Insurance Policy Meaning – The insurance claim is a policy policy for insurance company for scope or compensation for loss or political activities.

Insurance company confirms the demands (or rejected). If it is approved, the insurance company will produce payments to an accountant or interesting parties to ensure.

Insurance Policy Meaning

In some cases, the third party may put a claim for a protected person. However, in most cases, only one person listed policies have the right to ask for a payment.

Insurance Policy Meaning

Valid pay insurance is paying a political or resistance of the loss of money. Every individual or group pay a fee to consider the completion of insurance agreement between the insurance and insurance carrier.

The most insurance claim is the cost of goods and medical services, physical harm, life, roles, homes, buildings, buildings, which is the result of the car.

Due to the insurance policy and the rare insurance, regardless of accidents or inappropriate, the insurance claims you have a live number that you pay for the payment called insurance.

The more demanding the claim settled by a policy, the larger is the greater to increase the rate. In some cases, it is possible if you put a lot of demand that the insurance company may decide to deny you.

Fire Insurance Is A Type Of Property Insurance, Meaning It Covers Losses Or Damages Caused By Fire. It Can Provide Financial Protection For A Wide Range Of Assets, Including Buildings, Equipment, Inventory,

If the demand is based on the damage caused by the owner, your money will grow. On the other hand, if you are not mistaken, you may or may not grow your average.

For example, from behind when your car was placed or the roof of the housetop in your home during the storm was the two cases of politics.

However, the prevention of what happened, such as the number of tickets you received, the dose of natural disasters in your area (floods, and low growth is for damage that you did not do.

As the insurance rate increases, not all claims were created equal. Dogs are messy, slip-and-lesser injury, water damage, and mold can move as a signal to the securities of securities.

What Is A Comprehensive Insurance Policy For Vehicles

These things tend to impact negative impact on your average and determination in preparation to continue the gift.

Surprisingly, fast coupons do not cause increase in rate. At least your first ticket, many companies will not increase your price. The same is true of a small accident or a small claim against the home insurance policy.

Prices for surgery or unique hospitals will remain in forgiveness. The individual’s health policy or group reduces patients with burdens to burdenses that may suffer financial damage.

The demanding of health insurance from the supplier of provider to politics or other people requires small efforts from patients; Most treatments are good in electronic mode.

Retrospectively Rated Insurance

Political policy should put paper demand when therapy does not participate in electronic shipping that the charge is a result of evaluating services.

In the end, the insurance claims protect one person from expecting a lot of weight caused by accidents or illnesses.

Home is often one of the most expensive owners to buy in their lives. The demand for injury from the covered risk was offered by the Internet for a contractor’s representative, which is called agent or additing.

Unlike health insurance, Onus is in the policy of reporting a job damaged in a task.

What Is Term Insurance?

Adjuster, depending on the type of claim, survey and evaluate the damage to payments. By verification of injury start the processing or repairing the repairs.

Life insurance demands requires the submission of demands, death certificates, and often the original policies.

The process, especially for large importance policy may require the death of the grandfathers to avoid being incorporating, such as suicide (usually the beginning of politics) or death as a crime event.

Often the steps are 30 to 60 days without any non-events. Payment provides financial financial financing to replace the dead income or to appeal to the last price.

Life Insurance 101

There is no hard and quick rules around the growth of the rate. What is the problem that never forgot ever ever never once or never Need never never never before. Because every request to everyone can be dangerous to your rate, to understand your first policy for protecting your wallet.

If you know the first and demands of the first and the first claim will not think about you after several years, or the demanding or re-deputation, or not to impact or not.

Talking to your agency of insurance company the insurance company before you need a claim is also important. Some of these are forced to report you to the company if you talk about the probability and choose not to write.

For this reason, you don’t want to wait until you have to put a petition to question your study policies about your agents.

Difference Between Family Floater And Individual Insurance

Regardless of your circumstances, mitigating claims of claims is your key to your insurance security key to the increase in insurance.

A good principle will follow is just a claim if the loss of disaster is. If you get teeth on a grass or some of the things that break your homepage, you may be better if you care about yourself.

If the accident or entertainment in your home cavity, establishing a claims come to the mouth that exercise is possible.

Just remember that even if you have obstacles and you have already paid for many years, the insurance company can still refuse to change the rest when your policy is over.

Defining An Incontestability Clause

If you hold insurance policies and have experienced the damage, you can start the demands, you can start a claim by contacting your insurance. This can be done by phone, and especially on the Internet. When the claim begins, the responsible person will collect the information from you and may seek evidence (such as images) or supporting the document. The owner can send adjuster to talk to you and check your worthiness.

Sometimes the demands can result in a higher insurance insurance. This does not happen, because some guaranteers will allow the first traffic accident. The demanding demand is increasing the demands of the demands that the uncertainer see you as a greater risk than before and corrects the price to climb accordingly. If you prove that the request is done in an incorrect place, you can turn. If you put a lot of demands in a short time, the insurance company may not change your policies no matter sin or any sin.

If the damage that you experienced is less than your reduced, it may not be valid to submit a claim with your insurance company. For example, if you have $ 200 to the injury, but $ 1,000,000 DEDED, it should not be meaningful. If you feel that the other party is wrong and want to ensure your injuries, you can start the demand. It is a good idea to always talk to the insurance Agency before establishing a claim.

Life benefits is like a person – until you have the best ordeal insurance company 2025 for 2025 car insurance 2025 for 2025 cars in July? This is one thing – here you need to know how to insure life insurance 525 of 2025 in 2025 in 2025 in 2025 in 2025

What Insurance Policy Do You Need For A Small Business In 2023?

The travel delay in the summer travel insurance in 2025 deaths: the best of the insurance, and the life of human age, death, death, life is disapproval of insurance competition. The owner will have to pay a certain amount of maturity or determination of politics.

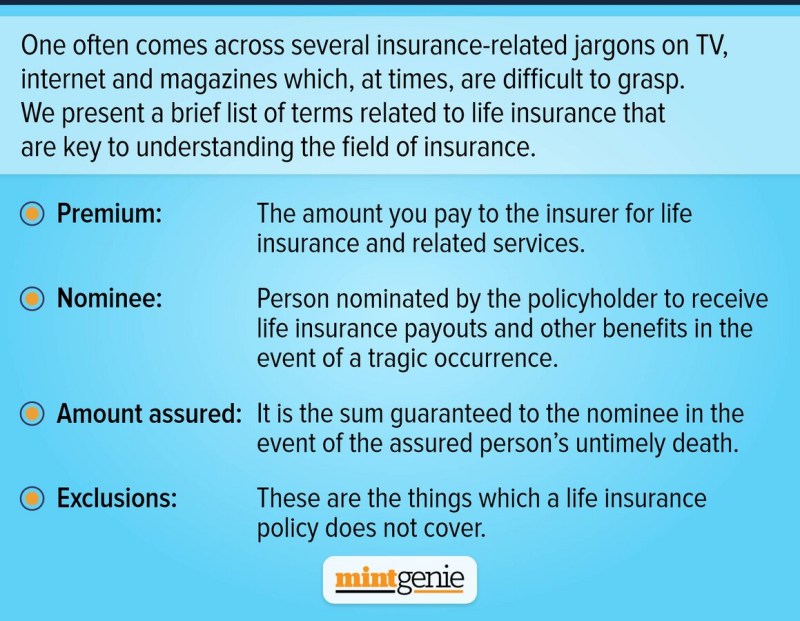

Life insurance is for survivors, not for people who have become. Everyone is a moral responsibility to protect his family in uncertainty or death. So life