Insurance Plan Meaning – Emergency insurance is a purely life insurance program that provides financial protection to candidates at the end of their lives provided during political periods. It provides an agreement between the owner and the insurer, where the insurer provides life cover for the convicted life, for which he/she pays the insurer’s reward. Emergency plans are designed for specific accommodations. If the insured’s life dies during the chosen stay, the insurer will pay the amount to help them with the costs or debts incurred by the loss of family members (if any).

Palak Bagadia, Related – Bajaj Allianz Digital Marketing in Life, whose experience covers content and performance marketing, recruitment, employee participation in the BFSI industry, and gains a deep understanding of the insurance field.

Insurance Plan Meaning

Rituraj Singh has over 6.5 years of experience in the insurance industry, Rituraj Singh is the product and brand manager for Bajaj Allianz Life Insurance and has not noticed new products, matches and brand projects using one-to-one intelligence and technology.

What Is The Effective Date In An Insurance Policy? (2025)

For example, suppose Mr. Sharma bought his life plan. He chose to guarantee an amount of 50 rubles and a political term of 30 years. Ten years later, he died in an accident. In this case, the family will receive Rs 5 million to benefit Mr Sharma’s death conditions and political conditions.

The amount guaranteed by the insurance company during the policy term pays all appropriate bonuses during the policy term. Therefore, if the insurer dies prematurely, the family will be compensated for any financial losses they may suffer, reaching the limit on the amount provided by the plan. They can satisfy their lifestyle and can meet their financial obligations/goals even if they are not in the family. This reveals the duration of insurance and makes it an important part of the portfolio of emergency plans.

Now that you know what insurance terminology is, check out the different types of fixed plans available on the market.

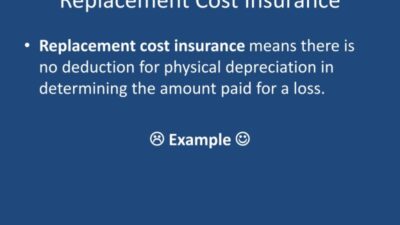

Under such plans, the amount guaranteed remains unchanged throughout the policy. If the insurer’s lifesaving dies during the policy period, the insurer will pay and terminate the plan.

Health Insurance Plans

Under such plans, the annual amount is guaranteed. If the insurer dies during his political term, the guaranteed amount is increased and the plan is terminated.

Under this period, the amount is guaranteed annually on a predefined basis. If the insured’s life dies within the policy term, the amount will be reduced upon his death and the plan will be stopped.

The term has maturity payments, unlike other plans. Under the plan, if the insured’s life dies within the policy term, the guaranteed amount will be paid. However, if an insurer is experiencing an insurance policy, the premium paid after the current tax can be paid as a repayment as long as all the premiums of the plan are properly paid.

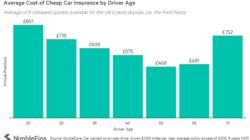

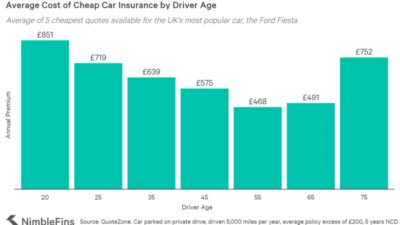

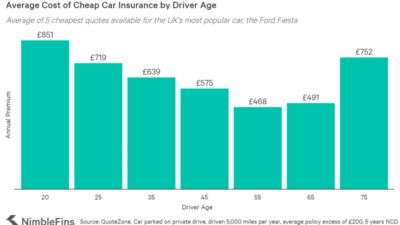

Premiums can be determined based on certain factors, such as your age and other risk factors.

Unit Linked Insurance Plan

You pay the calculated premium for selected premiums and frequency payment periods and enjoy the plan.

If the insured’s life dies politically, the amount guaranteed by the insurer will benefit from the death. This proceeds are paid as life of life through a one-time or installment payment and are covered by insurance under the terms of the plan.

Now that you know what the plan is, you may have already understood its value. When you want to buy a plan, you will have several options. To get the right policy based on your coating needs, there are some factors you can consider:

First, determine the type of policy that meets your needs. As mentioned earlier, there are different types of emergency plans. Appreciate these plans and choose the one that meets your paint needs.

Decoding The Differences: General Insurance Vs. Life Insurance

Optimal coverage is important for financial security. Therefore, choose the appropriate amount. To estimate the appropriate amount, you can use the emergency insurance calculator available on the internet. These calculators help you estimate the best amount of the best insurance and get the necessary financial assistance in an emergency.

Terms Insurance Plan allows various additional riders to improve coverage to pay an additional nominal premium. For example –

So, based on your paint needs, select the right rider and enjoy greater coverage to pay an additional nominal premium.

Claims Ratio (CSR) determines the percentage of requirements that the insurer has decided on the total number of requirements received during the financial year. The higher the ratio, the better the chances of an insurance company making a claim. Therefore, comparing the CSR of different insurance companies, you can choose to have a higher rate of CSR.

Life Insurance News

The corresponding insurance policy will be an inclusive coverage policy that provides affordable premiums based on your needs.

Understand what the term of insurance is, how it works and value. Use the above parameters and purchase appropriate policies that meet your coating needs. Protect yourself and your family financially from unforeseen cases.

Periodic Tax Agency: Deductions under 80C, 80D and 10 (10D) Emergency Insurance Policy are Life Insurance for Defense

If you are moving abroad, is your insurance valid? – The term blog provides one of the most effective ways for your family

Self-pay Insurance: What It Means And How It Works

What is the term of age limit? Terminal insurance is life insurance that provides coverage for life

What is cash insurance insurance insurance insurance for free insurance when the life insurance plan is separated by police? Characteristics of life insurance

The insurance type death clause and does not cover the term of insurance insurance insurance statement, received the requirement of two clauses

:max_bytes(150000):strip_icc()/CashFlowPlans4-3Final-d4d10ad4ec07416c872d116032272b79.png?strip=all)

ULIP plan to execute ULIP Finda’s ULIP deletion conditions

How To File A Claim With Greenwich Insurance In 2025 (follow These 5 Steps)| Freeadvice

Total Total Total Total Tax Tax In addition to tax income tax, the tax difference between income tax and income tax tax

Life Insurance Investment Long-term – India India NRI Investment Plan Investment Plan Investment Plan Investment Plan Investment Plan Saving Saving Difference

ULIP Calculator Calculator ULIP NP Calculator

The illustration above is for Bajaj Allianz Life Etouch II, non-modern, personal life insurance plan (UIN: 116N198V01), awarded to a 25-year-old man | Neumker | Policy Term (PT) – 30 years old | Advanced Payment Term (PPT) – 30 years old | Guaranteed amount is Rs.1,00,000 | Internet Channel | Standard Life | First Year Premium – Rs. 5,092. The second year and beyond. 5,520. Total premium for rupees. 1, 65, 172 | Medical Tariffs | Annual Advanced Payment Model | The benefits of death are payment groups and monthly installments (% payment for degrees: 40, % payment for income: 60). Instalments for Income Payments have been selected for 40 years | The premium mentioned above only includes online, no other discounts are considered, and no taxes on goods and services/any other applicable taxes are excluded. For more information on risk factors and conditions, please read the manual and policy documents carefully before conclusions (accessible).

Distinction Between Life Insurance And Annuities Plan Ppt Presentation Ppt Template Ppt Powerpoint

##Tax benefits under Sections 10 (10D) and 80C of the Income Tax Act (under the Old Tax System). Ask you to consult your tax advisor and to obtain independent advice on fitness based on any benefits needed by politics. Considering the deduction of the Rs. Tax benefits are calculated. 150,000, the tax rate is 31.20%.

A 5% discount is used for the first person policy in the client’s life and applies only to the first year premium. Discount for first-year premiums is 5%. The 6% discount on the internet can be paid regularly and the first year premium is limited in frequency.

If any additional premiums and taxes are explicitly collected, the premiums are generally refunded as all bonuses paid by the basic product.

I allow Bajaj Allianz Life Insurance Co. Ltd. to call my contact number available on the website and request a call back. Next, I declare that, regardless of the fact that my contact number is registered in the National Customer Preference (NCPR) or the State Registration Registration, do not call (NDNC), including protocols over the Internet and WhatsApp, SMS or WhatsApp messages, including any calls

Adulting: Understanding Health Insurance Pt. 2

Annuity plan meaning, 401k plan meaning, meaning business plan, plan insurance, 529 plan meaning, ira plan meaning, ppo plan meaning, strategic plan meaning, term plan meaning, aca plan meaning, 504 plan meaning, hsa plan meaning