Insurance Policy For Two Wheeler – Two wheeler insurance is a kind of insurance that includes motorcycles, scooters and similar two -wheelers. The main purpose is to protect yourself or your vehicle’s ride from financial setbacks in the case of accidents, theft, theft, third party responsibilities and more.

The 1988 Motor Vehicle Act notes that there is a legal need to insure the two -wheeler of the third party. Driving without insurance in a public area is a violation of the law and is punished under this law.

Insurance Policy For Two Wheeler

Whether you buy your two -wheeler online or by a traditional method, it is very important to get it from the insurer, which recognizes the IRDAI (insurance regulatory and India’s development).

Two Wheeler Insurance: Top 10 Two Wheeler Insurance Plans & Policies

Bike insurance provides protection against any legal debt that stumbles physical injury, death or property damage.

Bike insurance protection can be provided for loss or damage to your own bike by accidents, natural disasters, manilius disasters, theft and more.

Bike insurance may also provide financial assistance in the worst event that you or the driver is in a bad event.

This is the reward that the insurer will give you a premium discount if you do not make any claims in the policy year.

Why Is It Mandatory To Buy A 5-year Bike Insurance Policy When Buying A New Bike?

With roadside aid, hiding consumption, zero depreciation, and more, you will also get the flexibility of choosing optional cards to expand the coverage of your basic principle.

Volunteer exemption is part of the claim that you have chosen to pay before the insurer pays the remaining amount. When you take responsibility for a part of the claim, you will experience a low premium.

Bike insurance can provide financial protection against damage to electrical or electric parts fitted on your bike.

The amount of bike insurance is valid in India’s geographical limits. If you go to neighboring countries, you can expand when and when.

Two Wheeler Insurance Renewal Benefits

If you renew your bike insurance in a timely manner, this will ensure uninterrupted security. Other than the claim bonus, there are benefits.

In India, it is mandatory for at least third party to run a two -wheeler on public roads for third parties.

Two -wheeler provides financial security, booking yourself from unexpected costs as a result of accidents or theft. It can compensate for the cost of repair or change your vehicle.

In the event of an accident that causes injury to others or their property, your insurance policy will deal with your legal responsibilities.

Why Renew A Two-wheeler Insurance Policy?

In spite of theft, accidents, man’s misbehavior or natural disasters – two -wheeler insurance is your shield against a variety of risks. This is not just to protect your own drive; It also expands its safety to offset any legal responses that arise from third -party or damage to their property or financial losses.

We will face it: riding a bike in India is more than traveling from one place to the other. There is freedom. This is prudent. Sometimes, it is also about survival in moving traffic. However, there is some risk associated with that freedom, right?

Because of this, receiving good bike insurance by 2025 is not only a smart choice but also. Proper insurance scheme can save more time, money and progress from the USAs in the law rules with a third party covering of legal rules.

We have completed the research (so you don’t have to do) and we have set up a list of the best bike insurance plans for 2025 to make your life easier. If you want a comprehensive coverage that provides overall protection, you can, as essential but third party, can damage it.

No Claim Bonus In Two Wheeler Insurance

The detailed policy is the key to obtaining full security not only for others but also for your own vehicle. It has damage to third -party coverage and you can choose a variety of useful sub -programs.

In India, you should have at least third -party insurance. Although this does not compensate for your own damage, it is very important if your bike can damage another person or damage another person’s vehicle.

If you already have a long -term third -party policy (which requires new motorcycles), you may want to connect it to the policy of own damage. One includes theft, fire, floods, accidents and more. However, this does not resolve the responsibilities of the third party.

Note: This list is based on complete EDEM review, customer’s first intelligence, irregular research and vulnerable public data from twin. We focused on what really important: the need for support, service facility, pricing and buying after buying.

Best Two-wheeler Insurance Policy In 2025

However, depending on your part, the type of bike, age and insurance plans, features and prices may be different. Before engaging in anything, always read the penalty printing or approach the consultant.

No one wants to think about insurance. However, you have the insurance for your two -wheeler, not only prudent, but is forced by the law. By 2025, when prices are revised and new e-bike trends become popular, it is important to understand what you are getting.

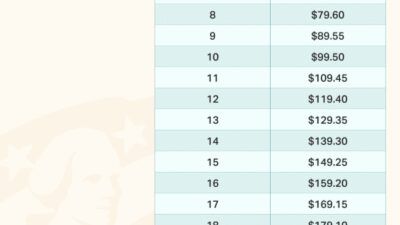

It protects you if you hurt or damaged someone else’s property or vehicle. According to the final price of Irdai:

Although this is optional, which offer gets? Your bike is protected from own damage insurance, accidents, fire and natural imagery. Premiums vary according to the time of the bike, sample, part and insured value (IDV). Your premium will go to sub -programs such as your premium motor protection or zero depreciation, but if you want peace of mind, they are worth it.

Don’t Let An Expired Policy Stop You From Revving Up Your Engine—renew Your #insurancepolicy Now! ✓ Low Premiums ✓ Hassle-free Renewals ✓ Expert Support ✓ Big Savings, Full Coverage How To Avail:

One is extensive, because the name represents. You are covered for both damage and third -party damage. Premium? It combines both, and the sub -programs you decide to add. And you need more security, more cost.

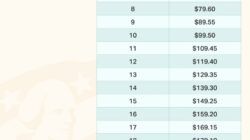

They are popular, and electric bikes are also needed for protection. By 2025, prices will be like this:

Do you still have cover? There are also 5 years e-bike schemes, and the premiums cost about Rs. 2, 466. Green, not bad for soft ride.

Despite many options, are they worth your money? As for the convenience, the Claim’s Immigration Rate (CSR) and network garages are ranked rather than the leading insurers to go:

6 Benefits Of Two Wheeler Insurance Renewal

Keep in mind that there is a lack of a one-lack of a solution, and look at your ITT and resolve which sub-programs is meaningful.

Riding a bike in India is funny, but without risks. There are some things that can go on the road, including traffic jams, unexpected weather and careless drivers. This reason is accurately unwilling to pass by the bike insurance policy.

According to the Motor Vehicle Act, you must have at least a third -party bike insurance policy to ride on Indian roads. If you are caught without, you are fined or bad, legal problems.

The road is not always beautiful for experienced riders. Even a small skid, sudden brake or accident caused by another person can be significantly harmful. Comprehensive bike insurance includes medical expenses, repair and other damage. Consider that when you need it, it is a diminishing strategy.

Best 5 Two Wheeler Insurance Policy For Bike And Scooters

You stop your bike and go to a coffee and when you turn, your bike is missing. Isn’t that terrifying? This is more frequent than you can imagine. If you do not have your own damage protection, your insurance is paying for theft or total loss, saving Emmy from paying for a car no longer.

The weather is always suitable for your bike. This includes landslides, floods, fire and storms. The damage is covered by the appropriate insurance amount.

The health insurance policy with the right sub -programs such as zero depreciation or motor protection will save you tens of thousands of rupees. What is the best part? The premiums are very low, especially online.

Here are some things you need to remember to get the best bike insurance plan for your needs –

5 Things To Consider When Renewing Your Two-wheeler Insurance Policy

When you choose two -wheeler insurance online, you open the process of regulating the process –

Along with SMC insurance, you will receive the flexibility of selecting from 30+ insurance companies and the standard support of our certified financial advisers. It is easy, convenient and uninterrupted, from your insurance trip, to the purchase to the claims.

Irdai has forced all insurers to confirm and control the identity of persons who are insured to avoid fraud and promote transactions. You must submit the following KYC documents when buying bike insurance –

This is the compulsory insurance that is forced by the law to drive a motor vehicle in India. This includes any harm or loss that has led to your vehicle or their property.

Why Should You Buy A Bike Insurance Policy

When your vehicle is damaged due to fire, rain and theft, your own damage insurance comes in the game. This allows you to claim compensation for the costs required to repair your vehicle.

As for two wheeler insurance, you have the option to improve your coverage with various sub -programs. Additional service specified