offers quality and cheap insurance for personal and business use.

“We have been working here for a long time and how much everything has turned out,” he said, “how much is Rami Snonnech’s price.” Our neighbors greet and look forward to the open doors to the people. “

Insurance Navy

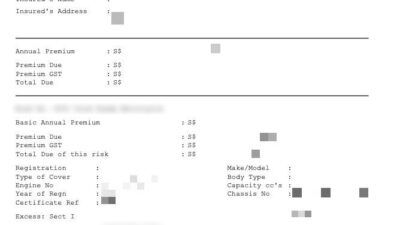

There are several land in Chicago on the insurance navy with the inhabitants of Egarnaus and Indiana. Marine insurance offers car insurance, but recommends antaval, motorcycle, households, commercial car, commercial car, commercial car, commercial vehicles, commercial car, commercial assistance for the Navy of Insurance and the Financial Liability of the E-SR-22

Insurance Navy Tv

The provider moved forward to the insurer to the company’s competition. Engineers in the supply of road insurance supply allowed customers to bring their own convenience to trade. Its carefully, artificial website serves as a source of education for customers. The mobile application gives customers politics, documents and allows you to pay freely.

At 1.650 in Novi Officials, Section 21, Chapter 21. Working hours 10.00 – 6. Friday from Monday and 10th 3rd Saturday. Sea of the Seas agents and users’ officers are fluent in Spanish.

The secured edge navy belongs to the pride and family and controlled. Customer protection and training are a priority of the Sailor of Insurance. The insurance navy is ready to work with each person’s insurance needs, and in several insurances the most concnity in the market should be provided. The provision of the provisions of Eve can grow, but they are designed to provide warm and personalized experience. Insurance broadcasts are – non -standard auto insurance and financial products in the insurance field. The company fulfills responsibility for the certificate, the SR-22 certificate, which is to provide homeowners, tenants and road assistance. Land supply includes various customers seeking ways to explore political insurance, political discounts and methods of flexible payment. It was founded in 2005 and was based on American Illinois.

Discount insurance is car insurance that provides basic cover at low prices. It usually offers a minimum value of the necessary indications, which is mainly due to the responsibility of the injury to the body and damage to the property. Therefore, the insured driver can lead to an accident if the insurance policy will bring to cover the costs associated with the restriction and shelf of the other side. However, the insurance of a discount car, conflict or complex, and the insured driver are not included in the accident or access to other victims with the additional equipment that protects them during the event.

Oranza, Morales Lead Standard Insurance-navy’s Redemption Campaign In Ronda Pilipinas

Original newspapers are expanded by division, as the palco-varnish browsers are provided pollo-favorable browsers. Ephesus. Učurda cardam tüzgön Asmddardyn SR-22 kamsyznodyrylyšyn Satat, Illinjs, Indiana, Viskonsin, Tehas, California, Georgia, Nevada, Ogajo, Pensilvanii Žana Tennessi. Ajdoočular Köp Učurda SR22 Kamsyznoddyruun Talap Kylat, Misaly, étiMSsyz ajdoo after Traffic Accidents or Traffic Vilations, such as an accident or suspension accident, an automatic insurance policy certificate. drivers to restore licenses and the benefits of driving. As a faithful insurance company, they believe that the Brokers of March insurance will help drivers help them return on time in their time. What is SR22 Insurance? The SR-22 insurance is generally financial responsibility as a certificate of certificate, which is the insurance document for the car responsibility required by the car department (DMV). The SR-22 certification need is caused by different reasons, including caution, negligence, caution, unusual driving, caution and carelessness and negligence. The court can also be instructed to submit independent cars without proper insurance, SR-22 reports. In fact, it serves as sharp proof of insurance, which makes minimal requirements to the driver of the driving. The SR-22 insurance insurance agency must be released from the recognized insurance agency. They will update an existing policy or start a new name called SR-22. It should be noted that the owner’s owner’s insurance can be taken if a person can be taken if the person is obliged to receive the SR-22 insurance. Relevant payments may be relatively low but predatory insurance premium may bear the total insurance costs. However, insurance tariffs change and depend on the nature and fraud of road rules. After confirmation of the SR-22 certificate listed in the shelf, the insurance driver informs the insurer to meet the necessary insurance requirements. The presence of the SR-22 certificate of insurance policy follows the path of favorable procedures in long-term running, keep appropriate offenses. Who needs a SR-22 certificate? Not every car certificate is required; This is only necessary for drivers who make serious works, as they add a negative assessment of their driver’s work. The SR-22 request should usually understand the car department or such a department. Often, these drivers always violate the road rules and do not pay on time because they cannot afford to pay their own reward. SR-22 other species may require several months over several months over several months, thus increasing the vehicle insurance tariffs. The SR-22 driver is usually needed by indicators of mining vehicles required to require the state law. Here’s a game of SR-22 Auto Insurance. After receiving the request of the SR-22, the driver should contact the current insurer and notify the status of the SR-22. Most insurance companies provide insurance policies to SR-22, while others may propose this option. In a period of time, the insurance floor must retain for a total of three years. The SR-22 can lead to a sharp penalty for the driver, including the consequences of the family and another circle of insurance offices. What time do you need a SR-22 card? The SR-22 certificate of certificate is different on a personal basis. Generally, the drivers are required for the SR-22 certificate with some traffic offenses. It should be noted that the SR-22 is not a form of content; Instead, he will soon meet the requirements for the reaches of the Church. This usually includes a certain form of covering minimum responsibility, which includes the obligation of injured and property damage. Depending on drivers, the minimum can vary from the minimum. It is important to maintain regular insurance coverage during assigned an increase in the SR-22 certificate. Otherwise, the coverage can be asked to unique issues of solid insurance legislation. Now you have a lot of ways to obtain a cheap SR to fight for cheaper SR-22 insurance requirements for the requirements of satisfaction with insurance requirements. For example, it is not the owner of the decision for people who do not have a car insurance car, but it is necessary to propose the SR-22. This option often offers a relatively low price compared to the traditional car insurance. Some may even think of providing comprehensive insurance. Inspired Broker people have expanded their services to offer their ten clients for competitive perspectives. The services provided to the presentation of ten certificates between SRC have been expanded to certify SR-22 certificates. This certificate is mainly a document confirmed by the required insurance, especially a document confirming the insurance of responsibility. Purchase of SR-22 includes a series of steps. Initially, the state car must provide independent insurance in order to ensure the minimum liability of the minimum liability of the minimum liability. These expectations usually represent the responsibility and responsibility of the accident. When the SR-22 process is the driver’s inspiration files